Dear Jonathan Gray: Why aren't you buying office?

EOP flashback...

"Gray was jittery about the bid. Not only would it be by far the biggest he had executed; it would be the largest LBO ever, and he was looking at writing a check for $3.5 billion or more, the most Blackstone had ever risked in a single deal."

"It would be disastrous if Blackstone paid top dollar and then found itself stuck with overpriced assets it couldn’t unload."

"For reassurance, Gray put in a call to Alan Leventhal, the head of the real estate investment firm Beacon Capital Partners, who had been a mentor and sounding board over the years. Leventhal had a pet theory that he had expounded to Gray in the past, and Gray wanted to hear it again."

"Leventhal’s view was that, in the best markets, where it was hard to build new offices, you would make money over the long run if you bought buildings below their replacement cost, because prices had a natural tendency to rise where the supply couldn’t expand much."

"'He gave me a pep talk. It was like a revival meeting,' Gray says. 'In life, sometimes you need a little confidence booster when you’re thinking about risking your entire career.'“

-- From "King of Capital" (Carey and Morris)

Leventhal's "pet theory" may seem simple, but it seems to have merit...

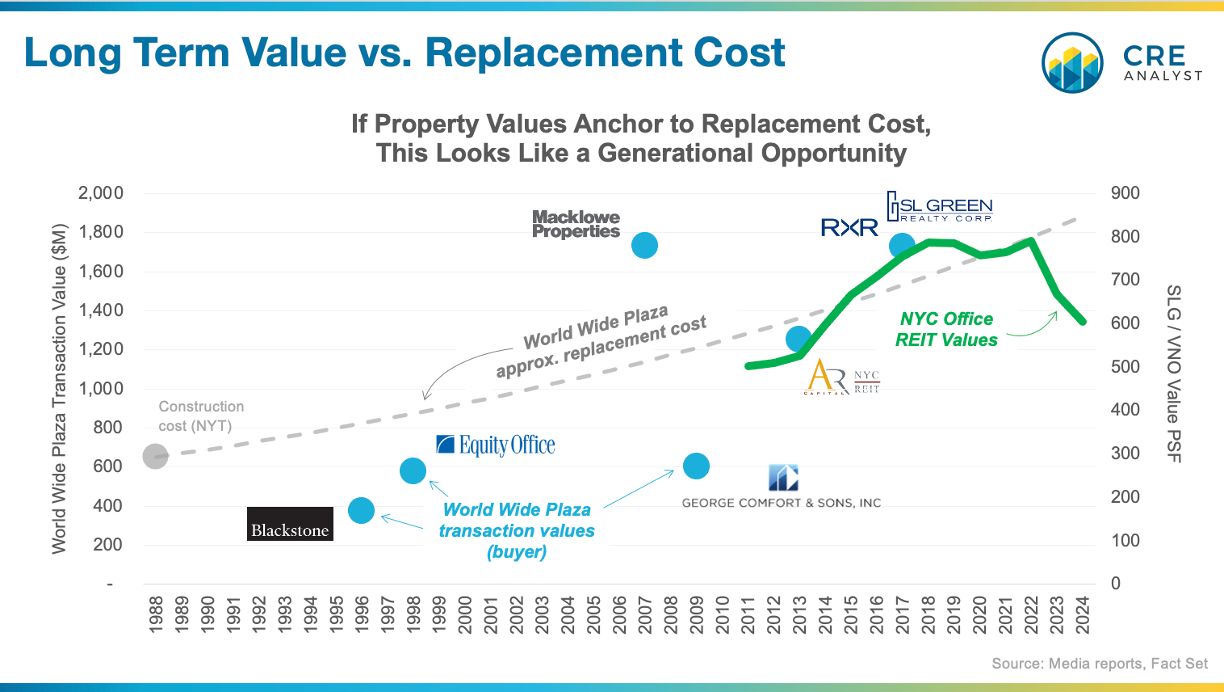

-- Replacement cost benchmark: World Wide Plaza was built in the late 1980s for about $650M.

-- Why World Wide Plaza? It's a big NYC asset that traded at peaks and troughs over the last few cycles, so we have actual transaction values.

-- NYC office value benchmark: SLG and VNO are NYC office REITs. Their shares are priced daily, which gives us an indication of broader NYC office values. Note: SLG is also a part owner of World Wide Plaza.

---- Takeaways ----

-- World Wide Plaza's historical transaction values seem remarkably anchored to replacement cost over the long term (assuming costs have grown at inflationary levels).

-- In recent years, values have fallen by 25%+ while costs have increased by 25%, which could create the biggest disconnect between replacement cost and market value in a very long time.

-- The entire office market has been painted with a singular brush, but we know that some assets are of much higher quality than others.

-- Blackstone is sitting on a mountain of cash and needs to put it to work.

Mr. Gray, we predicted (wrongly) that you would buy an office REIT last year. There are lots of reasons to think you and your team won't run back into office, but this cost vs. value framework (and your EOP experience) might suggest that you will. Only time will tell.

PS - We think you will go down as the greatest real estate investor of all time. Want to plug into one of our classes via Zoom to speak to our students? We'll gladly schedule you for a 2025-26 cohort, so you can tell us how you put BREP X's funds to work.

COMMENTS