Be careful what you wish for. You just might get it.

Twenty years ago, home prices crashed 20% nationally, with some markets plunging more than 50%.

Why?

Policy makers, lenders, and central bankers aggressively promoted an "American Dream" of homeownership until the bubble inevitably burst.

Foreclosures surged and nearly toppled the global financial system as desperate sellers sought buyers at almost any price.

Then came corporate landlords. Seizing opportunities created by low rates, these investors aggregated about 3 million homes from 2009 to 2021.

Although just a fraction of the 75 million homes sold overall, their impact was meaningful. Prices are always set at the margin.

Owner-occupiers buy based on income affordability. Investors buy based on return hurdles.

Using simple models, we estimate investor bidding drove an approximately 18% premium on home prices during the 2009 to 2021 "perfect storm."

Corporate landlords receive plenty of criticism for inflating home prices, but millions of homeowners reaped enormous gains from this trend, particularly those who sold into it.

Fast forward to today.

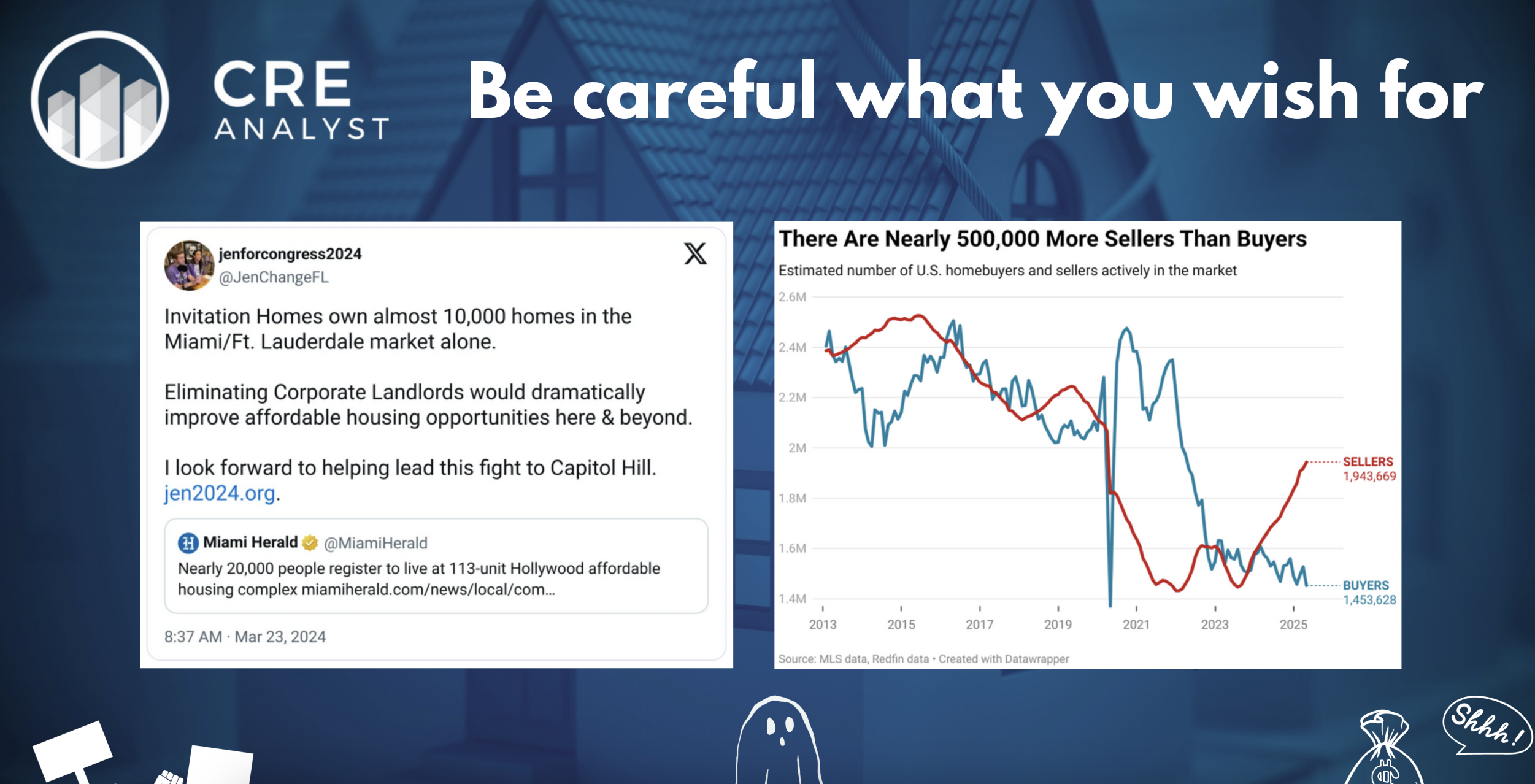

Corporate landlords are a constant focus of policy makers. ...easy scapegoats for housing market woes. Don't expect this focus to change.

But home prices again look vulnerable.

Will prices need to fall another 20% to lure investors back into the market? Current discounts in REIT stocks suggest a 15% disconnect.

The lesson? Be careful what you wish for.

Twenty years ago, home prices crashed 20% nationally, with some markets plunging more than 50%.

Why?

Policy makers, lenders, and central bankers aggressively promoted an "American Dream" of homeownership until the bubble inevitably burst.

Foreclosures surged and nearly toppled the global financial system as desperate sellers sought buyers at almost any price.

Then came corporate landlords. Seizing opportunities created by low rates, these investors aggregated about 3 million homes from 2009 to 2021.

Although just a fraction of the 75 million homes sold overall, their impact was meaningful. Prices are always set at the margin.

Owner-occupiers buy based on income affordability. Investors buy based on return hurdles.

Using simple models, we estimate investor bidding drove an approximately 18% premium on home prices during the 2009 to 2021 "perfect storm."

Corporate landlords receive plenty of criticism for inflating home prices, but millions of homeowners reaped enormous gains from this trend, particularly those who sold into it.

Fast forward to today.

Corporate landlords are a constant focus of policy makers. ...easy scapegoats for housing market woes. Don't expect this focus to change.

But home prices again look vulnerable.

Will prices need to fall another 20% to lure investors back into the market? Current discounts in REIT stocks suggest a 15% disconnect.

The lesson? Be careful what you wish for.

COMMENTS