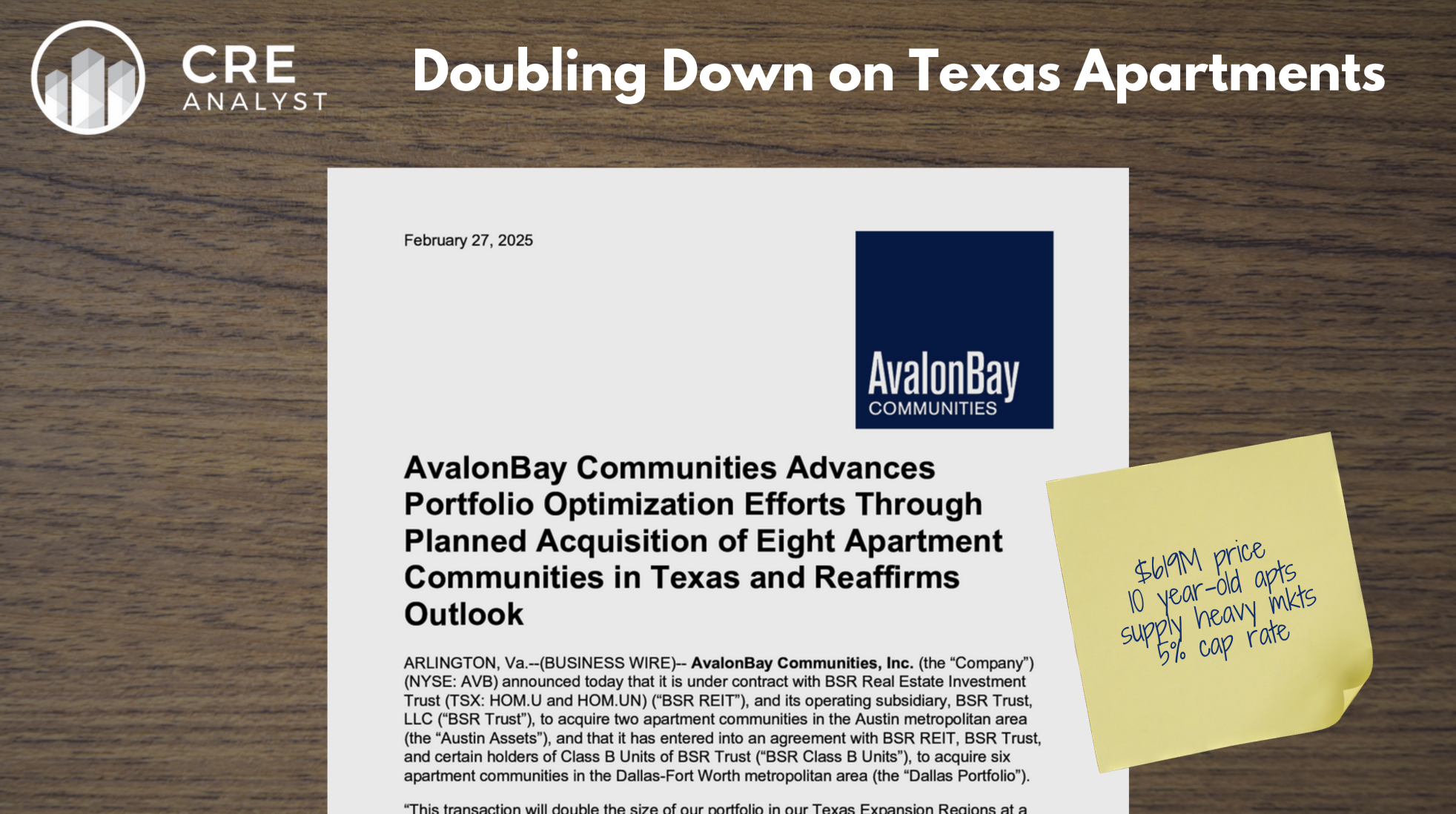

Behind the deal: Avalon Bay's $619M acquisition

[fresh read on stabilized apartment cap rates]

---- Transaction summary ----

Buyer:

AvalonBay Communities, Inc. (NYSE: AVB)

Seller:

BSR Real Estate Investment Trust (Canadian REIT)

Portfolio:

2,701 units

8 assets

10 years old on average

900 to 1200 SF avg unit sizes

2-5% vacancy

Total Acquisition Price:

$618.5 million

$229K per unit

4.7% to 5.1% cap rate

---- Buyer’s spin ----

-- Doubles AvalonBay’s presence in Texas

-- Enhances operating efficiencies in high-growth regions

-- Compelling basis vs. replacement cost

-- Suburban, garden-style communities align with AvalonBay’s strategy

---- Seller’s spin ----

-- Monetizes core assets

-- Captures a $111M gain on sale

-- Validates fair market estimates

-- Strengthens balance sheet with cash and shares

-- Reinvesting ~$190M into acquisitions with stronger growth potential

-- Rotates toward newer assets in high growth suburbs

---- Takeaways ----

1. Strong pricing is available

The notion that multifamily assets can't trade near a 5% cap rate in a 4%+ Treasury environment continues to be disproven. This transaction underscores that pricing remains strong for well-located, institutionally desirable assets—even 10+ year old assets. Multifamily isn't a monolith—higher-quality, well-leased properties still attract capital at solid valuations.

2. CRE markets follow the capital

This deal highlights how capital certainty drives investor demand. AVB, with sub-25% leverage, is funding this acquisition through proceeds from older property sales and by issuing equity at around a 5.0 cap rate. If your buyer has access to capital, "distress" is a comical concept.

3. Recycling and repositioning of players

AVB and BSR’s capital structures make the buyer-seller dynamic clear. AVB, with a 4.4% AFFO yield, can efficiently scale in Texas, while BSR, at 6.4% AFFO yield, is taking the opportunity to redeploy capital into assets with stronger growth potential. The transaction reinforces how balance sheet strength and investment focus dictate which firms are in acquisition versus disposition mode.

4. Unanswered questions

This trade affirms investor appetite for higher-quality multifamily, but major questions remain for the broader market. If well-leased properties in DFW and Austin are transacting at ~5% cap rates, what does that say about the assets closer to those markets' 10%+ average vacancy rates? How will new deliveries with higher rent profiles perform as demand normalizes? Longer stabilization periods could bury many sponsors behind the pref and many owners behind maturing construction debt. Could B and C assets (that traded in the 4s only a few years ago) trade at any price today? It's unclear if anyone is open to their office-like capex burdens.

COMMENTS