Blackstone's Tricon math shows why office remains sidelined...

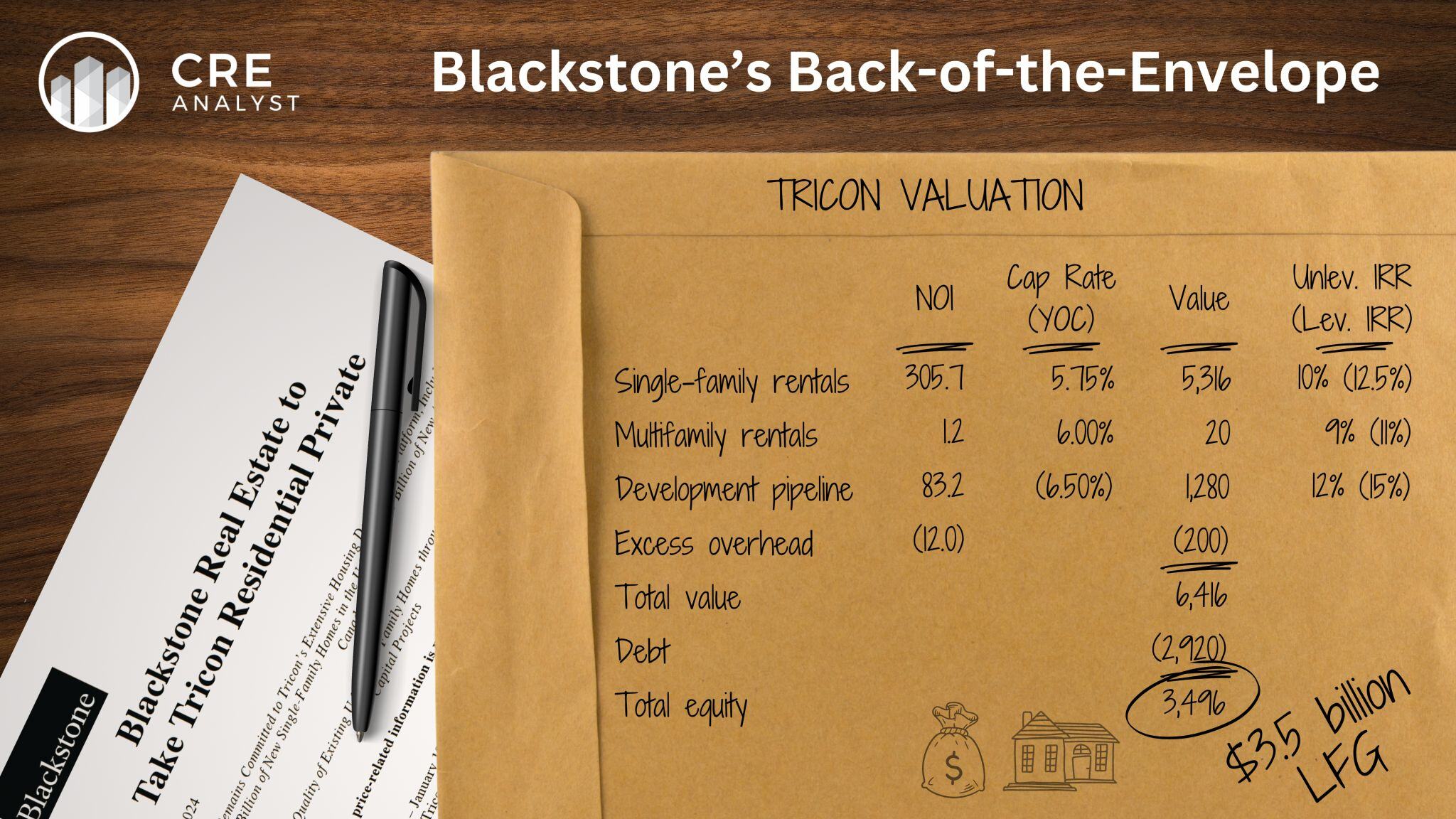

Blackstone announced yesterday that it has agreed to take Tricon private at a $3.5 billion equity value, 25-30% above where Tricon was recently trading.

---- Why does the deal make sense? ----

-- Strong outlook: The outlook for single-family rentals, especially lower-priced rentals like Tricon's portfolio, remains very favorable.

-- Idiosyncratic discount: Values are down, but Tricon (a complicated Canadian REIT with much higher overhead than its peers) was disproportionately punished when interest rates spiked.

-- Returns > BX's cost of capital: We think the acquisition price pencils to a mid-to-high 5% cap rate with embedded growth and favorable leverage, which equates to about a 12.5% leveraged IRR. ...well above BREIT's cost of capital and, although at the lower end of BREP X's target, within range of mid-teens returns.

---- Deal drivers ----

1. Strong fundamentals:

SFR rents continue to grow, and occupancies remain relatively tight.

2. Decent cap rate outlook:

Housing cap rates were in the 3s a few years ago. They're higher now, but 2x higher seems like an overshoot when income growth is decent, equity continues to like the space, and a few rate cuts would likely help housing cap rates before other asset classes.

3. Favorable leverage:

Tricon is only about 35% leveraged, but its 4.5% borrowing cost is irreplaceable today.

---- Why isn't Blackstone buying other discounted REITs? ----

Office is the obvious choice, with 10%+ implied cap rates. Why isn't that strong enough to attract Blackstone (yet)?

1. Weak fundamentals:

NOIs are pressured by high vacancy. No one wants to catch a falling knife.

2. Questionable cap rate outlook:

It's almost impossible to raise equity for office, which makes it hard to get comfortable making a bet that equity will return without aggressive hurdle rates.

3. Unfavorable leverage:

Let's say office REITs are trading at 10% cap rates but have 200 bps of CapEx drag, so the economic cap rate is more like 8%.

Assume they can eek out 1% NOI growth. ...that's about a 9% unleveraged IRR. Piedmont (an A- office REIT that is down about 70%) issued bonds within the last 6 months at 9.25%.

So even if Blackstone could capitalize an office deal, debt wouldn't juice returns, and 9% doesn't cover Blackstone's cost of capital. i.e., BREIT's cost of capital is around 9-10% and BREP's is 15% ish.

---- What has to change? ----

Once peak vacancy comes into view, the outlook for future NOI growth will improve, which will likely motivate lenders to re-enter the market, which will promote a more constructive view on equity and cap rates.

Simple guess: We need 200 bps moves across the board to trigger big office transactions.

1% --> 3% NOI growth

10% --> 8% exit cap rates

10% --> 8% borrowing rates

What do you think?

COMMENTS