“Trust in God but keep your powder dry.” Oliver Cromwell

"Dry powder" origins...

The phrase dates back to the days of muskets and cannons. If your gunpowder got wet, it was useless, so keeping it dry literally meant being ready to fight. That idea stuck. In finance, “dry powder” refers to uncommitted capital held back, ready to deploy when the right opportunity (or need) emerges.

From asset to liability...

But gunpowder doesn’t last forever. Over time, especially in volatile storage conditions, it breaks down. The chemical decay can corrode metal (like weapon chambers), cause clumping, reduce stability, and lead to uneven or failed ignition. So while it may look ready, old powder quietly shifts from being an asset to becoming a liability.

Today’s capital markets...

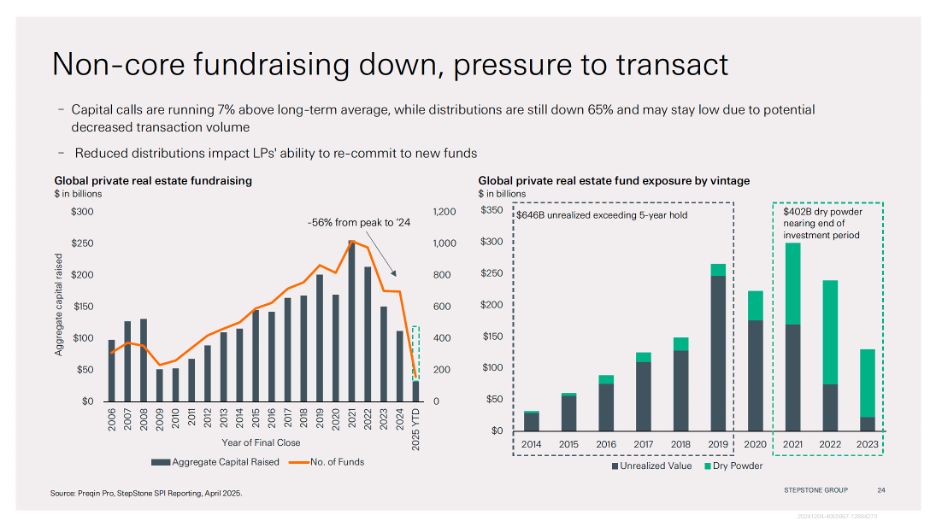

Post-COVID, value-add and opportunistic real estate funds raised record amounts. Twice the capital pulled in pre-GFC. Some was deployed, but a lot stayed on the sidelines. Many pointed to all this dry powder as a reason values wouldn’t fall: “There’s too much capital waiting to buy.”

Three problems:

1. The math blew up. Slowing rent growth and rising cap rates torpedoed the pro formas. Those 18%+ IRRs quickly turned into single digits, below promote hurdles. So managers waited.

2. Cash got tight. Higher rates and weaker fundamentals turned dry powder into defensive capital needed to stabilize existing deals, not chase new ones.

3. LPs are stuck. No distributions. No re-ups. No reallocations. Just quarterly reports with falling marks and fading return targets.

Takeaways...

As the charts below show, the clock is ticking. Pre-COVID fund capital is aging out, and much of the more recent dry powder still has nowhere to go.

PS -- We posted "the birth of dry powder" about a year ago with an interesting (albeit cheeky) take on how dry powder became such a popular talking point. Link in comments.

COMMENTS