Unpopular opinion: "Distress" is overrated.

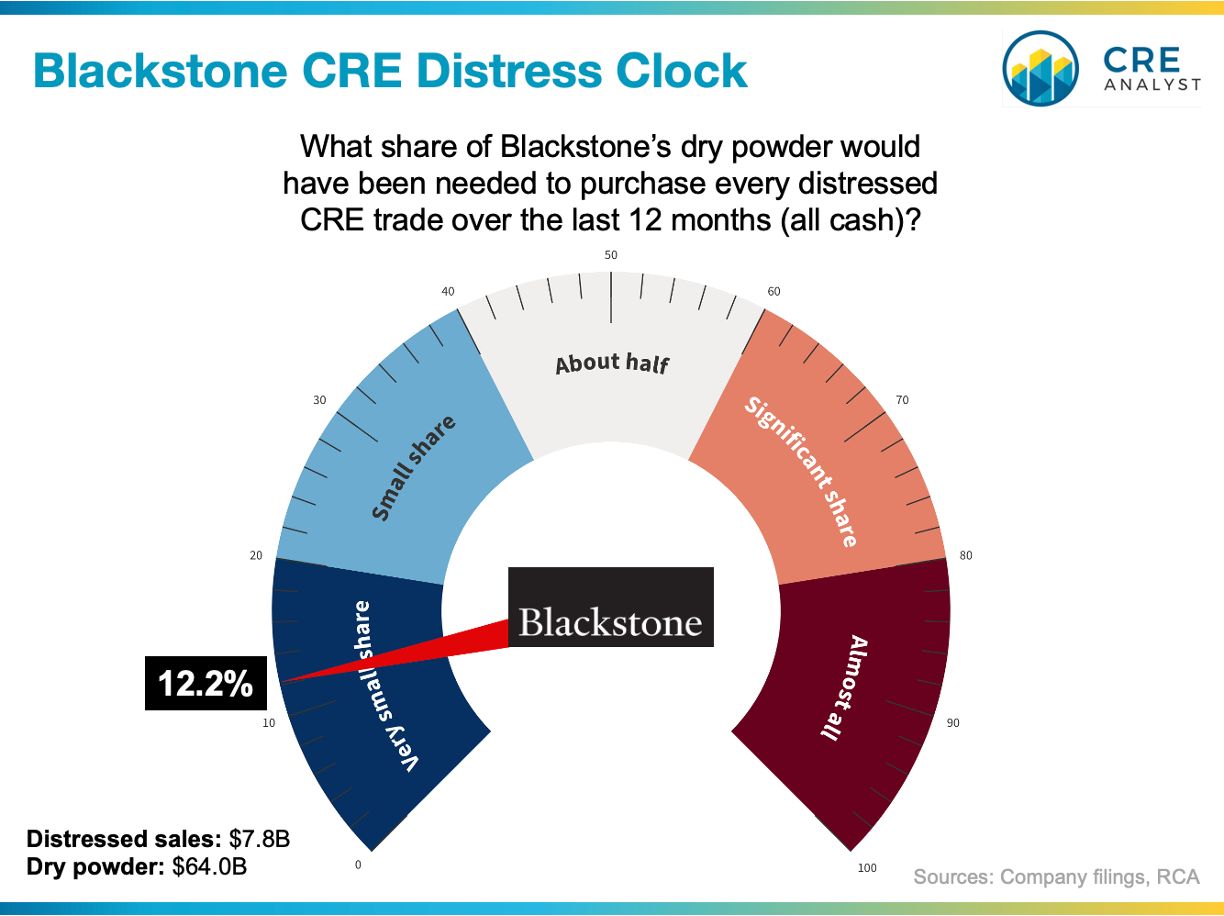

Blackstone could have purchased EVERY distressed sale over the last 12 months with a little more than 10% of its dry powder. Yes, Blackstone is an 800 lb gorilla, but it's a single firm. That's how much $ is on the sidelines, which is new for real estate.

----- What if we replay the GFC? -----

With its cash pile and roughly 50% LTV financing, Blackstone could have purchased every distressed asset that was sold in 2009, 2010, 2011, 2012, and 2013. Again, one firm.

Note: Blackstone had 'only' $9B in dry powder back in 2010.

----- Sanity check -----

Many people (typically sellers arguing that today's values haven't adjusted) use "dry powder" arguments to suggest that property values won't fall. We don't share their perspective.

----- Dry powder = An insurance policy? -----

Dedicated cash isn't an insurance policy for existing owners; in fact, it's probably more like an option AGAINST existing owners.

BUT a deep bucket of cash is, in a sense, an insurance policy for the industry that makes systemic debt/pension/banking losses much less likely.

Debt implosions blow up the real estate world, not equity losses.

----- Our working hypothesis -----

Opportunistic buyers need 18% ish returns, which they can't get unless values continue to fall and/or debt becomes significantly more efficient.

Equity investors will lose money. Probably a lot of money.

We estimate equity investors have already lost about 50% of the $4 trillion they had at the recent peak and could lose another 20% or so (on paper) before the market bottoms.

That'll sting, but equity losses create opportunities for future gains. Also, the vast majority of investors won't be forced to recognize losses at the bottom.

Key takeaway: No GFC-like systemic failure.

----- We could be wrong -----

We use our frameworks to come up with what seem like reasonable arguments around CRE markets and trends.

We share them to promote targeted debate, but we could easily be wrong, especially if one of the following surprises occurs.

1. Dry powder evaporates as owners are forced to recapitalize existing investments.

2. Property types and markets are more correlated than they have been over the last few years. A deep recession could weaken the stronger sectors and generate more distress.

3. Banking reset. Banks (especially smaller banks) are a critical lifeline to the real estate industry. A structural shock could be worse than imagined.

----- What do you think? -----

A. "Distress" is overplayed.

B. There will be a lot more distress than we think.

C. There will be a big difference between winners and losers.

D. Other

COMMENTS