"Dry powder" winners and losers...

DOMINANT CRE PRIVATE EQUITY FUNDS

It's easy to lose perspective of the CRE juggernauts' scale. Private dollars chasing real estate have exploded in recent years, but inflows have not occurred evenly across managers. In fact, two managers--Blackstone and Brookfield--have pulled away from the pack, proving that they can raise staggering amounts of capital in good and bad times.

CONCENTRATED REIT VALUE

Public REITs paint a much milder picture in terms of dollar inflows but a very similar picture with respect to haves vs. have-nots. There are about 104 listed equity REITs (excluding timber, infrastructure, and other non-traditional asset classes) with about $1.1 trillion in equity capitalization. i.e., the average REIT represents about $10 billion in equity market cap. However, the largest 10 REITs have an average equity cap of $50 billion each and collectively represent nearly 50% of the total REIT market.

This combination of factors--significant dry powder in the private markets, concentrated in the hands of the largest managers + discounted public market values + concentrated value in the largest REITs--creates a significant number of acquisition targets for the large RE private equity funds. For example...

LOTS OF OPTIONS

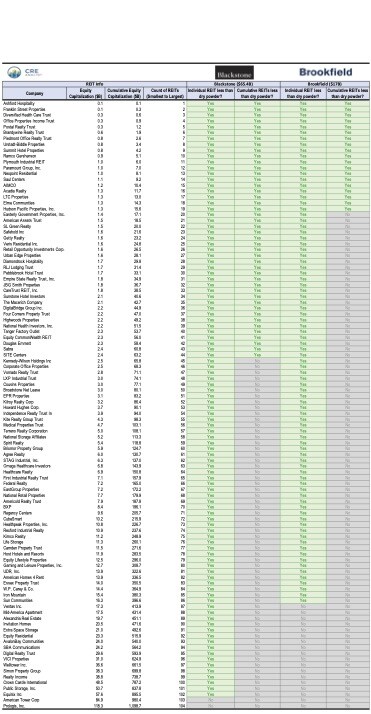

Blackstone could use its $65.4B of dry powder to:

...buy any REIT, except for ProLogis ($118B) or American Tower ($85B). i.e., BX could buy 102 of the 104 REITs.

...or buy 42% of the REIT universe (44 out of 104 REITs), collectively.

Brookfield could use its $17.0B of dry powder to:

...buy any REIT except for the largest 18. i.e., Brookfield could buy 86 of the 104 REITs.

...or buy 18% of the REIT universe (19 out of 104 REITs), collectively.

CHALLENGES

So why aren't we seeing the "haves" swallow the "have-nots"?

1. Blackstone and Brookfield need to earn 15%+ returns on their opportunistic "dry powder." Blackstone could buy every office REIT and still have several billion of dry powder left over; however, at a 10% cap rate and very low growth prospects, it would be very difficult to get yields that would satisfy their investors' expectations.

2. Debt markets are uncooperative. It would be very difficult to find a lender or a club of lenders that could finance a privatization in the current debt environment. This reality further inhibits PE funds' ability to achieve their return requirements.

3. It is often difficult to convince REIT executives to give up their gigs. Even small REIT executives are very well paid. For example, AIMCO--a REIT worth a little over $1 billion--paid its top 3 executives nearly $5 million last year, part of about $40 million in total G&A, to oversee 41 projects.

Note: REIT privatizations typically trade at 10-15% premiums, but for simplicity and perspective, we assumed no premiums for this analysis.

COMMENTS