Dusting off a lesson from the GFC...

In the darkest days of the financial crisis, Simon Property Group issued unsecured bonds at 10%+ (40% more expensive than its existing debt), which proved to be a turning point.

---- CRE capital cycles in a nutshell ----

1. Capital flows freely for 9 years.

2. Underwriting gradually slips, values and rents increase.

3. Lenders run for the sidelines every 10 years.

4. Owners get distracted with new problems.

5. Cost of capital spikes.

6. Buyers price new assets to worst-case scenarios.

7. Sellers hold onto old prices until forced to sell.

8. Buyers with unique access to capital get the best deals.

9. Market activity rebounds strongly off the bottom.

10. Capital forms to take advantage of first-mover pricing but herds in, pushing values up and yields down.

So why did Simon issue 10% bonds in the teeth of the GFC? Because you don't get attractive acquisition opportunities on average. Tapping the debt markets allowed Simon to take advantage of the struggles of others. Accessing capital, particularly debt, often differentiates LT winners vs. losers.

---- Current example: Camden ----

Camden, another publicly traded REIT, issued unsecured bonds last week at 4.9%, which is about 25% more expensive than its existing loans.

Most observers tend to focus on coupons. 10%, "that's high"; or 4.9%, "that's low." But the importance of borrowing in tough times is that it happens at all, and being back in the market when others are fighting for survival sets up success for years to come.

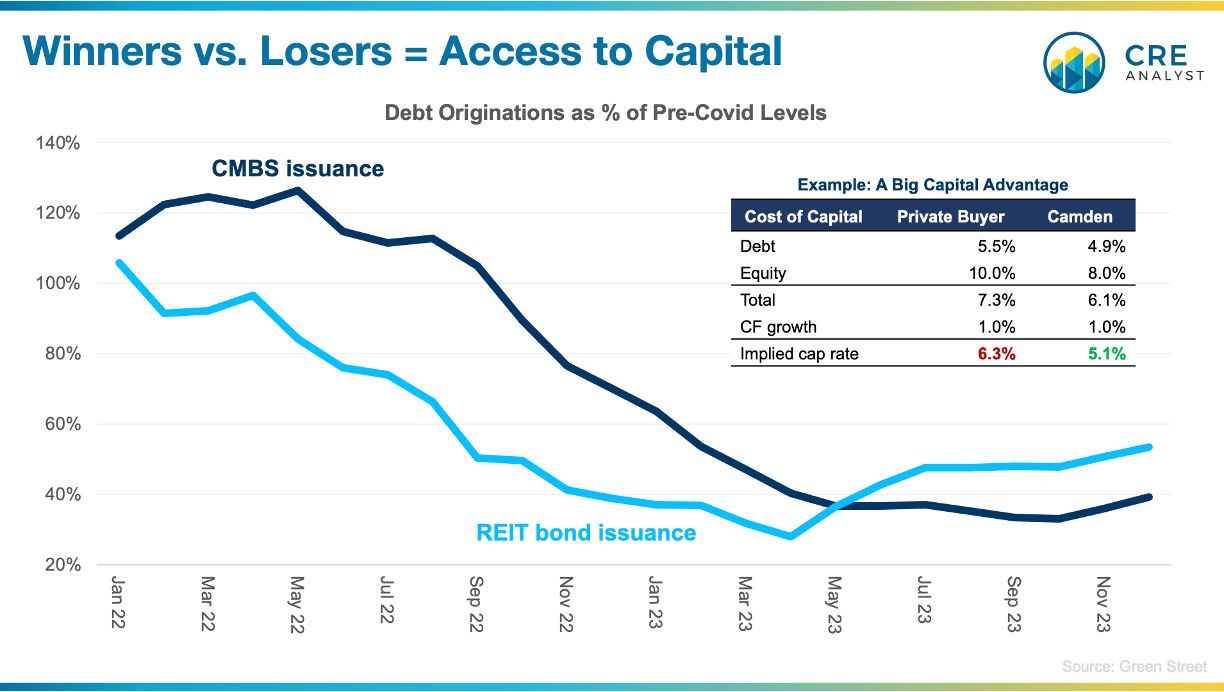

Consider Camden's situation now with 4.9% debt and equity at about 8%. Compare that to a private buyer who could borrow agency debt at 5.5% debt, raise equity for 10% (maybe), and be at an all-in cost of capital of about 7%. Assuming moderate CF growth, Camden generates value if it can acquire apartments north of a 5.1% cap rate, while the private buyer is sidelined until cap rates get to 6.3% or so.

But apartment cap rates won't get to 6.3% because REITs can tap enough capital to buy qualified properties long before they fall to those levels. ...all because they can access debt markets via unsecured bonds.

As you can see in this chart, REIT borrowing turned a corner in mid-2023, and although borrowing hasn't hit pre-COVID levels, REITs are tapping debt markets more actively and efficiently than CMBS borrowers.

People often talk about how real estate markets have become more sophisticated. We tend to believe that the alternatives generated by capital markets participants do more for the stability of our industry than anything else. REITs, with their relatively conservative approach and near-constant access to debt and equity, give us examples of this at play.

Perhaps this is a turning point...

COMMENTS