ULI and NMHC recently concluded, "commercial-to-multifamily conversion shows promise." We disagree and think the conversion narrative is overplayed...

SUPPLY: How much office space will be converted to multifamily?

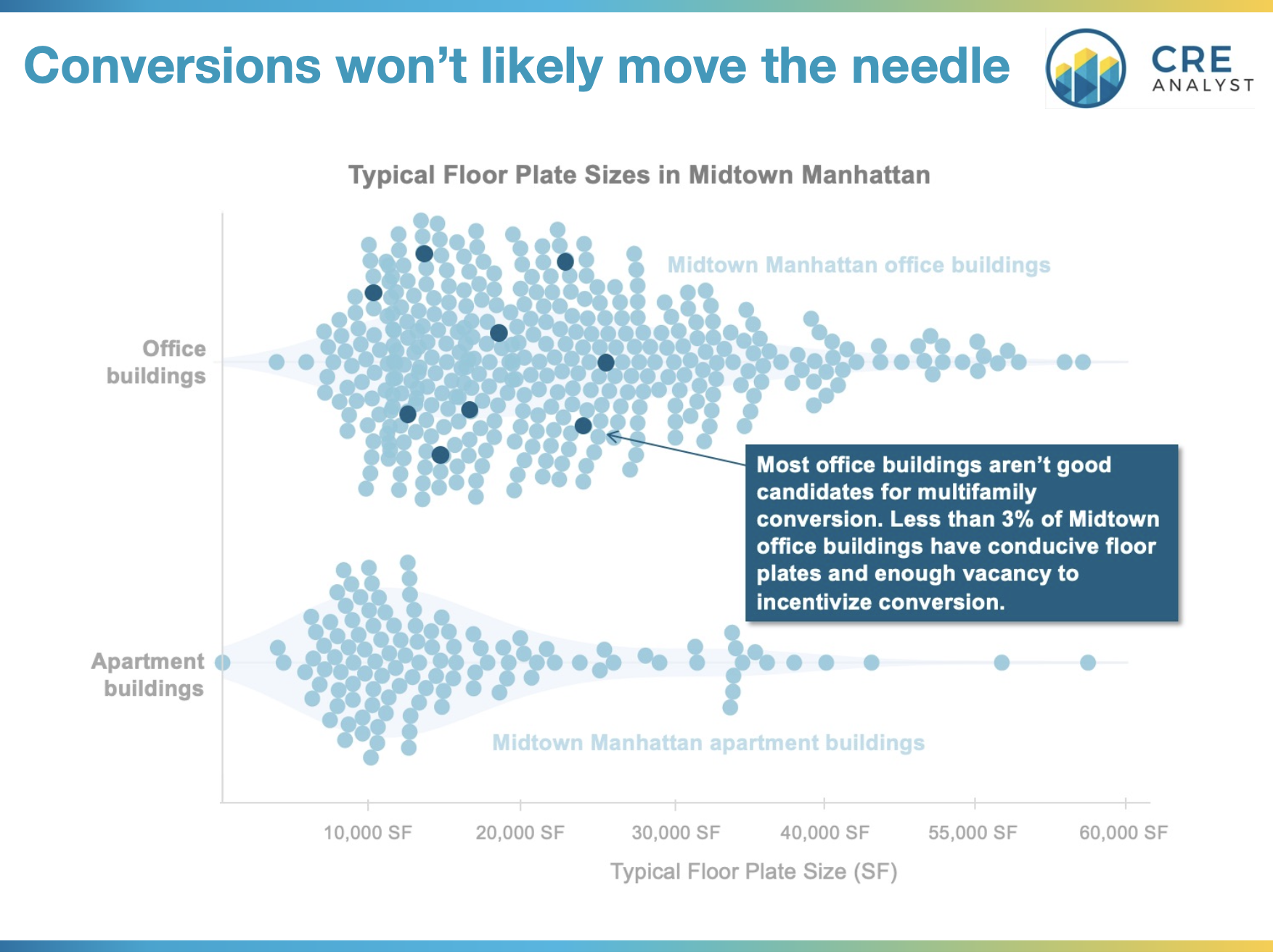

We surveyed large U.S. office markets--starting with Midtown Manhattan--and estimate that less than 5% of office space in most markets could be converted to office in the near term due to several challenges...

1. Floor plates: The average office building in Midtown Manhattan has a typical floor plate of nearly 24k sf vs. multifamily buildings with 16k sf. It's very common for office building plates to be 30-40% larger than multifamily. What do you do with dead, windowless space?

2. Building configuration: Columns, depths, large cores, and a lack of water/plumbing systems are significant challenges.

3. Building sizes: The average office building in Midtown Manhattan has more than 700k sf of usable space, which would equate to an average building size of 1000 units. Good luck leasing those projects up at 10-30 units/mo.

4. Encumbrances: Most urban office buildings are 70%+ leased, and less than 3-5% (depending on the market) are less than 50% leased. Tenants don't generally go away for free.

5. Zoning: Office buildings are often zoned exclusively for office. Converting them to multifamily or mixed uses can be extremely challenging, expensive, and time intensive.

6. Capital: In a more normalized capital markets environment, there's plenty of debt, but it comes from different sources with varying sweet spots. All of these sources are sidelined right now, with banks (primary providers of construction debt) undergoing the most systemic shift.

Bottom line: It's not impossible to convert office buildings to multifamily, but it's not easy. We believe it is unrealistic to think that a building can be converted simply because it's out of favor. Many other conditions have to be in place to make conversion viable, and these conditions seem to only be relevant for a relatively small share of existing office buildings.

DEMAND: How much space will office tenants need?

CBRE recently surveyed 200+ occupiers and found that 40% of tenants plan to meaningfully reduce their office footprints while only 10% plan to meaningfully increase their footprints. Perhaps more concerning, 14% of respondents plan to downsize by 30%+.

SUPPLY / DEMAND SCORECARD

Hypothetical scenario: Half of the office-to-conversion candidates turn into multifamily projects, shrinking office supply by about 2.5%, while 30% of tenants downsize by 10%, resulting in a 3.5% reduction in demand. All else equal, these two moves would result in a neutral net effect on the overall office market.

Therefore... Perhaps the headlines, conference panels, and industry reports on the "promise" of conversions are at least slightly overplayed.

COMMENTS