Is core real estate a myth?

We kick off every FastTrack cohort by covering the nine building blocks of the CRE capital markets...

Debt providers:

1. Banks

2. Insurance companies

3. CMBS

4. Agencies

5. Debt funds

Equity risk profiles

6. Core***

7. Core plus

8. Value add

9. Opportunistic

*** Core real estate is generally perceived to be "bond-like" real estate. i.e., great locations, high occupancy, stable income, etc.

Core investors make up a small share of the overall market, but they're important since they set the bar for pricing.

---- What makes CRE unique? ----

Yes, all properties are different.

And yes, as any recent grad will tell you, physical assets are cool because you can touch them. Bla bla.

But here's what differentiates real estate: Aging.

---- The building life cycle ----

Like a new car driven off the lot for the first time, buildings start to deteriorate when they hit substantial completion.

Some deterioration is "back of the house." e.g., elevators, mechanical equipment, etc. But this stuff, although expensive, doesn't generally define performance.

Competitiveness is what defines performance. Tenant preferences evolve substantially over decades; therefore, a building's attractiveness often dies long before its physical stature.

---- Example: Ceiling heights ----

15+ years ago, NYC office tenants didn't mind 9' ceilings. But sunlight in your workspace is addictive, and once you know it exists, those old buildings feel a lot darker.

Manhattan developers delivered 30 MSF of new office over the last 10 years, and they aggressively pulled tenants out of those old buildings by giving them higher ceilings (along with more outdoor space, congregating areas, and efficient floorplates).

"Barriers to entry" is one of the most overplayed terms in real estate, which is why the building lifecycle never stops.

---- Backtesting new vs. old buildings ----

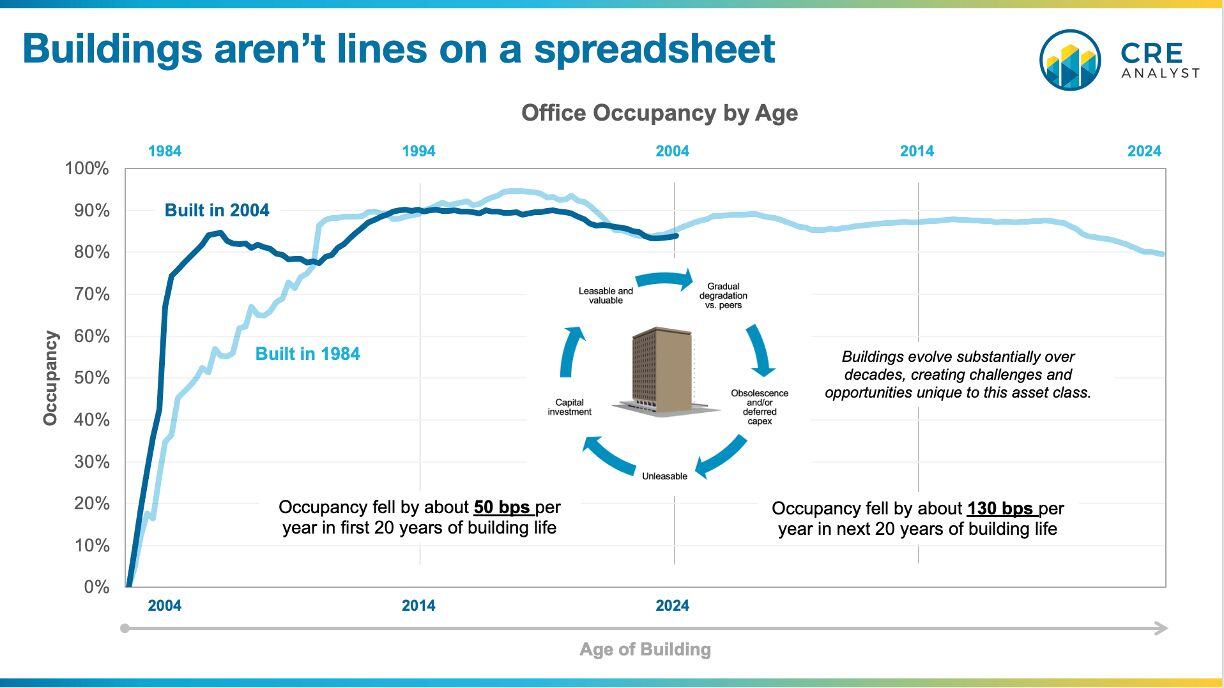

We wanted to track and compare occupancy by vintage, so we compared 40-year-old office buildings to 20-year-old office buildings on the same axis.

The similarities jump off the chart.

In a nutshell, old buildings erode at more than twice the pace of new buildings.

---- Good news ----

Every building gets old, but the building life cycle creates unique opportunities for real estate players and investors.

However, you can't memorize your way up the value-creating curve; instead, you need the hard skills that define our industry, i.e., market analysis, document negotiation, asset valuation, loan analysis, etc.

We kicked a new FastTrack cohort last week by diving into building lifecycles, capital markets, and career silos. Up next: Leasing, valuation, due diligence, debt, development, and JVs.

If this resonates with you and you want to level up, join an info session (see our website). The next FastTrack cohort starts in May.

COMMENTS