Pick one: Where would you invest?

Moving up the credit ladder…

---- 10 year treasury ----

4.3% yield

AAA credit

Guaranteed by best money printing press in the world but unsustainable fiscal situation

---- REIT bonds ----

5% to 5.5% yield

Investment grade credit (BBB)

< 35% LTV

Guaranteed by the most stable owners of real estate

---- CMBS ----

5.0% to 5.5%

AAA credit

< 55% LTV

Secured by diversified, stabilized real estate collateral

---- Traditional commercial mortgages ---

5.5% to 6.5%

Below investment grade equivalent credit

< 60% LTV

Secured by a single high-quality property

---- SASB office ----

6.5%

57% LTV

Secured by Rockefeller Center complex in NYC

---- Multifamily construction loans ----

7.0% to 8.0%

< 55% LTV

Secured by a single, to-be-constructed multifamily property in a market defined by excess supply, along with a developer's unequivocal pledge to complete construction

---- Office construction loans ----

8.0% to 9.0%

< 55% LTV

Secured by a single, to-be-constructed office property in a trophy location and in a market with strong demand for trophy office, along with a developer's unequivocal pledge to complete construction

==========

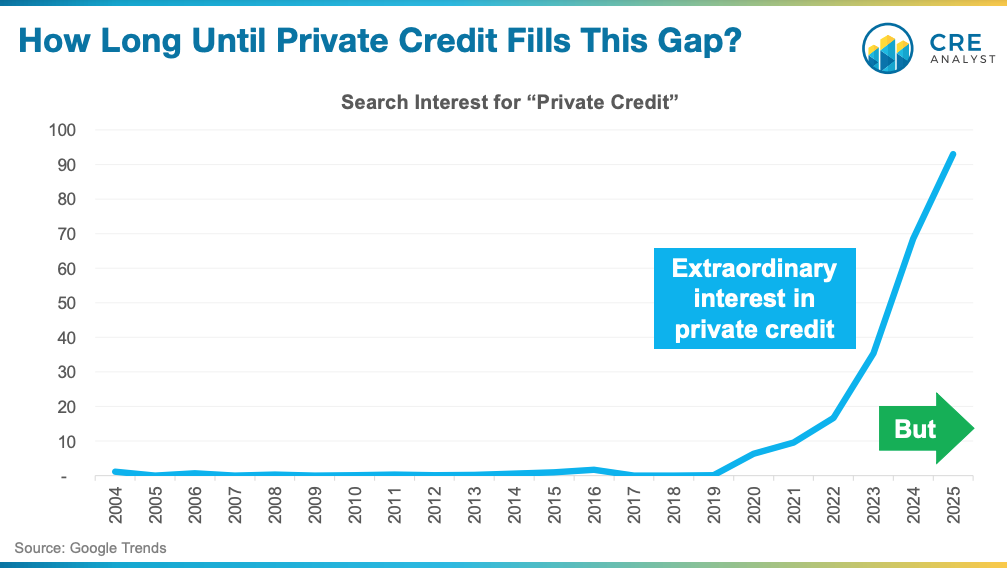

Interest in private credit is booming.

These investors have massive origination platforms and are generally defined by their ability to identify strong credit opportunities.

Yet, the one place they will not go continues to be office construction, despite very differentiated risk compared to other construction loan profiles.

Fools gold or excess spread hidden in plain site?

When will interest in this small corner of the market shift?

PS - Would you rather invest in a 50% LTC office construction loan at 8%+ or in the levered equity of your favorite property at a 5.5% cap rate?

COMMENTS