Real estate finance 101 in practice...

1. What defines debt:

Priority payment, no/fixed upside.

2. How do lenders determine proceeds:

LTV, DSCR, and/or debt yield thresholds.

3. Volatile lending activity:

Availability of debt varies across the cycle (big year = $300B, slow year $0), which can kill a business plan.

4. Fixed rates:

Long-term lenders don't like getting paid off when rates fall, so they charge proportionate pre-payment penalties.

5. Floating rates:

Low rates can be enticing when base rates are low, but they come with short-term maturities and rate exposure.

6. Positive leverage:

When UIRR > cost of debt, more debt -> higher leveraged IRR.

Challenge: Unleveraged IRR is an educated guess at best.

7. Negative leverage:

When UIRR < cost of debt, more debt -> lower leveraged IRR.

8. More debt = more volatility:

The more you borrow, the more volatile your annual returns will be.

9. Coverage vs. leverage:

Positive DSCR doesn't necessarily equate to positive leverage and negative DSCR doesn't necessarily equate to negative leverage.

10. First dollars vs. last dollars:

First dollars (debt) are lower risk/lower cost while last dollars are risky/get a disproportionate share of return. Dollars above around 65% are generally considered equity-like.

11. Defaults:

More than 30% of loans originated at cycle peaks have historically defaulted, while defaults for more normal vintages have been near zero.

12. Subordinate debt:

Debt investors can be stacked via subordinate positions, secured by the mortgage (B note), the borrower's equity (mezz), or prioritized equity (pref).

13. Incremental cost:

When comparing multiple loans with varied LTVs/pricing, you need to calculate the incremental cost of proceeds to evaluate positive/negative leverage.

14. Recourse:

Commercial mortgage lenders don't always require borrowers to stand behind repayment promises, but limited recourse (completion, bad acts, environmental) is very common.

----- Application -----

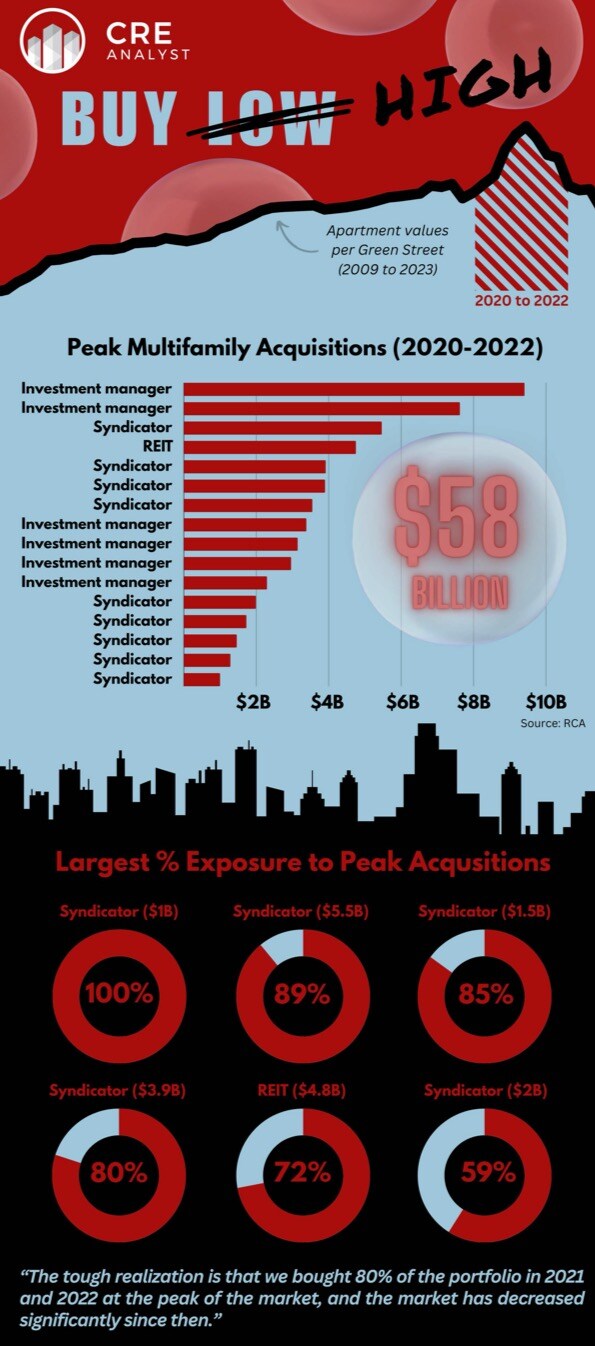

Given the gravity of these finance fundamentals, anyone who dominated apartment acquisitions near the peak a few years ago could be facing choppy waters.

...less available debt, higher rates, higher cap rates, lower NOI, pending maturity dates.

We studied NMHC's top 50 owners lists from the last few years to see which owners rose through the ranks while the market overheated.

-- 14 firms acquired $58 billion of multifamily assets near the peak.

-- 9 of these firms are syndicators.

-- 6 of the firms bought 50%+ of their portfolio near the peak.

----- Our perspective -----

Why are firm names anonymized?

Our goal is to shine a light on the fundamental mechanics of the CRE business. Debt is one of those fundamentals and it's a critical module in our FastTrack class. We don't need to list specific names to tie current challenges to the basics of real estate finance.

PS - Would you add anything to our finance 101 list above?

COMMENTS