Warning: Real estate markets follow debt flows...

DEFINED BY VOLATILITY

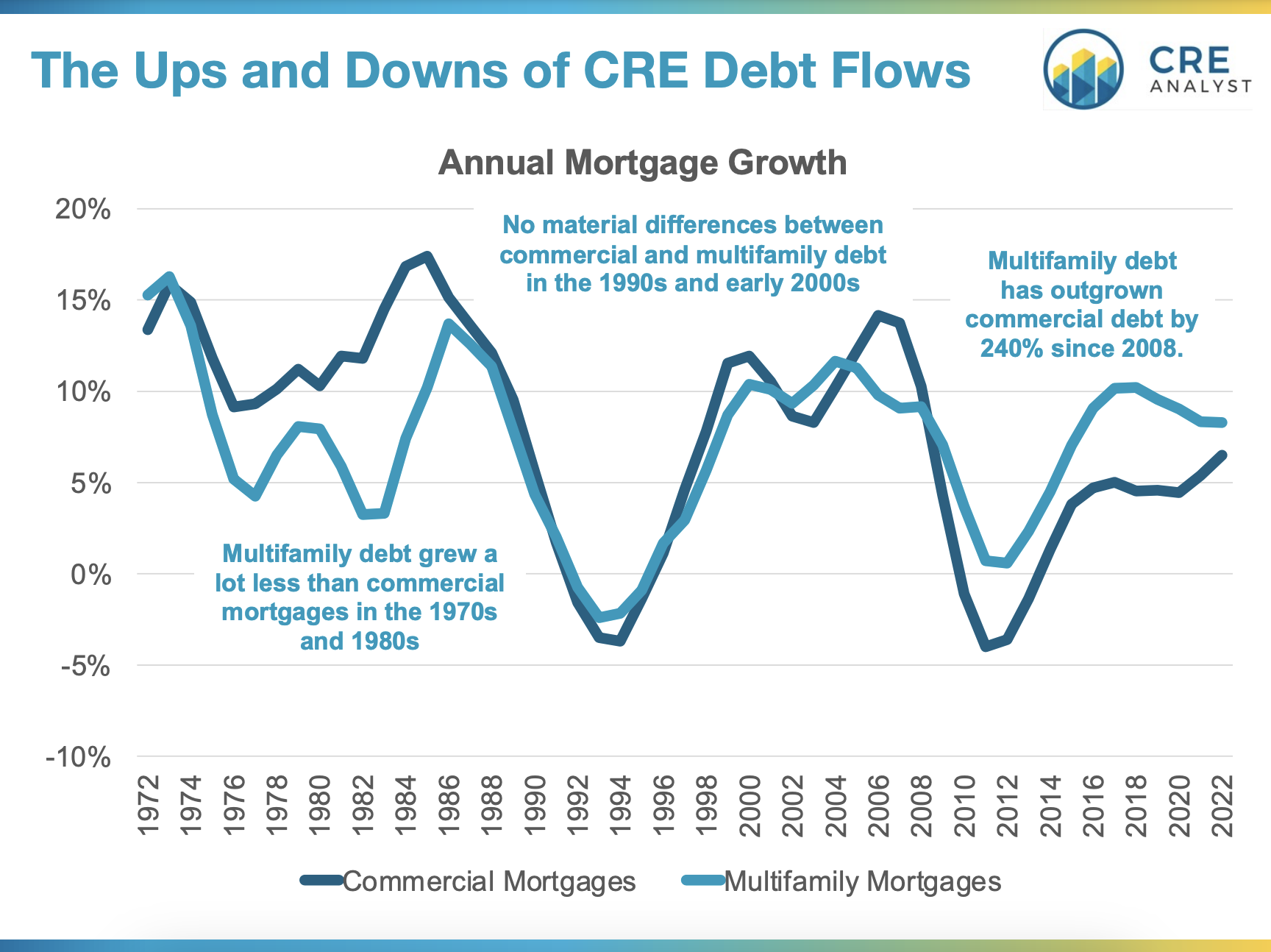

When real estate debt markets are on, they're extremely open, growing by $400 billion a year. But when they're off, they're dead (at best) or declining/deleveraging (at worst). Given this extreme volatility, borrowers with poorly-timed loan maturities often struggle to refinance outstanding mortgages.

DEFAULT RATES

We dove into the relationship between mortgage debt growth and default rates, uncovered a strong relationship, and quantified a trend that could be particularly concerning for multifamily borrowers...

Rather than measuring defaults at the time of default, we think it's more insightful to measure defaults by vintage, i.e., when mortgages were originated. Turns out, vintage default rates are extremely correlated to debt growth. In fact, commercial mortgage vintage defaults have been more than 70% correlated to annual debt growth over the last 50 years.

This observation makes intuitive sense: The only way for lenders to grow their loan books is to compete by offering higher proceeds and borrower-friendly terms, which pushes up property values; however, higher proceeds and more favorable terms don't affect NOIs; debt coverage (a primary driver of default likelihood) falls, increasing default risk; lenders keep competing until credit conditions deteriorate enough to bring defaults into view. For perspective, default rates in the worst vintages (e.g., 1986, 2008) have reached 30%.

MULTIFAMILY SUPERCYCLE

Commercial mortgage debt growth (excluding multifamily) has been relatively constrained since the GFC, growing by about 2% per year since 2008, but multifamily debt has been a very different story. Over the last 15 years, outstanding multifamily mortgage debt grew by 240% or 6% per year.

To put this into perspective, we tracked three major multifamily debt cycles over the last 50 years. After adjusting for inflation, the 1970s and 1980s saw outstanding multifamily mortgages grow by $640 billion. The 1990s and early 2000s saw outstanding multifamily mortgage debt grow by $949 billion. And the last cycle, despite being 3-4 years shorter than prior cycles, saw outstanding multifamily debt grow by $1.4 trillion. In other words, the last decade has been a bonanza for multifamily finance.

BACK-OF-THE ENVELOP PERFORMANCE ESTIMATES

If historical relationships hold, commercial mortgage default rates for loans originated in the last cycle will average 13-14%, and multifamily mortgage default rates will reach 17-18%. With current problem loans hovering at less than 2%, how realistic are these estimates? We're not sure; these are just semi-educated guesses. However, the significant growth of multifamily debt in recent years suggests a bumpy road ahead.

COMMENTS