The CRE domino effect...

----- A quick review -----

1. CRE capital markets were orderly pre-COVID

Yields were low, but strong economic growth and mild new supply led investors to take more risk in hopes of getting more returns. Aside from extremely low base rates, relative risk/return was stable and orderly.

2. Capital bonanza

During the pandemic, the Fed cut rates and injected $4+ trillion into the capital markets. Relative yields remained orderly but several conditions hit extreme levels: (i) interest rates, (ii) cash, (iii) transaction volumes, and (iv) property values.

3. The Fed's domino

When inflation sparked from 2% to 9%, the Fed aggressively hiked rates and pulled trillions of credit out of the debt markets.

----- A picture is worth a thousand words -----

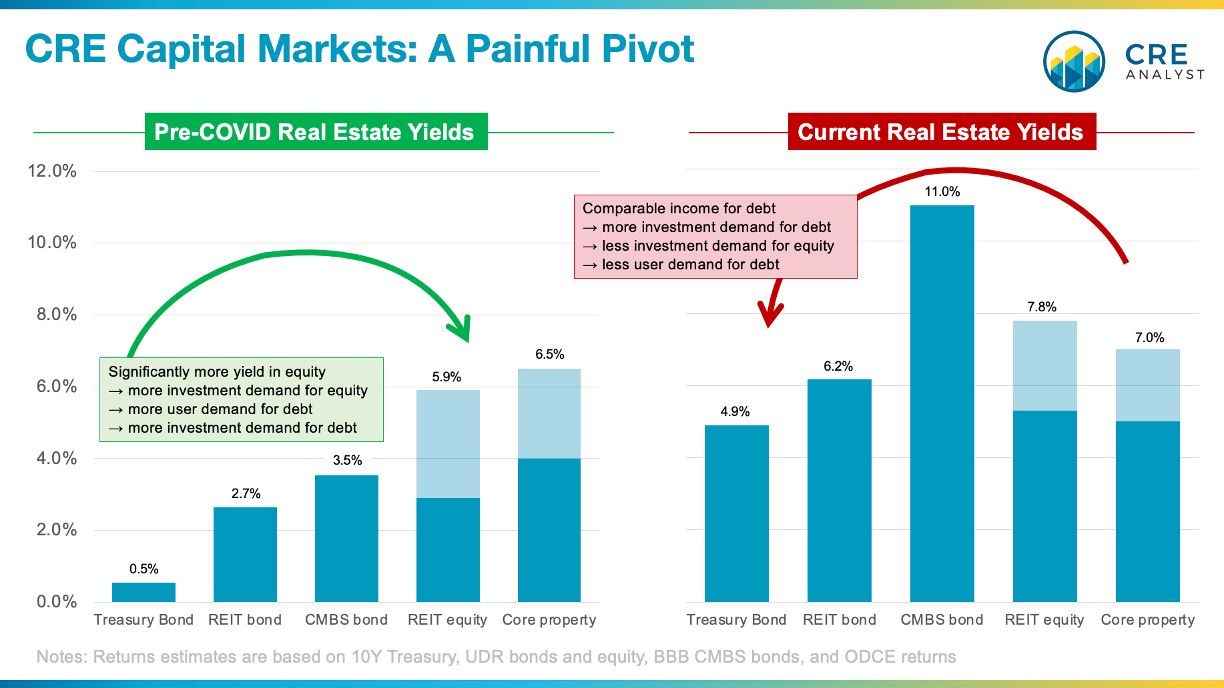

This chart summarizes how CRE capital markets responded to the Fed's domino...

1. Borrowing rates spiked, allowing lenders to finally get paid for taking credit risk.

-- Treasuries: 1% -> 5%

-- BBB bonds: 3% -> 6%

-- BBB CMBS: 4% -> 11%

2. "Relative value." Why would an investor buy a property with a 5% cap rate when the investor could be a real estate lender and get 6% yields?

There may be a good answer: Equity continues to generate higher yields if investors allocate value to future growth, but higher coupons for lending make it difficult for investors (especially when they expect a recession/slowdown in growth) to get excited about equity.

3. Everyone's a lender. Capital is flooding into debt markets, where investors can (at least in theory) get coupons above cap rates.

4. But where are the borrowers? In order to originate debt, lenders need borrowers, and borrowers don't generally want to pay coupons that are 2x higher than recent rates. And they certainly don't want to pay 12%+ pref equity rates. No equity means no borrowers. Prices will fall until yields and confidence lure equity investors back into the market.

----- Our hypothesis -----

Until a more normalized order is restored in the real estate capital markets, the following counterparties will remain in a painful cold war...

Lenders vs. borrowers:

-- Lender: Want to borrow 8% money?

-- Borrower: No.

Buyers vs. sellers:

-- Seller: Want to buy my property at a 5% cap rate?

-- Buyer: No.

Sponsors vs. investors:

-- Sponsor: Want to invest in my deal? It offers a 7% equity return.

-- Investor: No.

We believe real estate markets will re-establish a normal order of risk/return, but the path to a "new normal" could take years to achieve with at least a few surprises along the way.

But as Sam Zell once said to a conference full of real estate investors: "Where the f*#% else are you going to go?"

COMMENTS