Case study: Did this deal trigger the GFC?

Background:

Seventeen years ago this week, Lehman Brothers filed for bankruptcy.

What happened?

The market lost confidence in the value of Lehman’s real estate.

Why?

Questions about Lehman's Archstone carrying value began dominating headlines.

Here's what happened:

1) A massive real estate LBO...

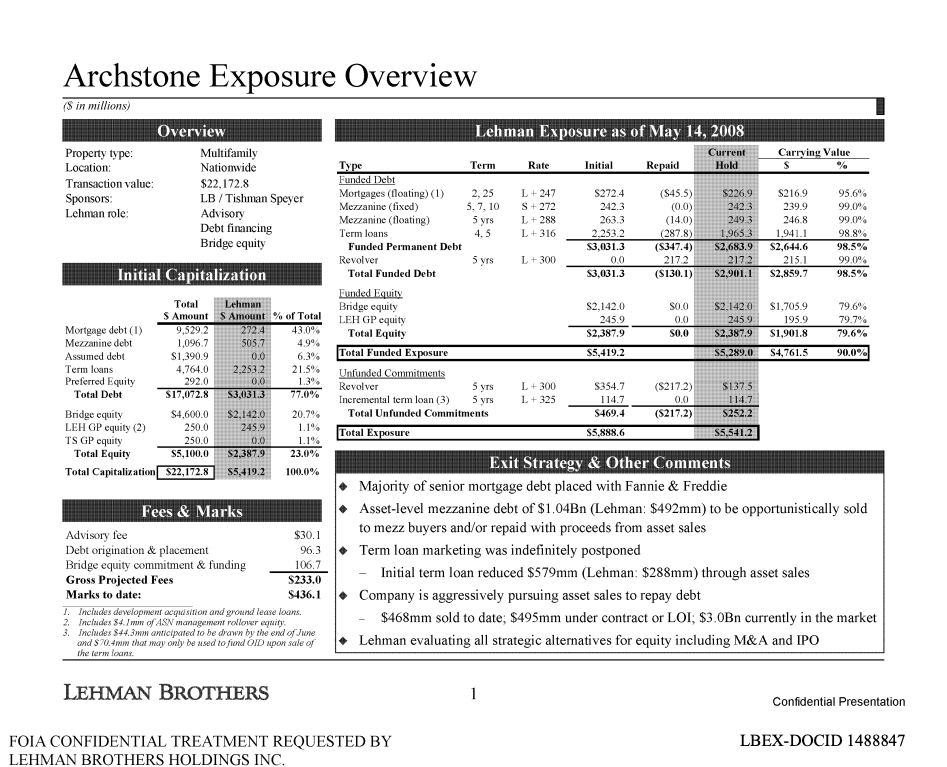

In 2007, Lehman Brothers led the $22 billion buyout of Archstone, one of the largest apartment REITs in the country.

2) A musical chairs strategy...

Lehman’s playbook was straightforward. Buy into a trophy portfolio, break the financing into pieces, and flip the loans and equity to other investors. That syndication strategy had worked for years.

3) The music stopped...

This time, it did not. Lehman ended up holding about $5.4 billion of exposure, split between $3.0 billion of loans and $2.4 billion of equity.

4) Lots of debt...

Archstone was already carrying heavy leverage. The deal closed at 76% LTV. Lehman’s $2.4 billion equity sat beneath nearly $17 billion of debt.

5) A billion here, a billion there...

A 10% decline in enterprise value meant a $1 billion hit to Lehman’s equity stake. That is exactly what started to happen as the housing market rolled over.

6) But 'we took our marks'...

At closing, Lehman booked a $230 million write-down but only to offset the fees it earned on the deal. The positions themselves stayed untouched.

7) Not exactly the plan...

The syndication pipeline froze. Instead of placing billions of loans and equity, Lehman managed to move only $43 million.

8) Public markets go first...

By early 2008, apartment REIT peers had lost 30 to 40% of their market value. Barron’s went so far as to suggest Archstone’s equity was already worthless.

9) Questionable valuations...

Lehman trimmed only $250 million in March, $100 million in May, and $125 million in Q3. The numbers looked disconnected from reality.

10) 20/20 hindsight...

Examiners later concluded that by late 2008, Lehman was overstating the value of its Archstone equity by $140 to $400 million.

11) Coming clean...

Product Control, the group meant to serve as a check on valuations, admitted it did not have the data or the authority to challenge the deal team. The same bankers who engineered the buyout also decided what it was worth.

12) The fatal crack in confidence...

When counterparties realized the marks were not real, the question shifted from Archstone to Lehman itself. If these numbers were wrong, how could any of the numbers be trusted?

==========

An investor failing to reflect market conditions in their carrying values.

Sound familiar?

COMMENTS