Are closed-end funds the real maturity wall?

Redemption queues received a lot of attention over the last 36 months.

...public vs. private valuation disconnects.

...investors lining up to exit.

...fund managers putting up gates.

This topic has plagued retail-oriented (BREIT and other non-traded REITs) and institutional (ODCE) open-end funds for three years.

Quick check on scale:

-- NTRs and ODCE total about $285B in NAV.

-- Their redemption queues are running at about 10-15% of NAV.

-- Resulting in capital outflow pressure of about $40B.

Maturity walls have also received a lot of attention over the last 36 months.

But contrary to many headlines, the loan maturity doomsday never materialized. ...at least not yet. Why not? In-place income and coverage allows lenders to kick the can. Why force a sale in a sluggish market?

But what about closed-end equity fund maturities?

Technically, closed-end funds don't "mature". Maturity is definitionally a debt concept. But as their name implies, closed-end funds are closed.

...meaning, they have stated end dates.

Managers can usually extend those funds, but they're heavily incentivized by profits (or a lack of).

...and the clock is ticking funds that were raised 7+ years ago.

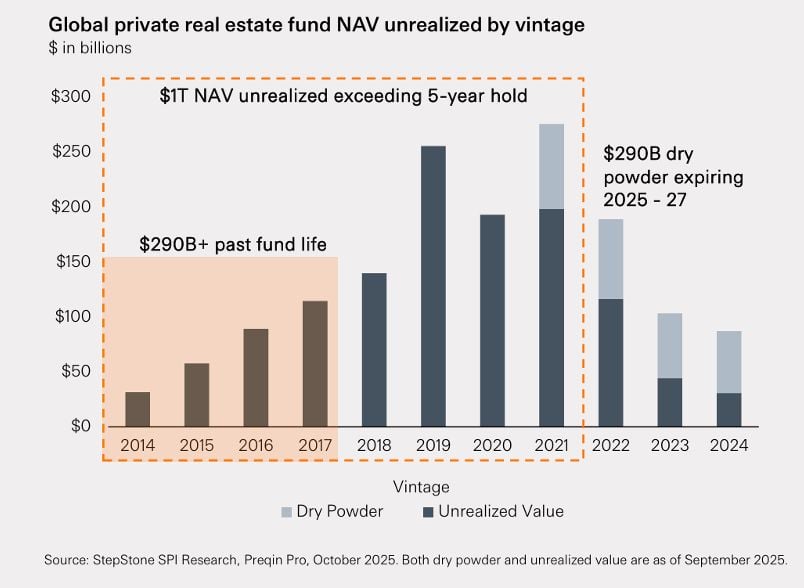

Per StepStone, more than $290B of equity is past its fund life. And pressure to sell will likely pick up as these funds move further beyond their state end dates.

The gravity of IRR:

Beyond investors just wanting their money back, these funds get paid on IRR, and additional time is the enemy of IRR.

BREP IX example:

Blackstone's flagship closed-end real estate fund BREP IX raised $20B for during Covid. Early reads on returns were 40%+, but those estimates fell to 7% as of last quarter. BREP's incentive fee is likely 0% when the fund's IRR falls below 8-9%, so why would Blackstone kick the can?

More broadly, will closed-end fund managers need to start churning legacy assets? If they lean on continuation vehicles, will values hold up or will there be downward pressure on marks?

Whatever the answers to these questions are, they seem to point to elongated sluggishness in asset pricing.

COMMENTS