[That escalated quickly.]

Re: Paydown

Dear Borrower,

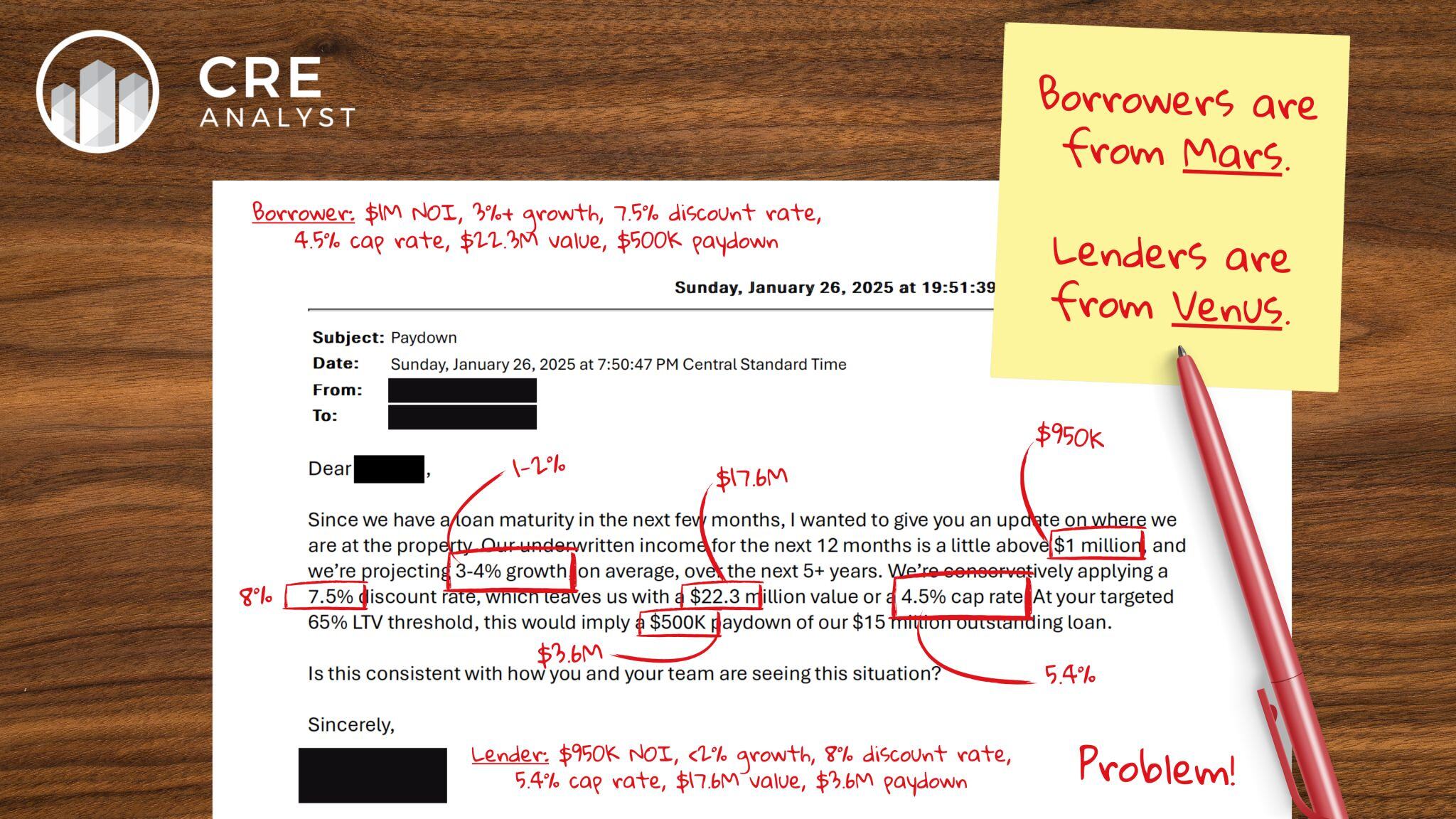

Thanks for the update. We’ve reviewed the situation, and based on our underwriting, the numbers don’t quite align. We're arriving at a $17.6 million valuation, supporting only $11.4 million in proceeds. This means a $3.6 million paydown would be necessary. Let us know how you’d like to proceed.

----------

Dear Lender,

Thank you for your response. I understand your analysis, but our projections are conservative and based on market fundamentals. I believe there’s room to revisit the $11.4M in proceeds. A seven figure paydown simply isn’t feasible.

----------

Dear Borrower,

Market conditions have shifted since you bought this property, and we cannot ignore current realities. We’re confident in our analysis and get a lot of pressure from our regulators to call it like we see it. The $11.4 million is the maximum we can extend. If that’s not feasible, I strongly suggest you explore equity contributions or other solutions.

----------

Dear Lender,

I understand conditions have changed, but the discrepancy here is significant. We’ve been operating this property efficiently and believe our projections are reasonable. A $3.6 million paydown isn’t workable—we simply don’t have that level of liquidity.

All you have is a take it or leave it offer?

----------

Dear Borrower,

We’ve been patient, but the numbers are not up for negotiation.

If liquidity is an issue, I'm guessing you will want to seriously consider marketing the asset for sale to avoid getting into an even more challenging situation. Either way, we need clarity on your plan before the loan matures.

I value the relationship here and have done everything I can, but you should know that we reserve all of our remedies.

----------

Dear Lender,

This is extremely frustrating. Selling the property or finding equity partners on this timeline wasn’t part of the plan. These terms are far harsher than we expected, and you’re putting us in an impossible position.

We need to discuss alternatives. Can we set up a call?

----------

Dear Borrower,

I understand your frustration, but this situation isn’t unique, nor unexpected given market conditions. The loan matures in a few months, and we’ve outlined the options.

We’ll schedule a call, but I’ll reiterate: there’s no flexibility on our end. The sooner you begin planning for a resolution, the better. I'll need you to execute the attached pre-negotiation letter before we talk.

Re: Paydown

Dear Borrower,

Thanks for the update. We’ve reviewed the situation, and based on our underwriting, the numbers don’t quite align. We're arriving at a $17.6 million valuation, supporting only $11.4 million in proceeds. This means a $3.6 million paydown would be necessary. Let us know how you’d like to proceed.

----------

Dear Lender,

Thank you for your response. I understand your analysis, but our projections are conservative and based on market fundamentals. I believe there’s room to revisit the $11.4M in proceeds. A seven figure paydown simply isn’t feasible.

----------

Dear Borrower,

Market conditions have shifted since you bought this property, and we cannot ignore current realities. We’re confident in our analysis and get a lot of pressure from our regulators to call it like we see it. The $11.4 million is the maximum we can extend. If that’s not feasible, I strongly suggest you explore equity contributions or other solutions.

----------

Dear Lender,

I understand conditions have changed, but the discrepancy here is significant. We’ve been operating this property efficiently and believe our projections are reasonable. A $3.6 million paydown isn’t workable—we simply don’t have that level of liquidity.

All you have is a take it or leave it offer?

----------

Dear Borrower,

We’ve been patient, but the numbers are not up for negotiation.

If liquidity is an issue, I'm guessing you will want to seriously consider marketing the asset for sale to avoid getting into an even more challenging situation. Either way, we need clarity on your plan before the loan matures.

I value the relationship here and have done everything I can, but you should know that we reserve all of our remedies.

----------

Dear Lender,

This is extremely frustrating. Selling the property or finding equity partners on this timeline wasn’t part of the plan. These terms are far harsher than we expected, and you’re putting us in an impossible position.

We need to discuss alternatives. Can we set up a call?

----------

Dear Borrower,

I understand your frustration, but this situation isn’t unique, nor unexpected given market conditions. The loan matures in a few months, and we’ve outlined the options.

We’ll schedule a call, but I’ll reiterate: there’s no flexibility on our end. The sooner you begin planning for a resolution, the better. I'll need you to execute the attached pre-negotiation letter before we talk.

COMMENTS