The ‘undersupppy’ of housing. A fake crisis?

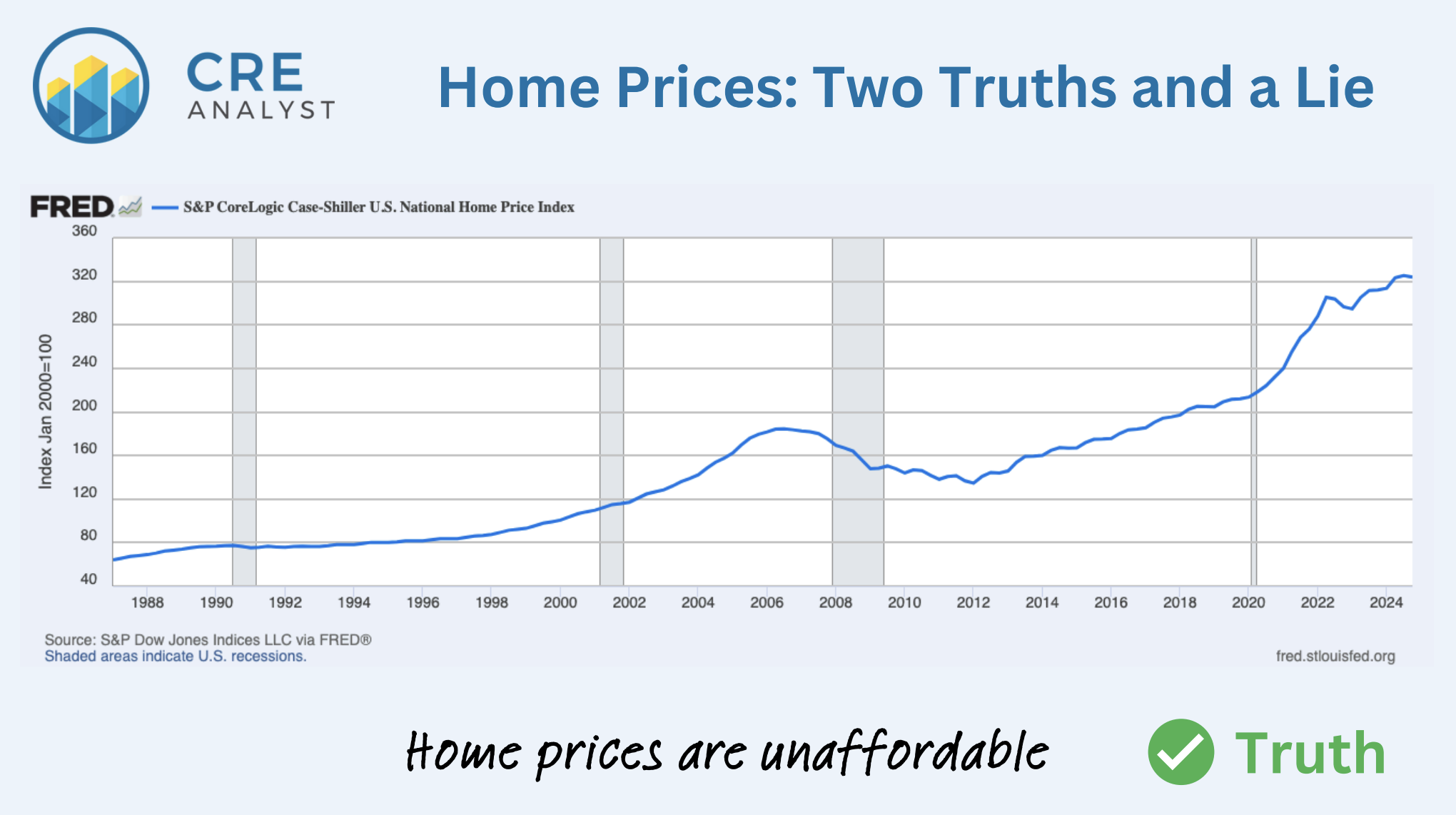

Yes, home prices are up.

And yes, housing starts are down.

But a lack of supply may not be driving the affordability crisis.

The real culprit could extend to commercial real estate.

What's the long-term correlation between home prices and new home starts?

1%

What's the long-term correlation between home prices and interest rates?

73%

Our hypothesis...

The widespread inability of 30-somethings to own a home is a crisis, but undersupppy may have much less to do with it than advertised.

The real driver of unaffordability?

Ultra-low interest rates following COVID.

The federal response to COVID was the most expensive intervention in U.S. history. More costly (in 2025 dollars) than WWII, the GFC, and every major natural disaster of the last 45 years.

Why? Because the Fed single-handedly became the bond market's rich uncle.

Rates were pushed to zero. The Fed’s balance sheet doubled. And the value of every capital-intensive asset—housing included—moved higher.

This wasn’t just a supply story. It was a cost of capital story.

...with real implications.

Building more homes might not restore affordability, and blindly adding units could lead to new problems (e.g., higher delinquencies).

Affordability isn’t just about units.

It's about capital.

If we're right--and elevated values have more to do with the cost of capital than the supply/demand of physical structures--commercial real estate isn't immune.

And a rebound in transaction activity could be bad for asset values.

Check out our full analysis here!

PS -- Real estate pricing is messy. Properties aren't commodities. But frameworks cut through the noise, and none matters more than the valuation and capital markets frameworks we cover in our FastTrack course. The next cohort kicks off in two weeks. DM us if you’re interested.

COMMENTS