So no one told you owning's gonna be this way...

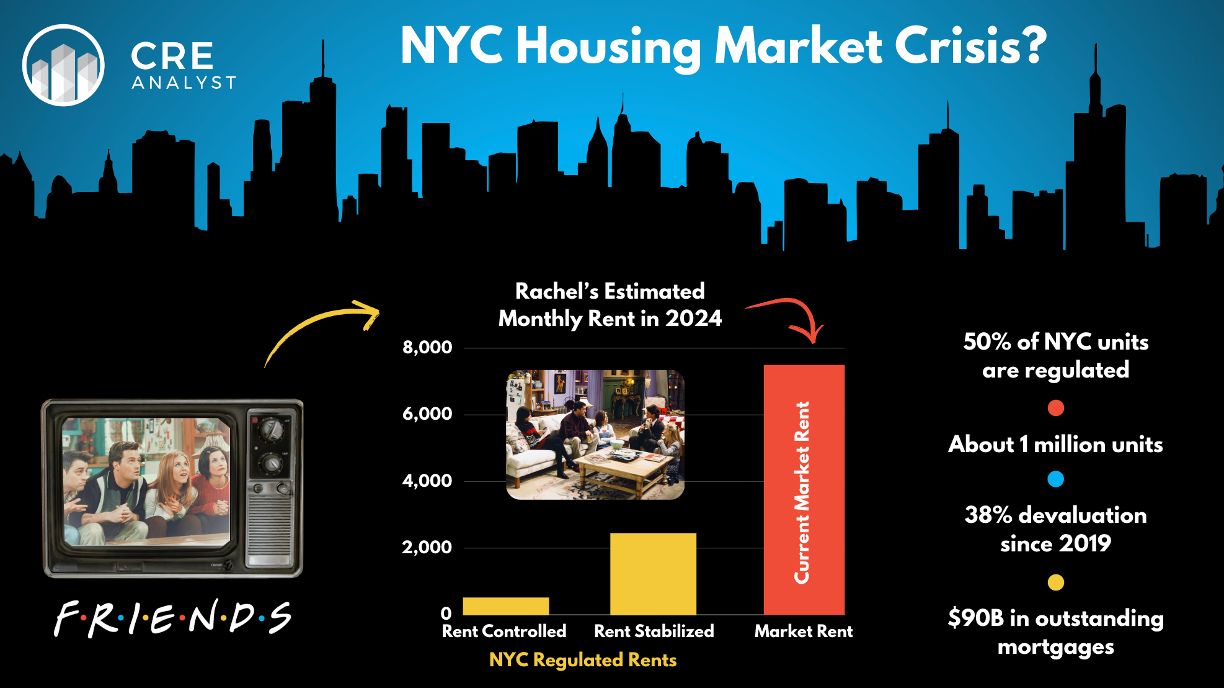

In the 1990s/2000s sitcom 'Friends', Rachel and Monica paid $200 a month for a two-bedroom apartment in NYC's Greenwich Village. $200 was extremely low, even for a "rent controlled" unit in NYC.

...but the consequences of NYC's unique rent regs may be coming to a head, which could hurt lenders, owners, and tenants.

---- NYC Rent Regulations ----

"Rent control" is an arcane series of regulations that keep rents for old NYC apartments anchored to prior generations. There are very few controlled units left in NYC.

However, many NYC rents remain regulated through NYC's rent stabilization program, which caps rent increases at relatively low levels. Maverick Real Estate Partners reports that about half of the apartments in NYC's five boroughs (totaling about 1 million units) are controlled or stabilized.

---- Challenges ----

Since rent regulations only exist in 4-5 U.S. cities, there's a general lack of awareness of the rent schemes, their effects, and pending rumblings from debt and equity in this space.

Several challenges seem to be emerging...

1. Regulation uncertainty/volatility: Owners and lenders are at the behest of politicians and regulators, who are highly responsive to popular opinion. See the example below of how this has been a problem in NYC.

2. Skewed valuations: CFs and cap rates are difficult to predict given the uniqueness of the asset class.

3. Specialized lenders: The multifamily debt markets are the most liquid within commercial real estate, but regulated housing is an exception. Since lenders are more concerned with downside, they often avoid the space, which leads to exposure issues when a few firms rise to dominate the space (e.g., Signature Bank).

4. Specialized buyers/owners: Owners must similarly specialize, which requires additional return premiums, pushing down liquidity and values.

5. Limited and dated supply: Given the extreme complexities, investors are more likely to invest in non-regulated housing product.

---- Housing market dominos? ----

NYC passed "The Housing Stability and Tenant Protection Act" in 2019, which (among other things) (i) prevents rent increases or deregulation upon vacancy, (ii) eliminates deregulation once rents or incomes hit certain thresholds, and (iii) caps rent increases enacted to recover building improvements.

Regulated property values in Manhattan down nearly 40% since the legislation was passed. And the largest lender in the space, Signature Bank, went away when the banking market imploded last year.

What's next for NYC's regulated housing market?

Canary in the coal mine or a nothing burger?

COMMENTS