Put yourself in Blackstone's shoes: Do you "extend and pretend," give back the keys, or come up with $800M to salvage your investment?

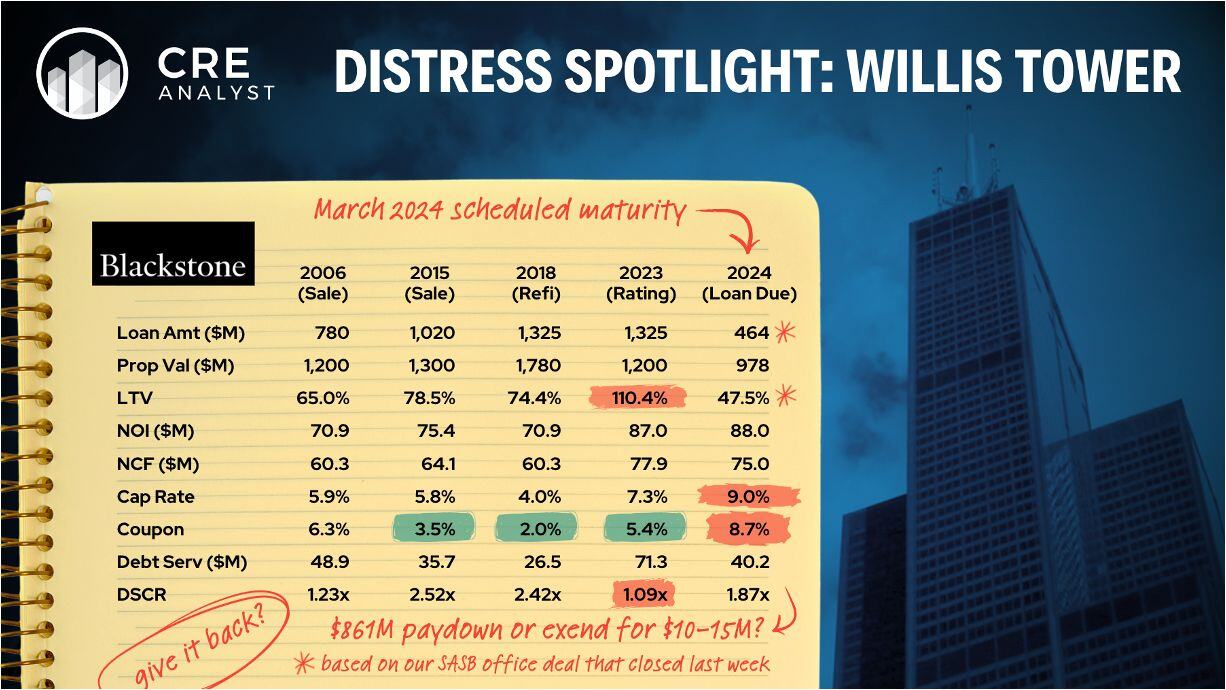

Blackstone's $1.3B loan on Willis Tower matured a few weeks ago. The firm has done a masterful job of renovating the property, substantially increasing NOI via a big remodel and driving sky deck operations (20%+ of NOI). But it might not be enough.

---- Kicking the can ----

The loan originally matured in March 2020, when the COVID earthquake started shaking the office market. Blackstone responded by exercising the first of its five, one-year extension options.

Those extensions started getting really expensive with the 2023 extension, which required a new $10M+ cap, pushing the maturity to March 2024. The office market and cap rates haven't improved over the last 12 months. However, the credit markets are a bit more active, and we have a fresh benchmark for how much BX would need to come up with to keep its investment alive at a final maturity...

---- Debt availability ----

Blackstone closed on a high-profile office loan last week on a Park Ave building in NYC. The 48% LTV loan ($464M in proceeds) is floating with a current coupon of 8.65%.

Back to Willis Tower, DBRS (rating agency) estimated that the existing $1.3B loan represented 110% LTV as of last year at a 7.3% cap rate. We think a 9% cap rate is likely more realistic, which would put the outstanding loan amount at 136% of the current property value.

---- Dilemma ----

Put yourself in Blackstone's shoes. This property sits in BREP VII, which is at the end of its life. It wouldn't be great to walk away from this property, but you cashed $240M out of the property when you launched this SASB issuance in 2018 and walking away likely won't move the needle for that fund.

If last week's SASB execution (re: the Park Ave building) is indicative, you'd need to come up with about $860M to stay in this deal. Blackstone has reportedly notified the servicer that it intends to exercise its final extension, which would push the final maturity to March 2025.

---- Two questions ----

This real estate train wreck (a $1.3B loan headed toward a $1B building) brings up two questions...

-- Will Blackstone's position be materially different in a year? What's the best the office market would be in a year? Will NOI increase by a few million dollars AND cap rates settle around 7% by March 2025?

-- Is this a decent example of what people are calling "extend and pretend" at work? We think very few servicers/lenders are "pretending" (they're requiring new caps and/or paydowns), but regardless of what you call it, this situation promises to give us a fresh read on the office market.

---- Your call ----

What would you do if you were Blackstone?

(A) Kick the can for a year by renewing your cap.

(B) Come up with $860M to refinance the loan.

(C) Walk away from the deal.

COMMENTS