Honest question: Is the housing market that bad?

Set aside the very real issues facing first-time buyers and renters who would prefer to own. We have spent and will continue to spend meaningful space diving into these challenges in other posts.

But consider this...

1. Locked in:

Most residents own their homes, and many are "locked in" with near-zero interest rates. But doesn't this mean a very large share of homeowners are living in homes that would otherwise be unaffordable? i.e., their standard of living is meaningfully better thanks to those low rates.

2. Debt free:

A very large share of homeowners (about 40%, which is a record high) own their home outright with no mortgage.

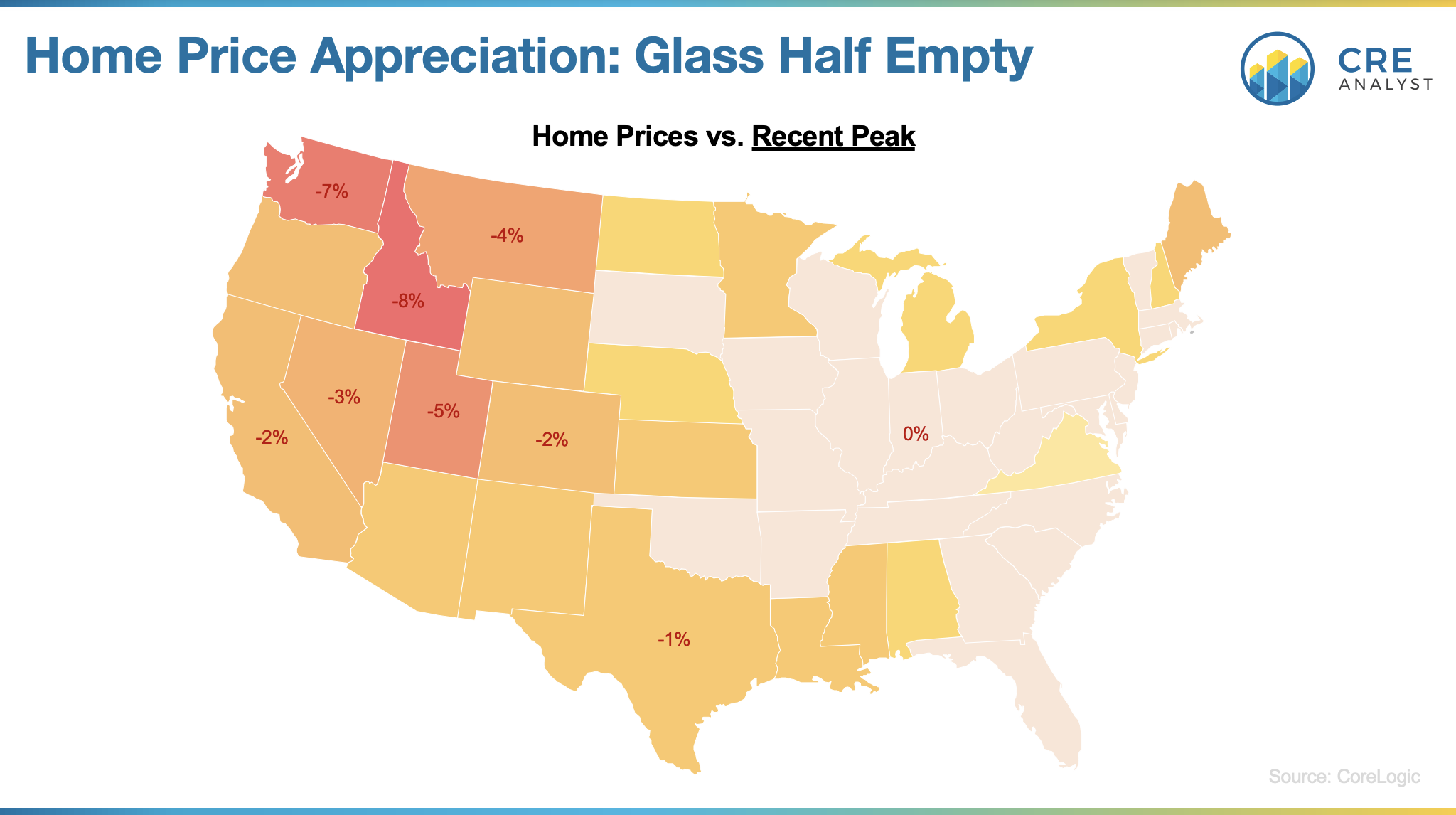

3. Appreciation trends:

The last year or so has been bumpy for some previously white-hot markets, but even those markets are up big over 3+ years. If you purchased a home five years ago, your home has increased by 55% on average, which means you likely more than doubled your equity.

There's so much handwringing about the housing market being terrible, but are you surprised to see that most markets have not materially fallen since the recent peak?

Make no mistake, there are some incredibly concerning aspects of the housing market. Most concerning: If you don't own a home now (or your parents don't own a home and plan to leave you their equity), it's going to be extremely challenging to get the house you have your heart set on. This is a very real and meaningful challenge.

But from a pure market health perspective, is the housing market a drag or tailwind for consumer balance sheets?

COMMENTS