Investment memo: The deal that killed Lehman Brothers...

"One of the company's worst deals arguably was for Archstone-Smith, a real-estate investment trust focused on high-end apartments in Manhattan, Southern California and the Washington, D.C., area. It was taken private by Lehman and New York-based Tishman Speyer in October 2007 in a $22 billion transaction." (Barrons)

---- Lehman's rationale ----

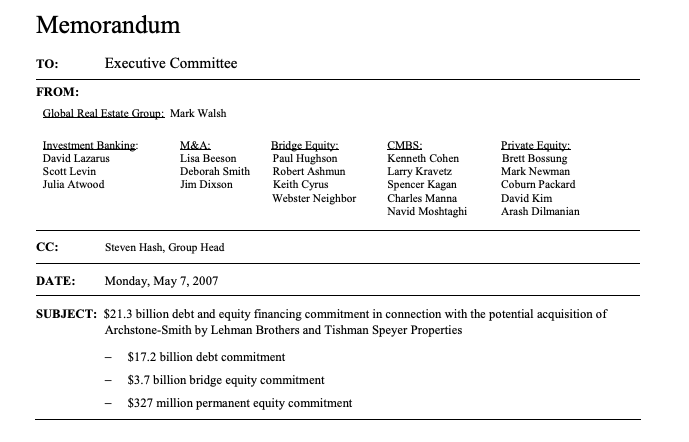

Per this investment memo, which was acquired via bankruptcy litigation filings, Archstone penciled due to the following factors:

1. Trophy portfolio: Class-A, high-rise heavy in key coastal markets.

2. Below replacement cost: $325k per unit buy-in vs. $390k cost.

3. Financing looked smart. More than $8.8B of mortgages were placed with Fannie and Freddie on day one.

4. Entry cap rate was ~4.05%. The deal was underwritten to mid-teens levered IRR. The fee stack (GP promote, management, bridge, and debt fees) made the platform math compelling.

5. The plan was to sell $9.2B of assets quickly to reduce leverage to ~70% and syndicate 50% of both bridge equity and debt almost immediately.

---- What actually happened ----

1. Public REIT comps cracked. Multifamily cap rates backed up and NAVs compressed. The 4% entry cap blew up.

2. Syndication markets froze. Bridge-equity marketing stalled, and subordinate debt stopped trading indefinitely.

3. Cash flow snags: ~$700M NOI versus ~$1B of interest. The equity was underwater almost immediately.

4. Internal and external scrutiny mounted. Archstone became a lightning rod on earnings calls as investors questioned marks.

5. Write-downs came, but not fast enough. Later reviews suggested Lehman’s equity stake was still overstated by hundreds of millions even after impairments.

Barrons wrote at the time: "The deal's capitalization rate -- annual rental income divided by purchase price -- was aggressive at close to 4%. Using a cap rate of 5%, to reflect the current real-estate market, there would be little or no value in the Archstone equity."

Critically, Lehman's investment in Archstone represented about 20% of the $800B firm's entire equity as of 2Q08.

Read the full memorandum here.

PS -- Want to see other internal Lehman presentations on the Archstone deal? Comment below on the best or worst parts of this deal from the memo. The fees looked sweet. Would you have done the deal?

COMMENTS