You can always stick your head in the sand… for a price.

The good, the bad, and the ugly of passive real estate investing.

---- The good ----

Public REITs trade daily, so you can sell anytime.

Non-traded REITs (NTRs) look stable.

---- The bad ----

1. Public REIT prices can fall a lot when sh*t hits the fan. You can still get out, but you may be looking at 40-50% discounts.

2. You can't really sell NTRs, but you can raise your hand and the sponsor may take you out.

3. NTR prices don't fall as much because their values are based on appraisals.

[That sounds good, unless you want out. Why would a sponsor take you out above market value?]

---- The ugly ----

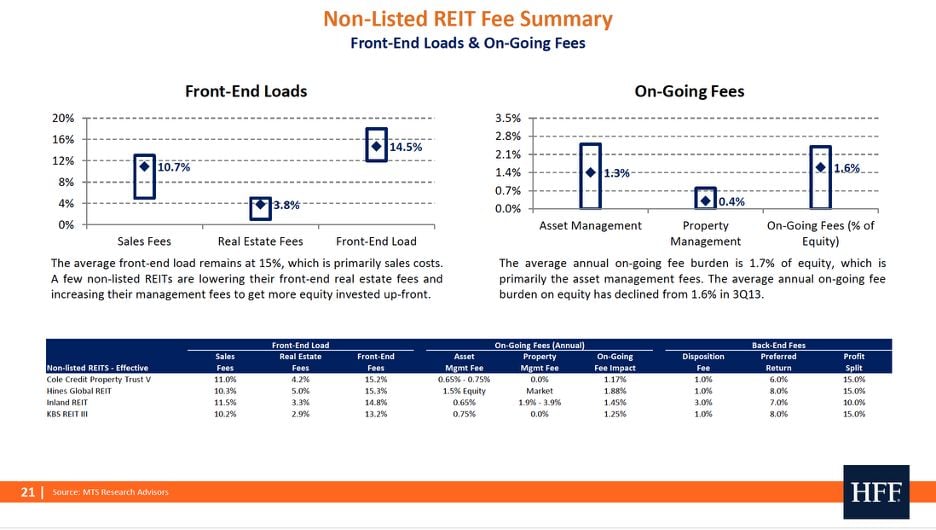

Only 96–98¢ of every $1 gets invested due to sales and placement fees.

Then the sponsor gets 1%+ annual fees + 12.5% of profits over 5%.

...more aggressive than most institutional funds (especially open-end funds).

---- The uglier ----

Ten years ago, these fees were a lot worse.

Think 15% up front, 1.5% annual, plus exit fees, and promotes.

A big-named sponsor liquidated one of the funds on this 10-year-old slide within only a few years of proclaiming:

"We are very pleased with the appreciation in the values of the high-quality investments in our portfolio since last year’s valuation. In just one year, our appraised real estate values increased by 8.1%. This significant increase is especially worth noting given that approximately $2.5 billion in assets, or approximately half of the portfolio, was acquired within the last 24 months..."

"We are also pleased to note that [liquidated NTR] has maintained the same high-quality per-share distribution level for 13 consecutive quarters..."

"We attribute this consistency primarily to the advantageous timing of our real estate purchases, the portfolio’s high occupancy rate of 96%, the quality of our tenants, and the diversification of assets in our portfolio."

---- Takeaways ----

1. REITs give investors an easy path to passive ownership.

2. Publics are liquid while NTRs look more stable.

3. The costs of NTRs are steep: Illiquidity and fees.

4. But NTRs have gotten cheaper and more aligned.

Which is 'better'?

Probably depends on your temperament and liquidity needs.

Will NTRs continue to get cheaper?

Probably. Lots of sponsors are chasing retail dollars.

What about private funds and partnerships?

Stay tuned.

PS -- We think it's important to compare capital and vehicle structures across the industry. Sound interesting? DM us to explore our upcoming FastTrack cohort. Spots are filling fast.

COMMENTS