Early prediction: "Preferred equity" will soon be the most overplayed term in CRE, but the lack of senior debt is the real story.

BACKGROUND

When the financial world thought rates couldn't go any lower, the Fed injected $4-5 TRILLION into the bond market, pushing Treasury yields down to 0.50% and CRE coupons to 3.5%.

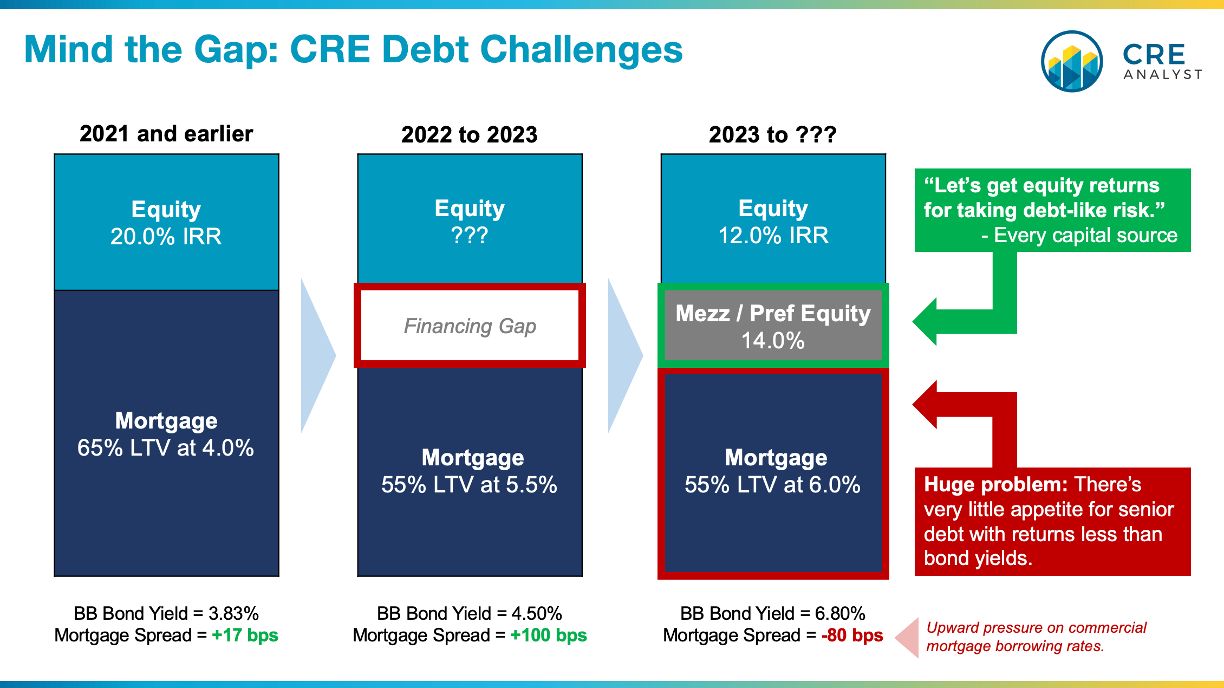

Then the Fed pivoted from firestarter to firefighter (mid-2022), pushing Treasury yields up to 4.0% and CRE borrowing rates to 6.5%. Credit markets freaked out, and lenders increasingly found themselves on the sidelines with proceeds falling from 65% LTV to about 55% LTV.

A BIG FINANCING GAP

Less debt, higher rates, and a flat/inverted yield curve have created a meaningful capital disconnect for real estate borrowers: Senior lenders will go up to about 55% LTV at higher rates, but equity needs more favorably priced debt to activate their "dry powder" with 15%+ returns.

Thus the opening for 'bridge' capital (mezz/pref equity), which pencils out to get higher returns than equity without taking first loss risk.

A FLOOD OF PREFERRED EQUITY

We think equity investors and high-yield debt investors are quickly moving to fill this gap. Equity-like returns for debt-like risk = easiest fundraising pitch of all time. Therefore, we think "pref equity" and "mezz" will dominate discussions. However, the path to deploying this capital could be bumpy because...

1. By the time preferred equity providers get organized, they'll be competing with one another to fill the void, which will put downward pressure on the cost of preferred equity and upward pressure on last-dollar equity returns. We think this will happen quickly.

2. Since pref equity only fills 10-20% of the capital stack, capital providers need to make a lot of investments to consume a meaningful amount of dry powder. Few shops have sufficient production machines.

3. Although pref equity returns pencil, very few sponsors get excited about 14%+ subordinate financing. They'll try to bridge the gap themselves if they can, which inherently limits the runway for this strategy.

4. Big potential losses: Subordinate debt strategies have a unique risk/reward profile. Upside is capped with total downsize. Since mezz/pref positions don't have exposure to the safe part of the capital stack and defaults can trigger acceleration, relative risk can multiply more than other real estate investments.

CONCLUSIONS

Bridge financing, i.e., preferred equity/mezzanine debt, is uniquely attractive right now since senior lenders have pulled back, but we think there will be a significant oversupply of this product over the next 18-36 months.

Preferred equity may get the headlines, but we think the absence of senior debt is the real story; if negative relative value vs. corporate bonds remains, CRE borrowing costs will certainly increase.

COMMENTS