Unpopular opinion: "Distress" is (still) overrated

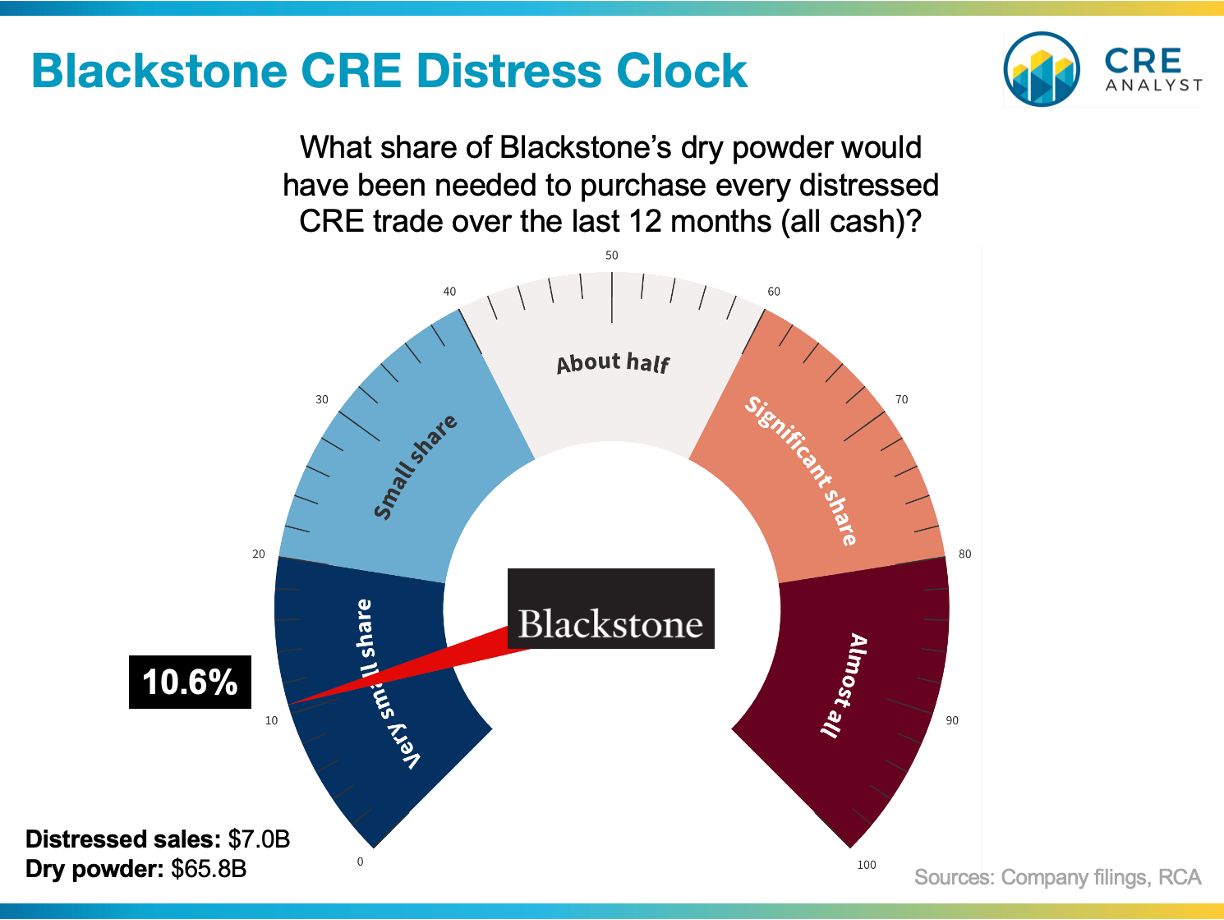

Blackstone could have purchased EVERY distressed sale over the last 12 months with a little more than 10% of its dry powder. Yes, Blackstone is an 800 lb gorilla, but it's a single firm. That's how much $ is on the sidelines, which is new for real estate.

----- What if we replay the GFC? -----

With its cash pile and roughly 50% LTV financing, Blackstone could have purchased every distressed asset that was sold in 2009, 2010, 2011, 2012, and 2013. Again, one firm.

Note: Blackstone had 'only' $9B in dry powder back in 2010.

----- Sanity check -----

Many people (typically sellers arguing that today's values haven't adjusted) use "dry powder" arguments to suggest that property values won't fall. We don't share their perspective.

----- Dry powder = An insurance policy? -----

Dedicated cash isn't an insurance policy for existing owners; in fact, it's probably more like an option AGAINST existing owners.

BUT a deep bucket of cash is, in a sense, an insurance policy for the industry that makes systemic debt/pension/banking losses much less likely.

Debt implosions, not equity losses, blow up the real estate world.

----- Our working hypothesis -----

Opportunistic buyers need 18% ish returns, which they can't get unless values fall...

A handful of researchers track value declines, but we think Green Street's CPPI is the most realistic. It suggests about a 24% decline for the major property types, which would imply $2.7 trillion of commercial real estate paper losses.

That'll sting, but equity losses create opportunities for future gains. Also, the vast majority of investors won't be forced to recognize losses at the bottom.

Key takeaway: No GFC-like systemic failure.

----- What do you think? -----

A. "Distress" is overplayed.

B. There will be a lot more distress than we think.

C. There will be a big difference between winners and losers.

D. Other

PS - The amount of distress has fallen moderately since we last posted on our Blackstone CRE Distress Clock (in August) and Blackstone's dry powder is higher, so our clock measure has fallen from 12.2% to 10.6%.

COMMENTS