More risk, lower return?

CRE is living in the upside down.

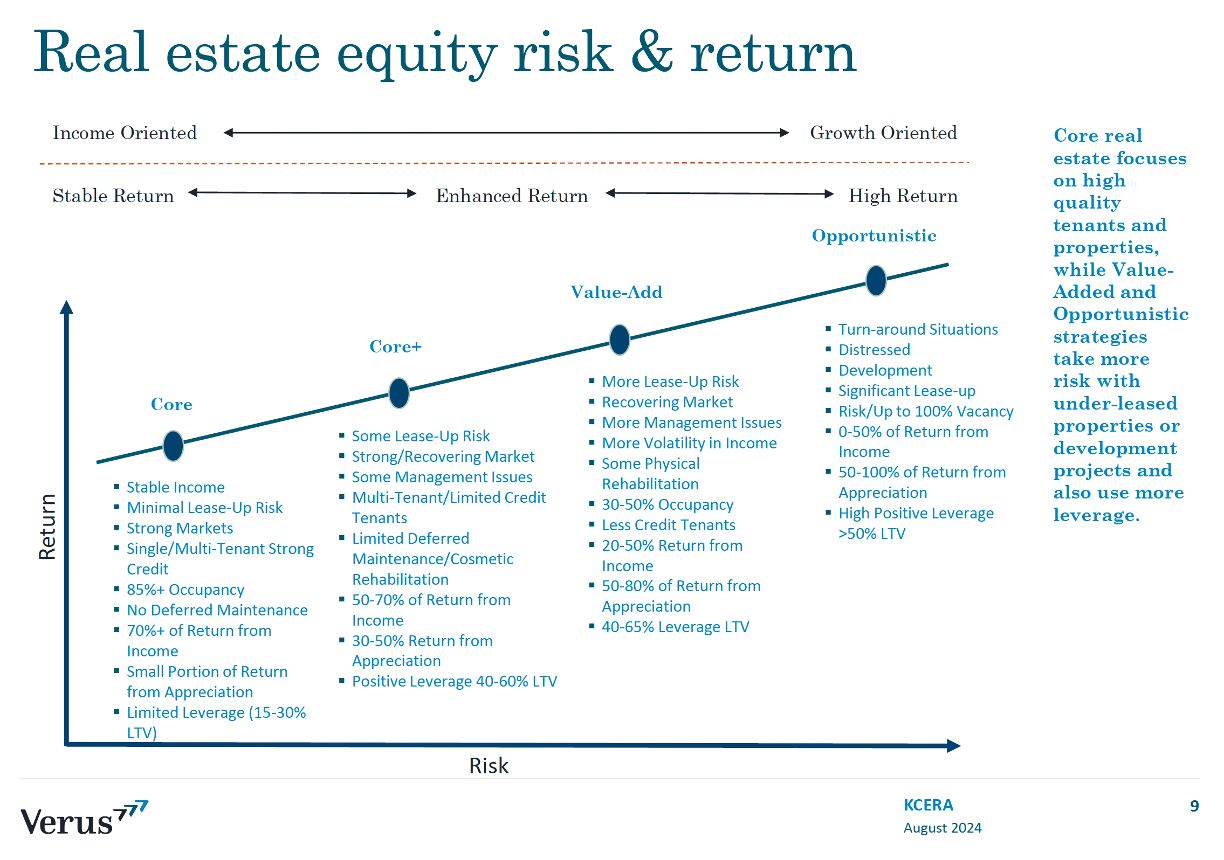

The first chart represents how most LPs think about real estate risk and return.

Want more return? You have to take more risk.

Reaching for incremental return? You should expect more risk.

But recent history seems to throw a wrench in this approach.

The second chart represents our best guess for returns over the last 10 years for those LPs based on recent performance reports. This anecdotal history suggests a more complicated experience, where some higher risk buckets have delivered lower returns.

This doesn't mean these risk buckets are useless. Investors need a way to think about risk. But it implies, perhaps, investors should be extremely careful about assessing risk.

Core equity has underperformed just about everything over the last ten years (including debt). But core has outperformed core plus and value-add? Why?

Has opportunistic truly delivered stronger returns or have those funds simply not reflected the market's lower values (yet) since so much capital is locked in those funds?

Key takeaway: Assessing risk and return is as much judgment as it is quantitative, which requires real estate skills.

Interested in building these skills? DM us to explore joining our upcoming FastTrack cohort where we build skills around the 8 fundamentals of our business.

COMMENTS