"Fearmongering: the action of intentionally trying to make people afraid of something when this is not necessary or reasonable."

---- Recent headlines ----

"Multifamily is the next stress point in commercial real estate"

"Multifamily risks a huge distress problem"

"Distress soared 440% in a key corner of the commercial real estate debt market in the last year"

---- Our takeaways ----

1. Multifamily properties and mortgages are under pressure

...borrowing rates were sub 3%.

...loan proceeds approached 70% LTV.

...cap rates were sub 4%.

...household formations have downshifted.

...supply is ramping up meaningfully.

2. Fear-inspiring headlines make it easy to lose sight of reality.

...all major indicators are moving in the wrong direction.

...but mortgage quality has not imploded.

...some pockets are struggling.

...others seem to be in decent shape.

3. For investors and industry players, facts matter.

Narratives don't pay the bills, so we're diving into the most likely sources of multifamily stress to share fact-based perspectives on the current situation.

---- First up ----

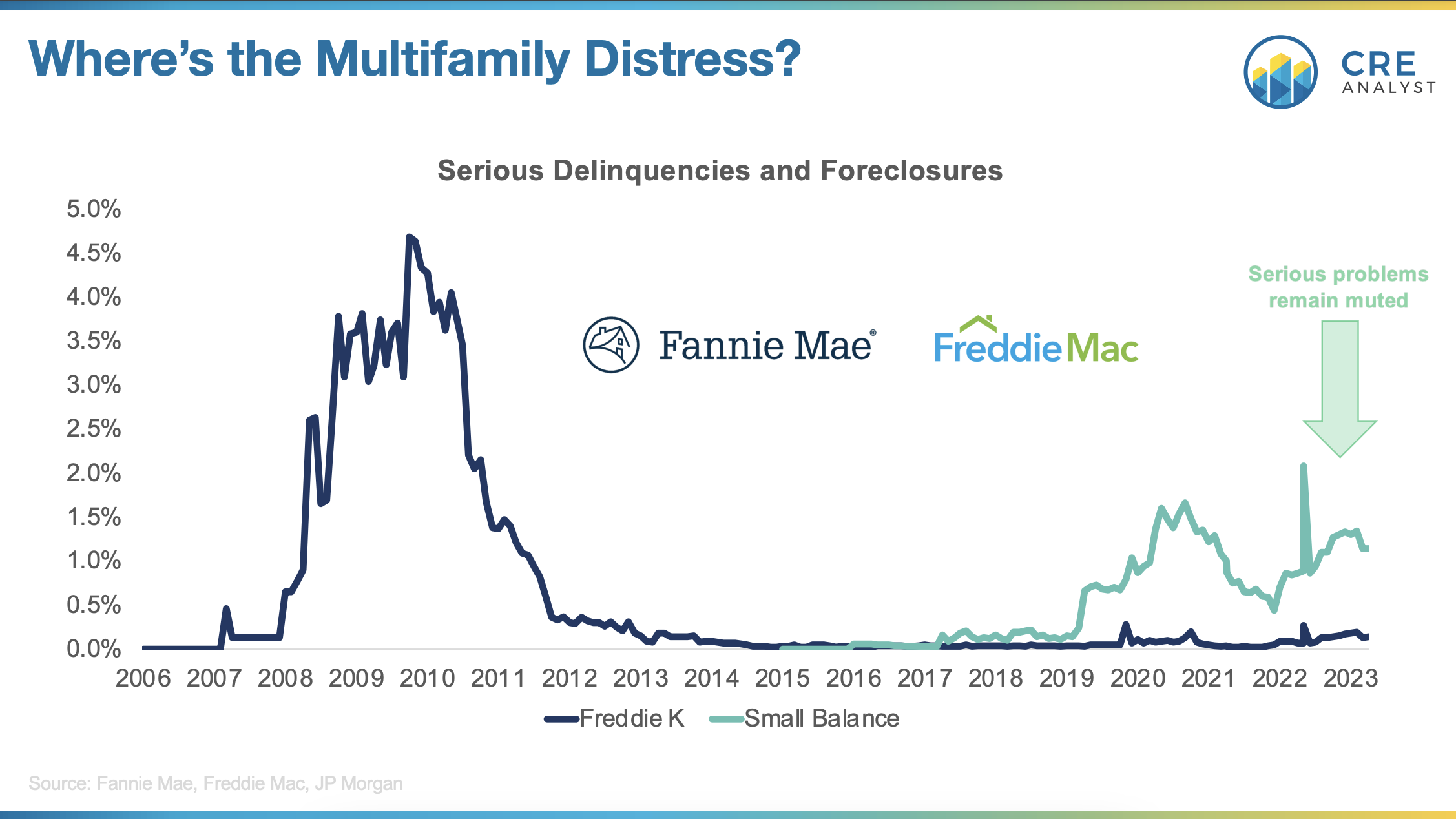

A quick look at agency loan performance:

-- Delinquency rates are up a lot on a relative basis.

-- But problem loan rates generally remain relatively low.

-- Down-the-middle agency loans continue to perform well.

-- Two potential pockets of problems: floaters and small balance loans.

---- Estimating multifamily distress ----

We're tracking $61 billion of outstanding floating-rate Freddie loans.

1. How much will these borrowers have to collectively pony up to avoid foreclosure?

a) $1 billion

b) $3 billion

c) $6 billion

d) $9 billion

e) More than $9 billion

2. What share of floating rate loan pools have average DSCRs below 1.0x?

a) Less than 2%

b) 2% to 5%

c) 5% to 10%

d) 10% to 15%

e) More than 15%

3. What share of floating rate loan pools have minimum DSCRs below 1.0x?

a) Less than 2%

b) 2% to 5%

c) 5% to 10%

d) 10% to 15%

e) More than 15%

We'll publish our answers to these questions tomorrow.

PS - To clarify, we continue to believe there will be an increase in multifamily distress. There will be winners and losers, but the indicators we track fail to reveal any sort of systemic crisis (as we'll outline over the next week).

COMMENTS