Office mortgages: lifeless with a metallic aftertaste?

Commercial mortgages can be a lot like wine, which could be a bad sign for office lenders. And, if history is a decent indicator, the pain and aftertaste could be worse than anticipated.

----- Vintage risk: wine -----

A lot goes into making a good wine. Region, location, climate, seasonality. But it largely comes down to grapes, and--more specifically--when a wine's grapes are harvested.

...which results in two counterintuitive takeaways:

1. Relatively BAD wines from a good vintage can be GOOD.

2. Relatively GOOD wines from a bad vintage can be BAD.

And BAD wines from BAD vintages are terrible.

----- Vintage risk: CRE -----

There's a similar dynamic with commercial mortgages, as Moody's concluded in a pre-GFC study:

"Moody's was granted access to a data base that offers the best of both possible worlds: Data that ranges over a full cycle that also has depth, in this case loan level details about leverage. This has enabled us to examine the role of leverage across the full cycle, which we believe to be the first work of this sort in our industry. A key conclusion is that the power of the real estate cycle trumps other variables."

Moody's found that "risky" high LTV loans originated in strong vintages defaulted less (3.9%) than low LTV loans originated in weak vintages (5.4%), and high LTV loans originated in weak vintages experienced exponentially more defaults (30.7%).

---- Why does this matter? ----

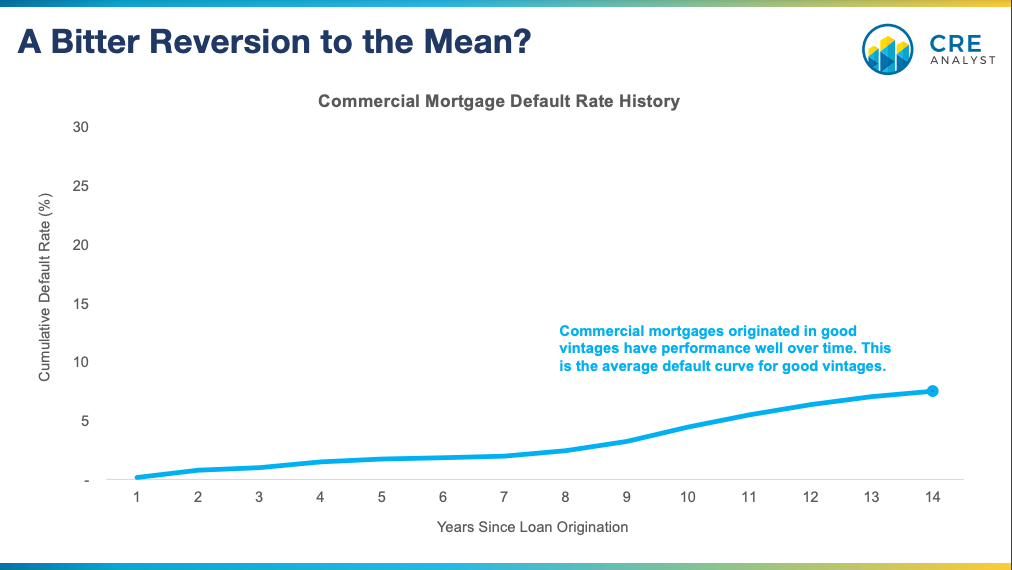

Lenders have had an incredibly good run since 2010. Default rates have rounded to zero, and, although base rates were historically low, spreads were relatively attractive. Virtually no credit loss = profits.

It would be hard to see an entire recent loan vintage mimicking the pre-GFC bad vintages or the 1980s bad vintages (i.e., 30% default rates).

...except in office, which is experiencing the clearest recessionary cycle in decades.

If recently originated office mortgages follow the path of those more challenging historical vintages, i.e., if Moody's was right and cycle timing matters more than anything when it comes to mortgage credit quality, then office lenders could be in for a very painful reversion to the mean.

Perhaps just as importantly, mortgage problems have historically played out over very long periods of time. Therefore, there may be no quick end in sight.

Where do you land on this?

A) This time is different. It won't be that bad.

B) Brace for impact.

C) Other

Read the full analysis here.

COMMENTS