Is the "maturity wall" an urban myth?

----- Ever heard of Slender Man? -----

In 2009, an anonymous blogger was playing around trying to leverage his Photoshop skills to create a new mythological creature.

His images of a faceless, shadowy figure hovering around unsuspecting kids quickly became an urban myth. 'Slender Man' memes and videos terrified kids and their parents and received national media attention.

Then two 12 year olds nearly stabbed a classmate to death, claiming they were afraid that Slender Man would kill their families if they didn't commit the murder.

----- What's this have to do with CRE? -----

Like bloggers with Photoshop skills, CRE pundits love a good boogeyman narrative.

-- 'Commercial Property Faces Crisis' (WSJ, 2009): $524.5 billion of whole commercial mortgages held by U.S. banks and thrifts are expected to come due between this year and 2012. Nearly 50% wouldn't qualify for refinancing in a tight credit environment...

-- 'High losses, slow burn' (Goldman, 2008): CRE losses will exceed $180 billion, matching subprime losses.

-- 'Maturity Wall Looms Anew for CMBS' (Globe Street, 2016): The question of how, or if, borrowers will be able to refinance the nearly $120 billion in CMBS loans maturing through 2018 is on the minds of market participants, including the ratings agencies.

----- Headlines from the last few months -----

-- Looming maturity wall gives rise to new 'blend and extend'

-- A $1.5 Trillion Wall of Debt is Looming for US Commercial Real Estate

-- Commercial Mortgage Sector Faces Another Wall of Maturities

-- Colliding with CRE's maturity wall

----- The allure of "maturity walls" -----

-- Simplicity

-- Fear of loss

-- Difficult to disprove

-- No recourse for being wrong

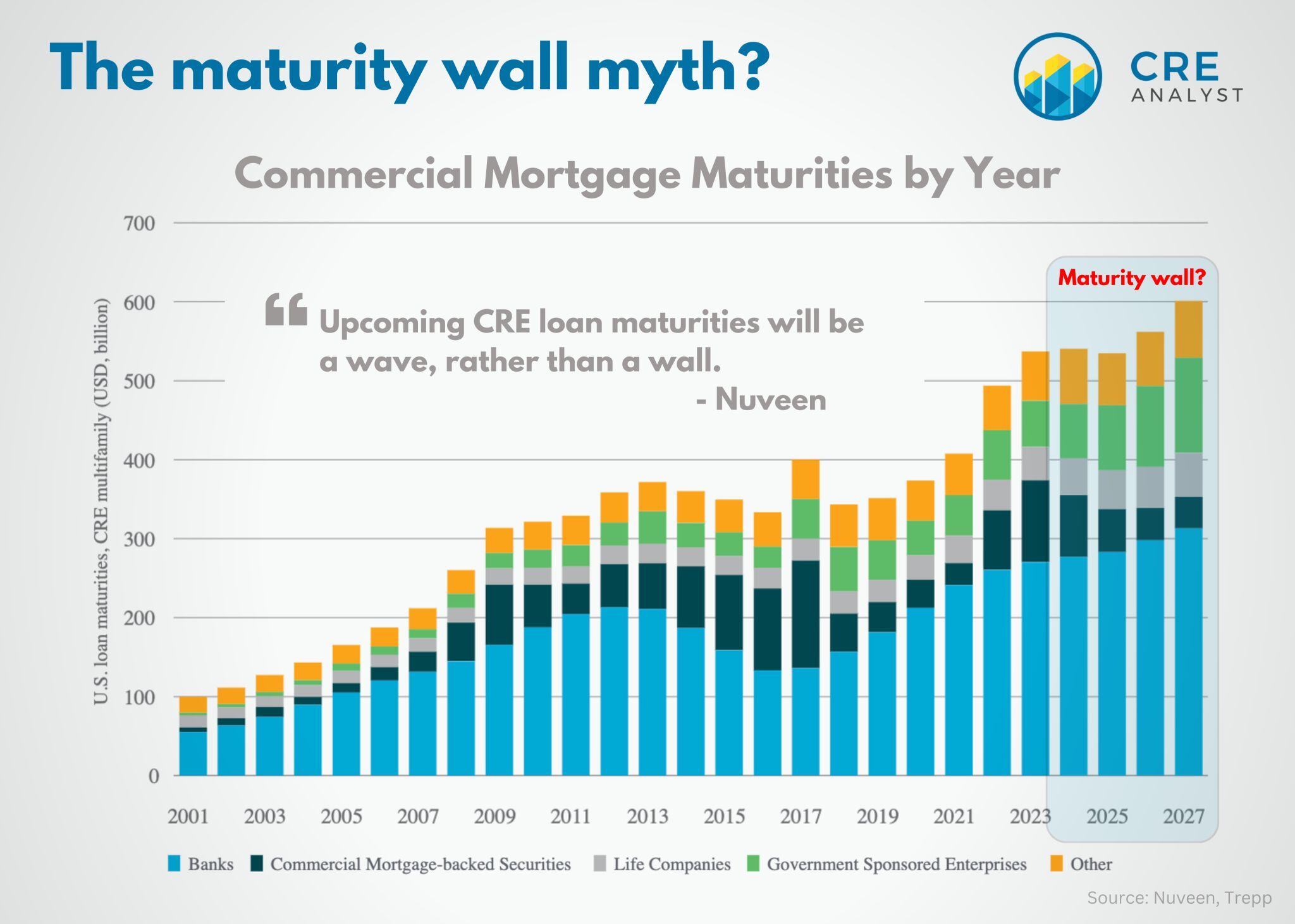

-- Scary charts (debt amounts tend to rise with values, so maturity charts are almost always mountainous)

----- Takeaways -----

1. Defaults will get worse before they get better: CRE charge-off rates round to zero, but the combination of higher interest rates, slowing fundamentals, and a hangover from exuberant underwriting almost guarantees a pickup in defaults and losses.

2. But CRE credit risk is nuanced: Two banks with largeCRE exposures (Valley National and OZK) have $44 billion in collective CRE loans vs. $11 billion of collective equity. However, the average LTV of their portfolios is less than 53%.

3. Facts matter: Nuveen recently reported that upcoming maturities will be more of a wave than a wall. While "maturity wave" doesn't generate as many clicks, it's a valid point and helps to explain why prior calls for maturity wall destruction haven't materialized. i.e., waves are easier to digest than walls.

4. The risks of fear mongering are real: Depositors get spooked, and unlike the GFC, they can withdrawal billions of dollars in the hours after a string of negative headlines (e.g., doom loop, maturity walls, etc.)

COMMENTS