Someone is always calling for a crisis, often with a familiar pattern:

1. Bank XYZ has too much real estate exposure.

2. Real estate markets are challenged.

3. Credit problems will spike.

4. Banks are highly levered.

5. Therefore, XYZ must be in trouble.

A great example: the narrative around Bank OZK.

The Wall Street Journal wrote:

“...the Little Rock, Ark., lender is diving headlong into some of the shakiest commercial-property markets in the U.S. at a time when investors are beginning to worry that the real-estate rally of the past few years is coming to an end.”

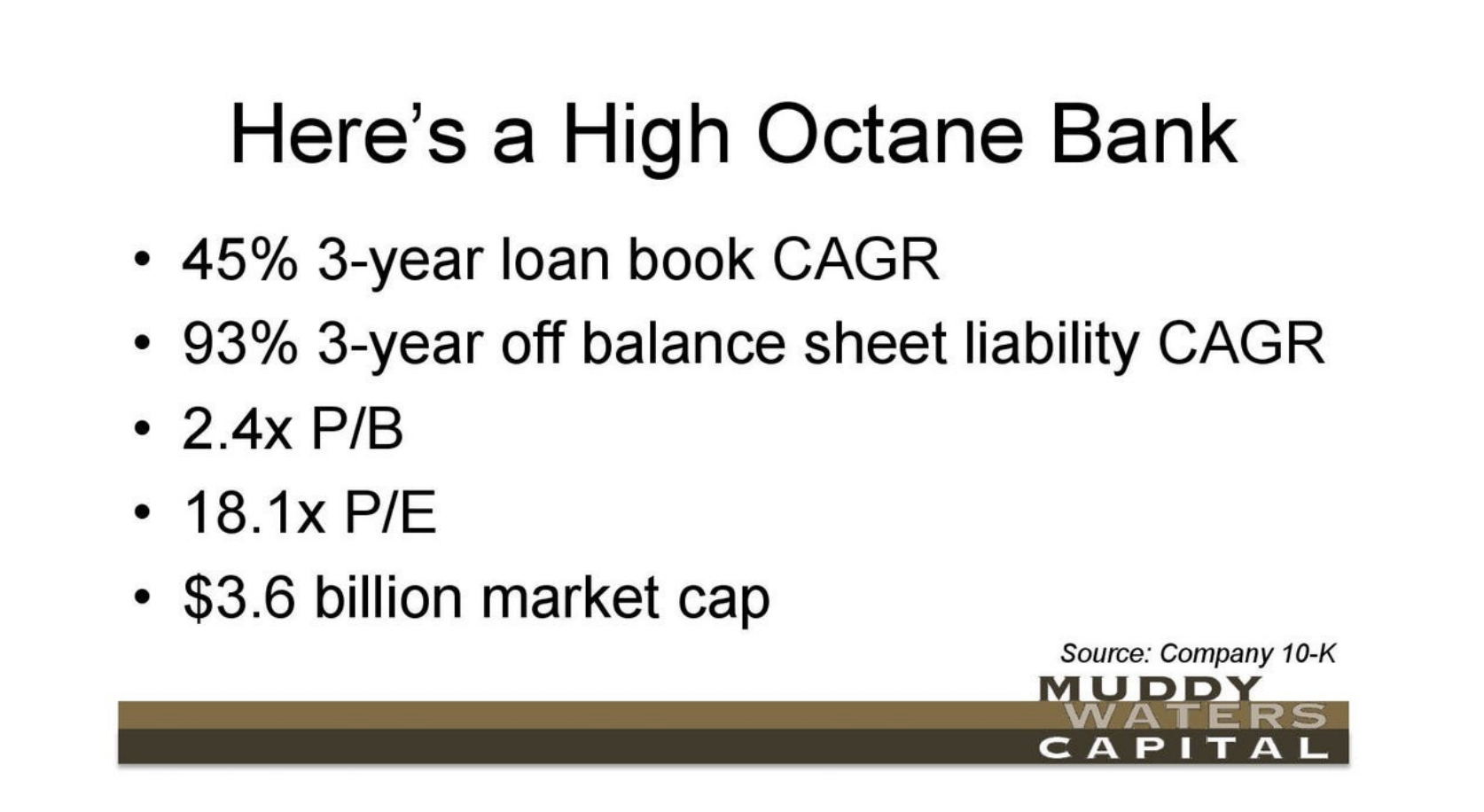

And activist investor Muddy Waters amplified the fear with a compelling storyline: a small Arkansas bank making disproportionately huge construction loans in big coastal markets.

The stock fell 25% in a matter of months.

Here’s the twist:

This was ten years ago.

What's happened since?

Short answer: nothing.

In fact, the reality has been much closer to the opposite of the doom and gloom predictions for OZK.

-- OZK’s loss rates remained far below industry averages.

-- The bank grew its asset base by 80%+ over the decade.

-- The stock is up 20%+ from that period.

Takeaway:

It’s easy to scare people.

Harder to inform them.

And hardest of all to actually execute in the real world.

PS — want to know how OZK has consistently outperformed? DM us to explore joining our next FastTrack cohort, where we cover lending and borrowing in detail (along with the other 7 primary real estate fundamentals).

COMMENTS