"nar·ra·tive: a way of presenting or understanding a situation or series of events that reflects and promotes a particular point of view or set of values"

---- 2024's prevailing narrative ----

It's almost as if every real estate pundit just discovered:

That mortgage rates were 3% a few years ago...

...which made home prices skyrocket.

...which made renting more attractive.

...which elevated rents.

...which made 4% cap rates seem reasonable.

...which made 70% LTV loans look like 50% LTV loans.

...which made lenders want more multifamily debt.

...which put even more downward pressure on borrowing costs.

...which made 5%+ development yields seem reasonable.

...which led to very robust supply pipelines.

Now there's a sudden recognition that trouble could emerge from new realities:

-- 7% mortgage rates

-- Excess supply

-- Stalled rent growth

-- Inflated seller expectations

-- Unrealistic buyer expectations

-- Less debt/transaction activity

-- Near-term maturities

-- Expensive interest rate caps

-- Normalized cap rates

---- Competing narratives ----

1. Titanic: All is lost.

2. Episodic: Pockets of investors will pay for their aggressiveness.

---- Our observations ----

Regardless of your bend, we thought it would be helpful to share a few data-based insights.

1. Floating rate focus:

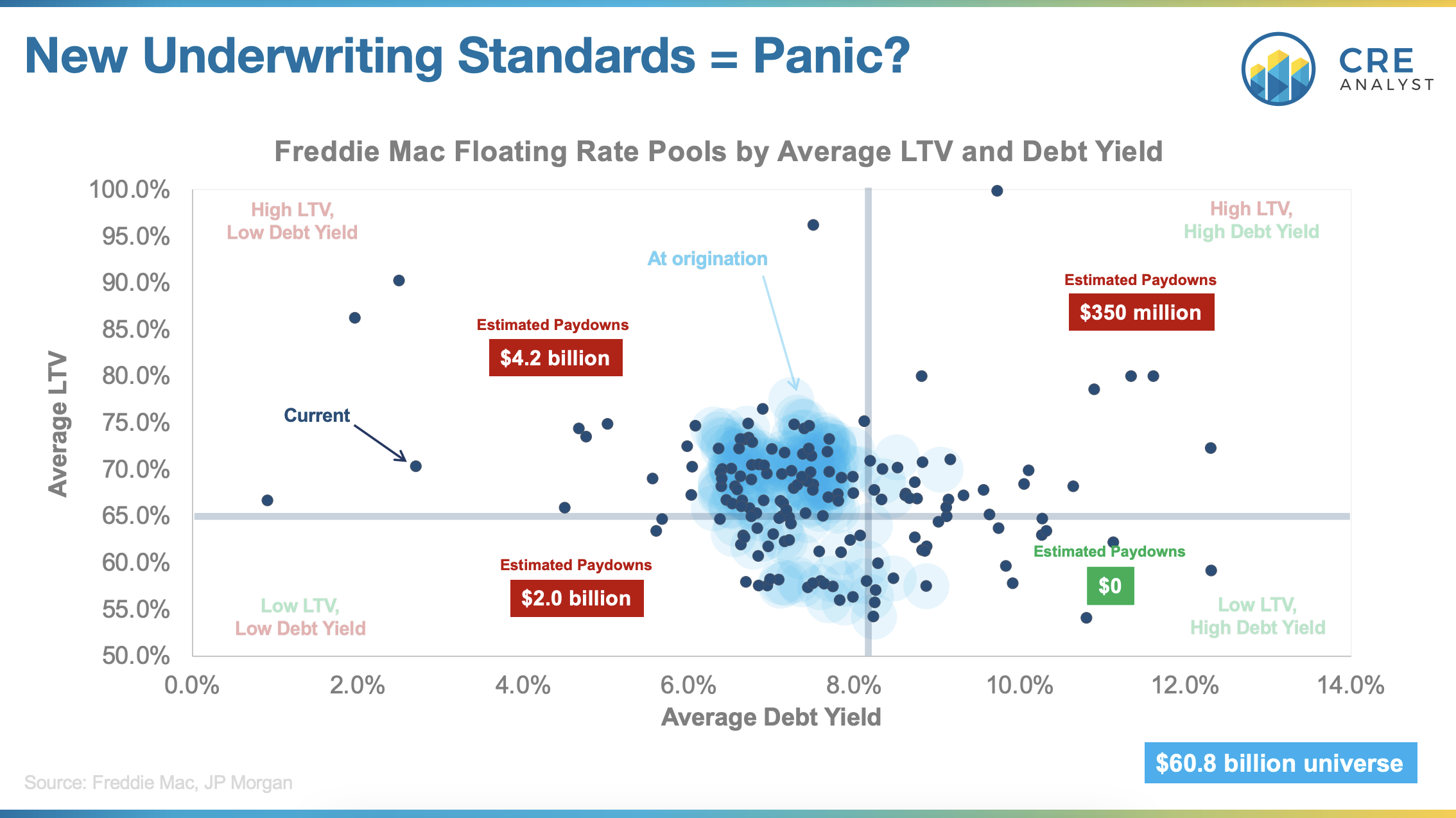

We've focused our attention on the $61 billion in outstanding floating rate agency mortgages (Freddie K).

2. Deleveraging:

If pool-level averages are reasonably indicative, we estimate that borrowers will need to come up with about $7 billion (11% average paydown) to right-size outstanding floating-rate debt. ...assuming lenders are currently sizing to 8% debt yields and 65% LTV thresholds.

3. Sufficient coverage:

$59 billion of the pools (97%) have average DSCRs above 1.0x, which implies that most borrowers can cover debt service. Therefore, lenders may be more willing to extend maturities.

4. Most pools have some problems:

86% of outstanding pools have at least one mortgage that doesn't cover debt service.

5. But losses remain low:

Losses have rounded to zero to date.

6. Extend and pretend is a myth:

Extensions are occurring, but servicers are getting paid down and/or rate cap replenishment. i.e., extensions aren't free and no one is pretending.

7. Growing watchlist:

Nearly $13 billion (or 21% of the pools we analyzed) currently sits on a watchlist.

---- Quick stats ----

-- $40 billion originated 2020-22 (2,700 loans)

-- 20% of these loans in Texas

-- Avg debt yield below 7%

-- Avg coupon of about 3%

-- Less than 1% in special servicing

-- 20%+ on watchlist

-- Current avg LTV below 70%

-- Current avg DSCR of 1.5x

-- Current avg occupancy of 93%

What's your narrative: Titanic or episodic?

COMMENTS