Multifamily distress: Look out below! (or maybe not)

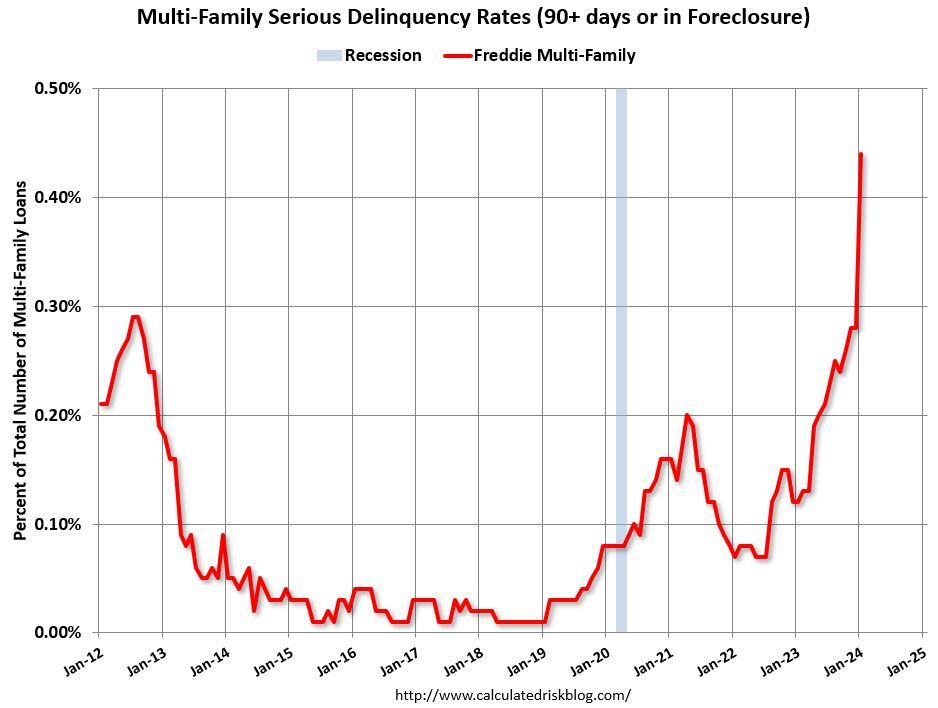

Bill McBride, a widely followed and respected housing pundit, recently highlighted a surge in serious delinquencies related to multifamily loans...

"Freddie Mac reports that the multifamily serious delinquency rate increased sharply in January to 0.44% from 0.28% in December, and up from 0.12% in January 2023. ...this will be something to watch as more apartments come on the market in 2024."

Then JP Morgan's CMBS/RMBS team followed up with some context...

"We received a number of questions this week on Freddie Mac's multifamily serious delinquency rate, which spiked in January to their GFC highs. While we don't deny that delinquency rates are rising for multifamily broadly (as we had anticipated) and likely will continue to grow, some context is required here."

"...we found that the majority of the spike in January was due to a large senior housing loan and $182mn of FRESB loans backed by NYC rent-regulated properties sponsored by Emerald Equities."

"If we strip out both Bishop Senior Living (which seems more idiosyncratic) and the Emerald Equities loans (perhaps less idiosyncratic but a narrower NYC rent-regulated multifamily problem), the serious delinquency rate

for Freddie K/Q and FRESB combined, drops from 0.41% to 0.27%, a 5bp increase month-over-month."

"Yes, multifamily delinquencies are rising even for the GSEs but the spike was more idiosyncratic and not necessarily symptomatic of widespread issues)."

"Even with the spike, the serious delinquency rate was only 44bp, a far cry from what we are seeing in non-agency CMBS."

Our takeaway...

The narratives around a real estate apocalypse are building but losses continue to be relatively muted. The risk of narratives outrunning reality seems high. Might be good to take anecdotal evidence with a grain of salt.

COMMENTS