"Clearly too high. Let's just say it."

'The ODCE overall is marked to a 4.6% cap rate as of last quarter. Industrial is at a 3.9%, apartments are at a 4.5%, office is at a 6%. [To invest in core funds today] you have to be comfortable allocating into those valuations...'

-- Non-core investment manager

'...which are clearly too high. Let's just say it.'

-- Leading real estate fundraiser

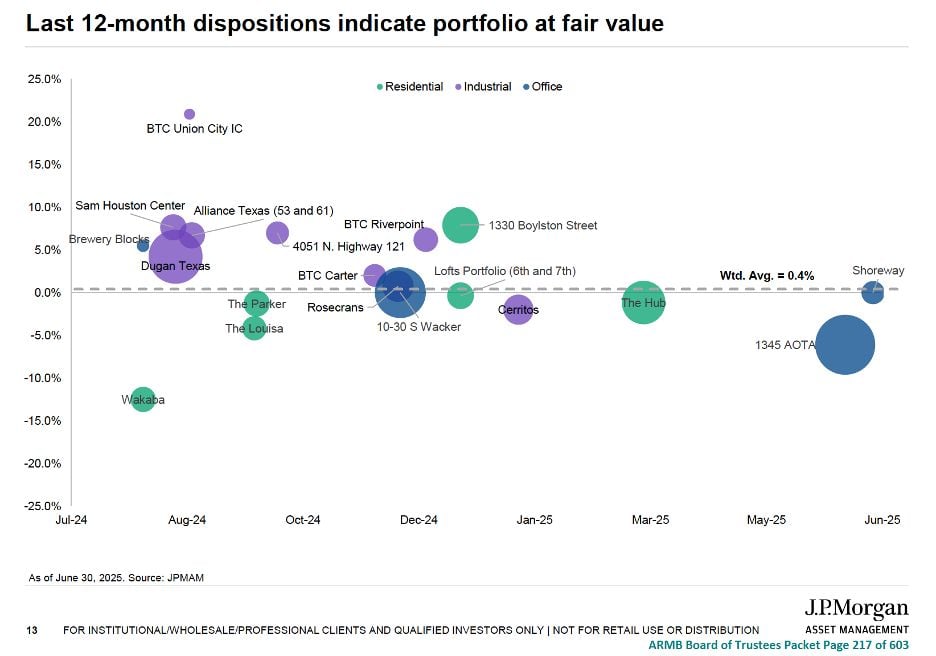

...but we are consistently selling properties above their carrying marks.

-- Leading core fund

Core funds, which make up a relatively small share of the real estate capital markets but serve a critical role by defining pricing for the highest quality assets, remain on the sidelines thanks to redemption queues.

The three-year culprit: many investors don't believe those funds' carrying values.

But there are three different perspectives on this key tension:

1. Managers of more opportunistic funds are wisely pointing out their competitive advantages. i.e., investors in their funds don't have to buy in at low cap rates.

2. Fundraisers are conveying how difficult it continues to be to raise core capital in the face of redemption queues, lower REIT values, and lower secondary values.

3. Core fund managers are saying they're regularly selling above their marks, suggesting they aren't actually overvalued at all. [This slide is from one of the largest fund's recent pitch deck to a large investor.]

Where do you land?

PS -- Kudos to Nancy Lashine for continuing to bring the tensions that define real estate capital trends to light by having engaging conversations with guests like Tom Gilbane on Park Madison's Real Estate Capital podcast.

COMMENTS