Can we have an honest discussion about "negative leverage?"

MYTHBUSTER: Negative leverage is NOT necessarily when borrowing rates are higher than cap rates.

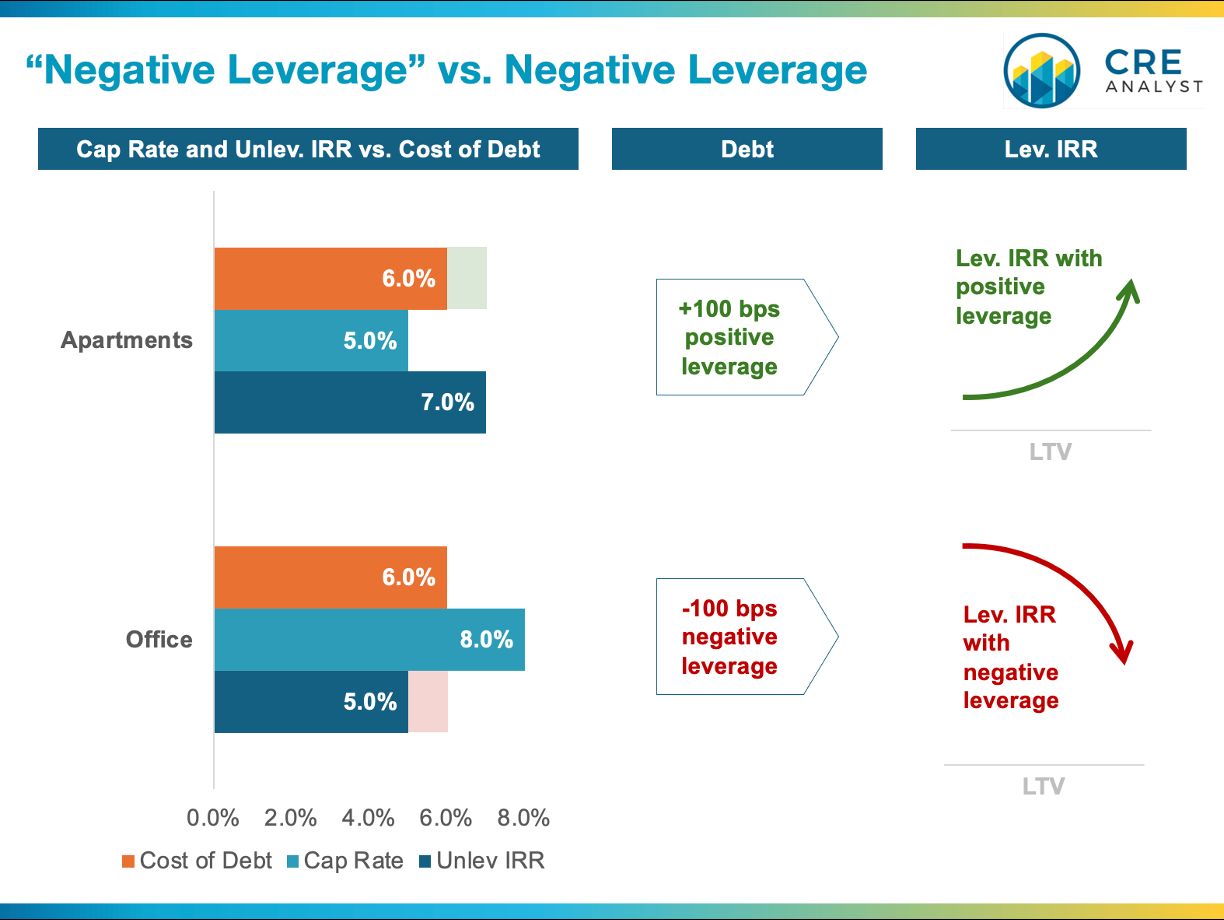

WHY IS EVERYONE TALKING ABOUT "NEGATIVE LEVERAGE?" Because, for the first time in decades, borrowing rates (6-7%) are higher than cap rates (5-7%). But borrowing rates (6-7%) are not higher than underwritten unleveraged IRRs (7-8%). Which way is up?

WHY DOES LEVERAGE MATTER? Just about every dollar that's been lost investing in income-producing real estate over the long run has been lost due to leverage and/or ill-timed maturity dates. Using leverage wisely can generate significant wealth, but misusing leverage can evaporate wealth and destabilize markets.

WHAT IS POSITIVE LEVERAGE? When unleveraged IRR is greater than the cost of debt. ...not necessarily when cap rate > cost of debt.

WHAT IS NEGATIVE LEVERAGE? When the cost of debt is greater than unleveraged IRR. ...not necessarily when cap rate < cost of debt.

WHAT ARE THE EFFECTS OF LEVERAGE?

(1) Magnified leveraged returns:

Positive leverage: More debt -> significant increases in LIRR.

Negative leverage: More debt -> significant decreases in LIRR.

(2) Magnified return volatility over the investment hold period.

WHY IS LEVERAGE SO POWERFUL? Buying a property that generates a 9% UIRR (regardless of the property's cap rate) and leveraging it with 6% debt up to 60% LTV generates a favorable margin on 60% of the capital stack, which magnifies returns to equity. More debt -> less equity -> more magnification.

CAP RATES DON'T DEFINE LEVERAGE? No. Cap rates are useful, but they ignore a few key aspects of real estate returns. ...namely CapEx, income growth, and future cap rate changes/appreciation.

WHY DO CAP RATES GET SO MUCH ATTENTION? Because other factors are speculative. CapEx and income growth are unknown at the time of investment, but ignoring them doesn't make them go away. Need proof? Why are apartments favored over office buildings despite apartments' lower cap rates? ...because apartments generate stronger income growth with lower CapEx burdens vs. office buildings.

WHEN SHOULD YOU USE LEVERAGE? When you are highly confident in your underwriting and have a wide spread between your underwritten UIRR and the cost of debt.

WHEN SHOULD YOU BE CAUTIOUS ABOUT LEVERAGE? When your underwriting is "priced to perfection," when there's a tight spread between underwritten UIRR and the cost of debt, and/or when there's material uncertainty around the future cost of debt (i.e., uncapped floating rate debt).

WHEN DO WE FIND OUT ABOUT LEVERAGE PROBLEMS? We often don't know that we're originating problem loans until years later. e.g., 1986 loans didn't blow up until the early 1990s, and 2005-07 loans didn't blow up until 2009-10. Good news: Leverage has been relatively constrained over the last ten years vs. prior cycles.

COMMENTS