Five more minutes, mom.

A hypothetical walk down memory lane.

---- Dreaming ----

You had some extra cash before the pandemic and invested in Blackstone’s flagship opportunistic real estate fund, Blackstone Real Estate Partners.

---- Side note on closed-end funds ----

BREP is a closed-end fund series, following a common cycle:

1. BREP IX raised $21 billion in commitments between 2019 and 2022.

2. It had a few years to deploy that capital.

3. Then, over a 7–10 years, the fund must liquidate and distribute.

4. If all goes well, Blackstone launches the next fund: BREP X.

Notably, during the life of a closed-end fund, investors get updates that reflect actual returns plus anticipated future exits, making estimates of final net IRR heavily dependent on future asset sales.

Now, back to memory lane.

---- Early return estimates: the highs ----

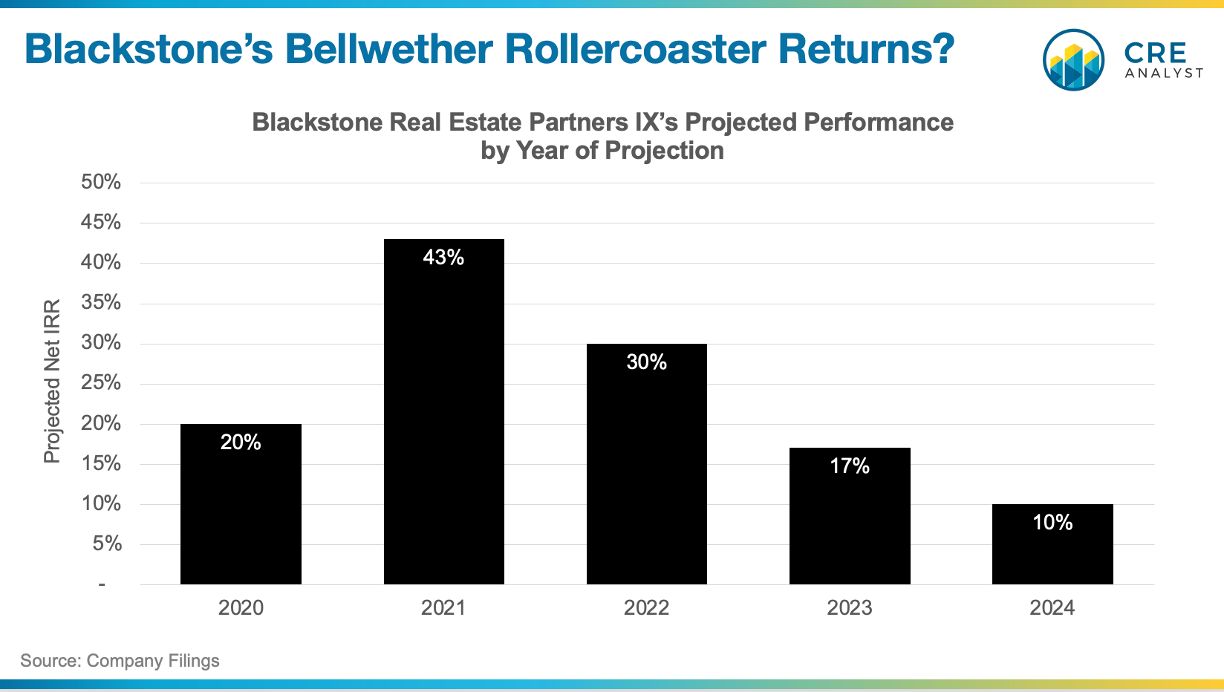

As an early investor in BREP IX, you watched nervously during the initial pandemic scare. Then, excitement kicked in. Fund reports started rolling in, and the numbers were eye-popping.

You initially expected high-teens returns.

By year-end 2020, estimated returns had surged to 40%+.

A year later, projected returns dipped to 30%, but the outlook remained stellar as the fund neared 20% invested.

Then, interest rates started rising. The bid-ask gap widened. Deal activity plummeted.

---- Updated return estimates: the lows ----

By 2023, with 40% of the fund invested, projected returns had fallen to 17%—lower than pandemic-era highs but still strong by industry standards.

Then came the 2024 update: a revised net IRR of just 10%.

---- Back to reality ----

You're still dreaming. But your alarm is blaring, and you're running out of snoozes.

Nightmare Scenario 1:

You're a BREP fund manager watching your carried interest evaporate.

Nightmare Scenario 2:

You're another fund manager, facing an even sharper decline. Some funds may face principal losses, and raising the next fund is getting harder by the day.

Nightmare Scenario 3:

You're an LP investor in one of those other funds. At first, it was just a timing issue. Now, you're questioning your allocation strategy.

Time to wake up.

COMMENTS