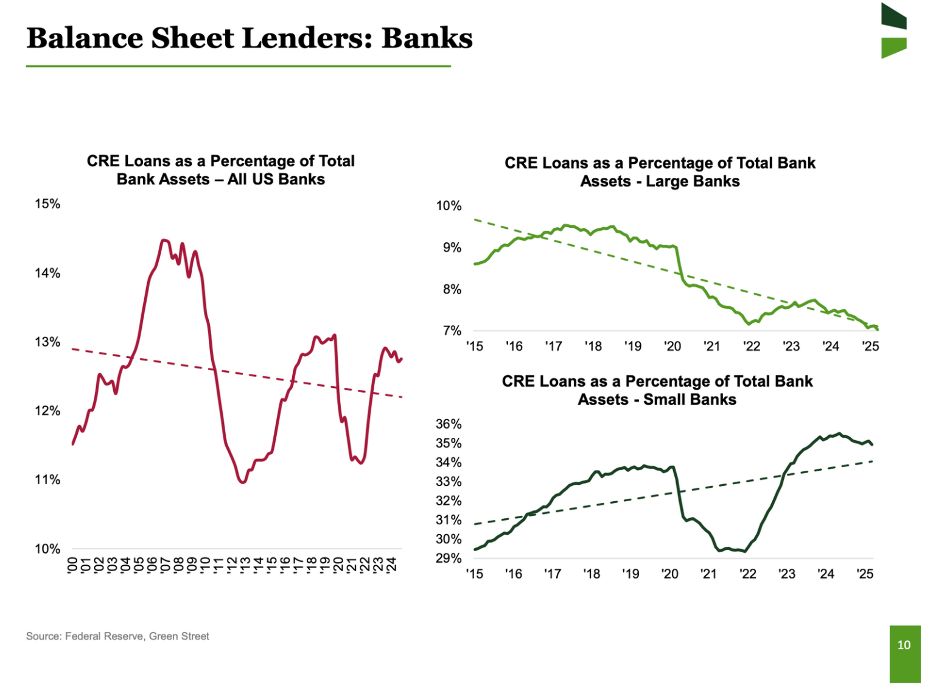

CRE lending has decreased the most at:

(a) big banks or

(b) small banks

The answer might surprise you...

Greenstreet seems to have made some meaningful investments in their real estate debt provider coverage over the last year.

This slide is from a webinar they sponsored earlier this week, and the nuggets go way beyond topside Fed surveys.

Great example of how you have to disaggregate markets to understand trends/outlooks.

Link to the webinar in the comments.

Our working thesis...

Pockets of extreme losses within the real estate capital ecosystem will eventually cause real pain with some sponsors and a handful of big lenders (more of a sidelining effect than insolvency), but the overall consequence of higher rates could be more akin to being stuck in the mud vs. implosion or widespread distress.

PS -- This is a working theory, not gospel. What would you add, challenge, or reframe?

COMMENTS