Nothing to see here...

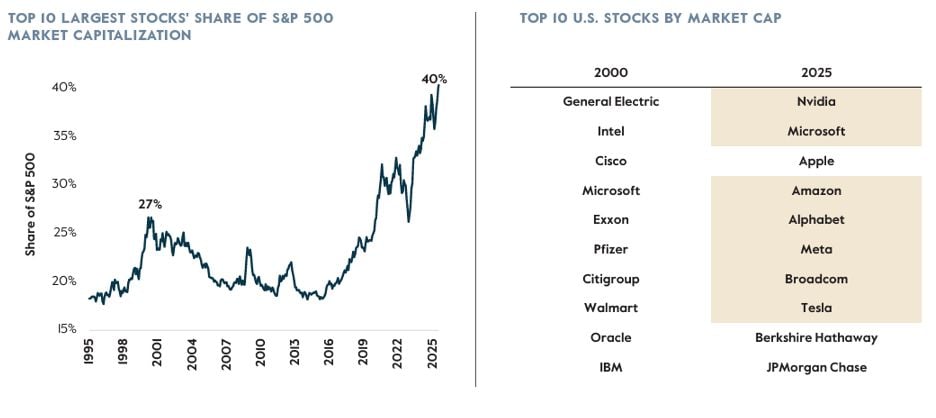

1. AI stocks now represent 43% of S&P 500 market cap, the highest concentration since the 1960s.

2. The top 4 AI companies are spending $300B+ annually on capex vs. $150B pre-AI trend.

3. Only 1 in 20 AI business integrations show measurable ROI (MIT study).

4. Investor risk-taking now exceeds dot-com bubble levels (JPM data).

5. AI companies are trading at 38x forward PE vs. 22x for non-AI stocks.

6. Real interest rates historically hit 4% during comparable capex booms.

7. Non-AI companies already showing negative earnings growth.

8. Some models project $25 trillion in "optimal" AI investment vs. current $800B spent.

9. Manufacturing costs could approach zero if productivity promises materialize.

10. Historical precedent: Revolutionary technology and financial bubbles often coincide.

The market has made an extraordinary bet on AI transformation, concentrating nearly half of its value in companies whose returns remain largely theoretical.

Whether this represents visionary investment in the next industrial revolution or dangerous speculation will likely be determined by execution timelines that remain highly uncertain.

The gap between transformational potential and current measurable returns has created a fascinating tension where both technological revolution and market correction could prove inevitable.

CRE isn't exactly caught in the middle but is certainly exposed if the AI frenzy proves to be a bubble.

What do you think?

A. AI is completely overhyped.

B. AI will change the game but on a slower-than-anticipated timeline.

C. AI is worth the type.

1. AI stocks now represent 43% of S&P 500 market cap, the highest concentration since the 1960s.

2. The top 4 AI companies are spending $300B+ annually on capex vs. $150B pre-AI trend.

3. Only 1 in 20 AI business integrations show measurable ROI (MIT study).

4. Investor risk-taking now exceeds dot-com bubble levels (JPM data).

5. AI companies are trading at 38x forward PE vs. 22x for non-AI stocks.

6. Real interest rates historically hit 4% during comparable capex booms.

7. Non-AI companies already showing negative earnings growth.

8. Some models project $25 trillion in "optimal" AI investment vs. current $800B spent.

9. Manufacturing costs could approach zero if productivity promises materialize.

10. Historical precedent: Revolutionary technology and financial bubbles often coincide.

The market has made an extraordinary bet on AI transformation, concentrating nearly half of its value in companies whose returns remain largely theoretical.

Whether this represents visionary investment in the next industrial revolution or dangerous speculation will likely be determined by execution timelines that remain highly uncertain.

The gap between transformational potential and current measurable returns has created a fascinating tension where both technological revolution and market correction could prove inevitable.

CRE isn't exactly caught in the middle but is certainly exposed if the AI frenzy proves to be a bubble.

What do you think?

A. AI is completely overhyped.

B. AI will change the game but on a slower-than-anticipated timeline.

C. AI is worth the type.

COMMENTS