Canary in the coal mine: an early indicator of potential danger or failure. Real estate example…

Property:

Apartments built in early 1980s

Purchase price:

$111M

Acquisition:

2022

Leverage:

75%

Syndicated equity:

$21.5M

Equity placement fee:

$1.9M

Sponsor acquisition fee:

$2.2M

Going-in cap rate:

3%

Assumed exit cap rate:

4.4%

Sponsor promote:

50% over a 10%

Underwritten investor returns:

18.5% IRR, 1.7x multiple

One-off deal? Not at all.

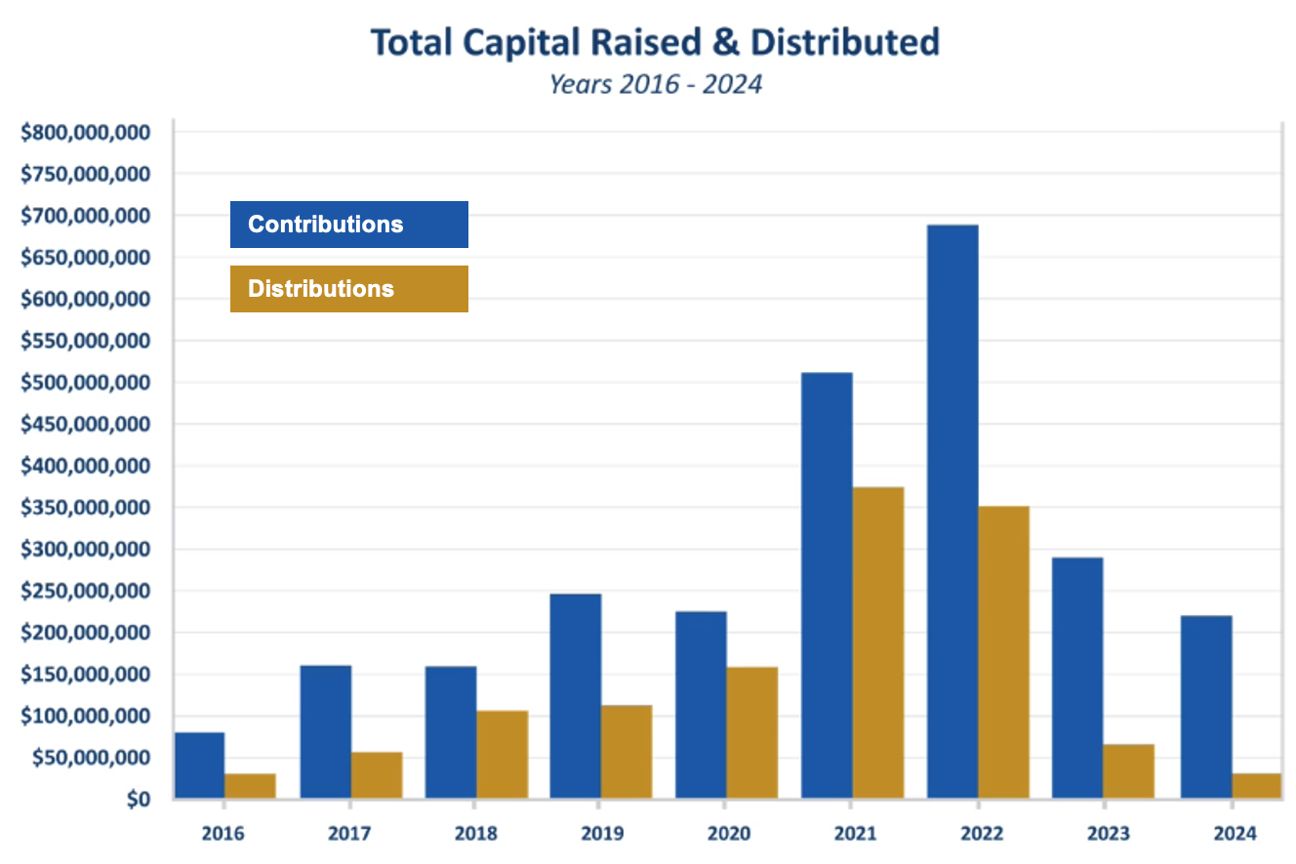

This syndicator put out $1.2B near the peak of the market 3-4 years ago.

Look out below.

COMMENTS