How to manufacture 10% returns from debt investing in a 4% market...

1. Take some credit risk:

Risk-free bonds are around 4%. Corporate bonds generate an incremental 100 bps over risk-free rates, and real estate lending generates, say, 150-300 bps.

2. Take some floating rate risk:

Generate a little extra spread by financing shorter-term business plans.

3. Borrow:

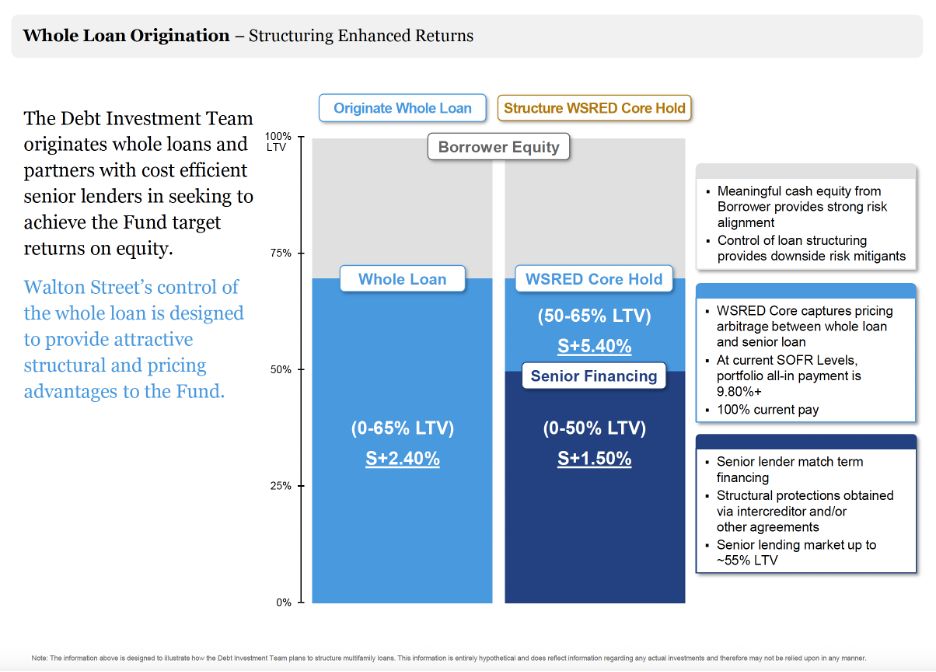

Magnify returns by giving the safest portion of the investment to a lower cost of capital provider.

"At current SOFR Levels, portfolio all-in payment is 9.80%+"

Lots of ways this industry darling approach could evolve in the coming months and years. What's your guess?

COMMENTS