Would you rather be a credit fund investing in transitional assets or a bank at 10-to-1 leverage?

That’s the core tradeoff playing out between banks and private credit funds.

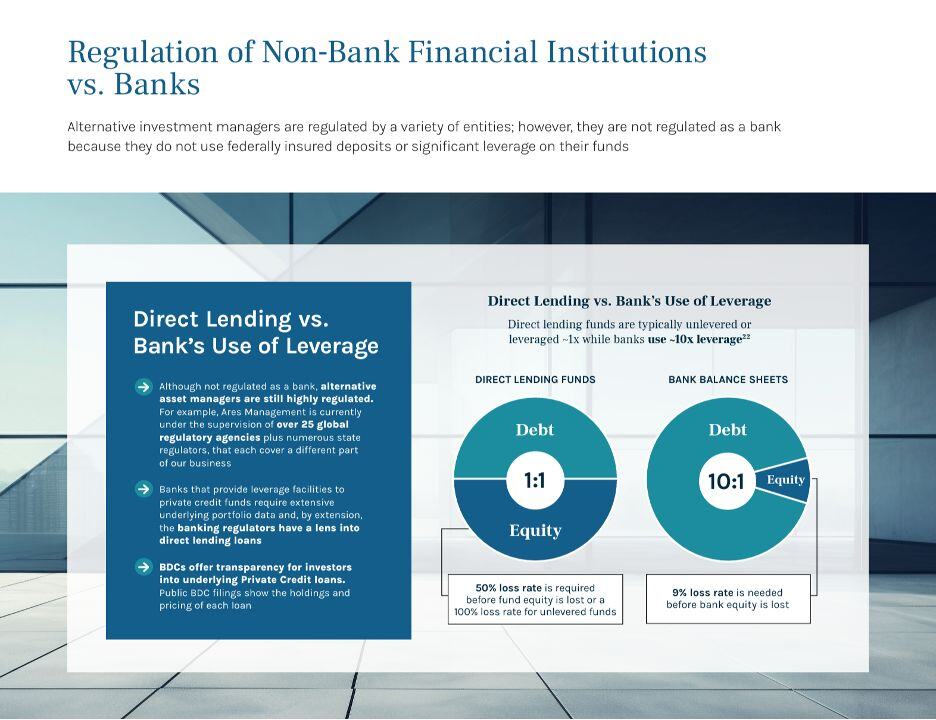

Banks brag about the safety of their loan books, but the typical bank balance sheet runs 10-to-1.

So if 20% of your book defaults with a 50% severity, the bank's equity is completely wiped out.

Private credit funds flip the equation. They often lend to nonbank-eligible or non-investment grade borrowers, often in the middle market and/or in subordinate positions, where yields are higher and underwriting is bespoke.

But they typically use less leverage, which dramatically changes downside exposure.

However, it's worth noting that private credit funds are increasingly layering on more back leverage—through CLOs, fund facilities, and structured products—to enhance returns. ...often pushing effective leverage well beyond 1-to-1.

Which brings us to the real question:

Is default risk more dangerous, or is leverage?

Default risk slowly eats away at returns. Leverage risk can turn a shallow dip into a liquidity crisis.

Notably, it’s not about which model is “better.”

It’s about understanding embedded risks.

(Graphic via Ares Management)

PS – Our FastTrack course includes a full module on debt and capital structure. It’s one of the most technical sections we teach, but also where the most light bulbs go off. Even experienced professionals often overlook how leverage truly works. If you're looking to sharpen your instincts around debt, risk, and capital flows, DM us. Our next FastTrack cohort kicks off in two weeks.

COMMENTS