Great example of how real estate "winners" and "losers" are defined over decades not months...

---- Flashback ----

Why were REITs slow to recover from the GFC?

1) What was once “conservative” wasn’t

Before the GFC crisis, 43% LTV sounded safe, but a 40% decline in values turned that “conservative” leverage to 70%, leaving many REITs scrambling. Forced equity sales at low prices and distressed property sales became common.

2) Financial distress is extremely costly ***

Despite property values recovering to exceed their 2007 peaks, REIT share prices stayed low for nearly a decade. The gap was largely due to the hangover from financial distress.

3) More debt means missed opportunities

While private equity firms like Blackstone snapped up bargains during the trough, heavily leveraged REITs couldn’t play offense.

4) Better leverage metrics are essential

Using asset values in leverage calculations can be misleading during market bubbles. Post-crisis, income-based measures emerged as better indicators of leverage.

*** In its compelling study on effective REIT capitalization, Green Street noted:

"Credit crunches have proven to be such disruptive events, that they create wonderful opportunities for companies that keep large amounts of 'untapped borrowing power.' The tendency of markets to transition from bubble to bust and back again has never been more obvious, and companies with balance sheets that allow them to play offense amidst the worst busts are likely to create a lot more value for shareholders than companies that are on their heels the whole time."

Source: Capital Structure in the REIT Sector (2/26/15), Green Street

---- Back to today ----

"Balance sheet restructuring" may not sound as sensational as "bankruptcy," but a slow race to escape a troubled balance sheet may be more painful (and costly) than traditional bankruptcy.

We think there are three big bombs in real estate:

1) Too much supply

2) Too much debt

3) Interest rate spikes

One of these bombs tends to explode every ten years.

---- Sidelined ----

This downturn's culprit was an interest rate spike, destabilizing many real estate balance sheets.

Firms reliant on unsustainably cheap debt originated during the Covid rebound, when the Fed pushed interest rates down by putting $4T+ into the bond markets, are sidelined.

---- In the game ----

REITs learned their lessons in the aftermath of the GFC. They couldn't compete with debt-fueled acquisitions over the last decade but are emerging with unique advantages.

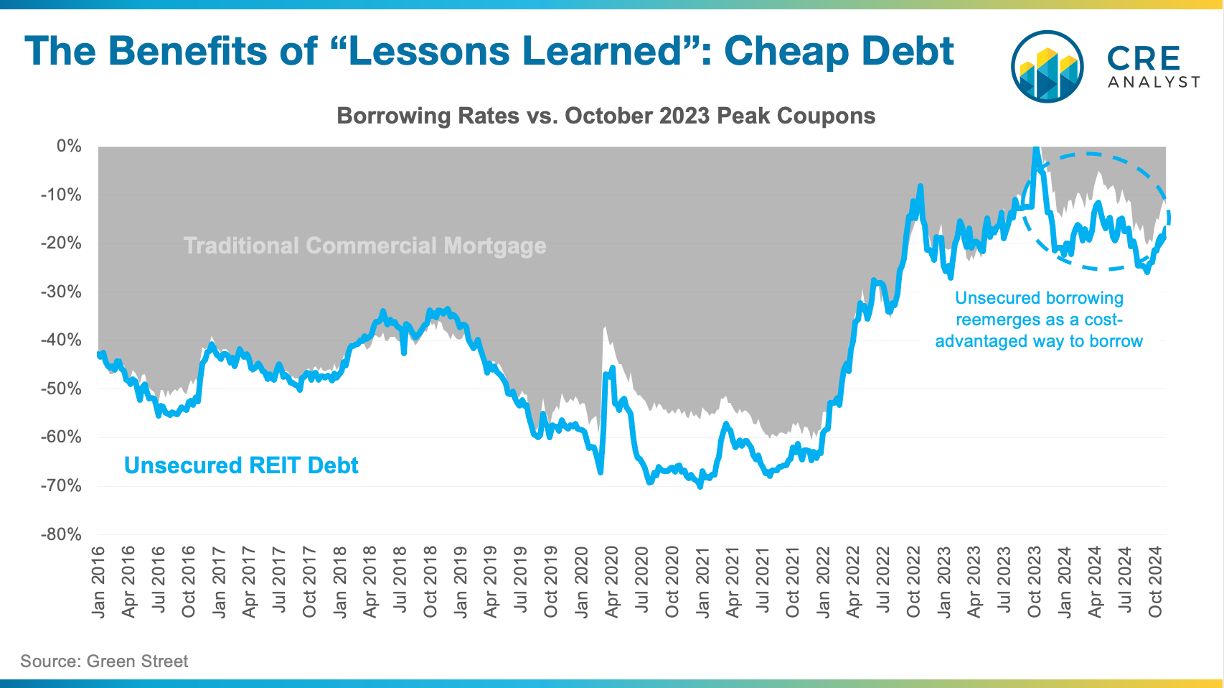

Among these advantages is more consistent access to relatively cheap debt. Since interest rates peaked last October, REIT bonds have been more than 15% cheaper than conventional commercial mortgage debt.

REITs are in the catbird seat and will almost certainly use these advantages to make big moves in the coming months and years.

COMMENTS