Two CRE axioms, good news, and bad news...

Axiom 1: Real estate performance depends on debt

-- Commercial real estate is very capital-intensive.

-- The availability of debt is highly correlated to property values.

-- Mortgage flows are more volatile than other debt sectors.

Axiom 2: There are only three fundamental threats to CRE performance

-- Threat 1: Excess debt

-- Threat 2: Excess supply

-- Threat 3: Rising interest rates

----- Historical perspective -----

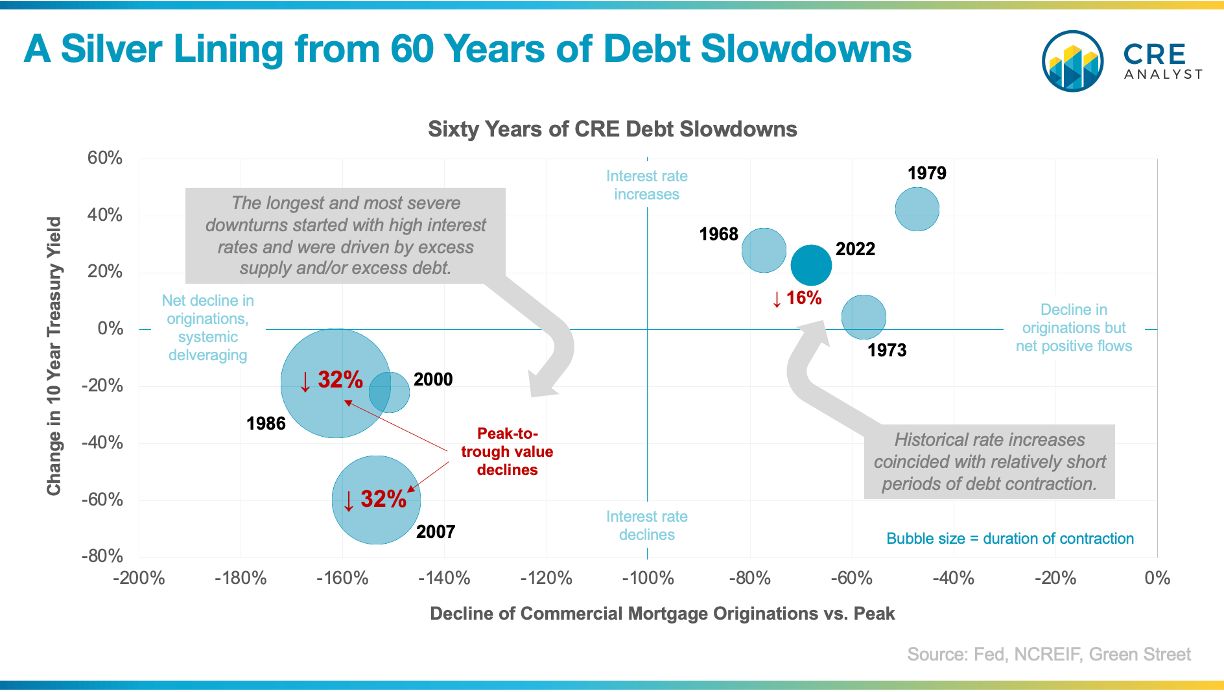

-- Excess debt: Commercial mortgage defaults exceeded 30% three times over the last 100+ years. CMBS/CDOs in 2005-07, S&Ls in the 1980s, and mortgage bonds in the 1920s. In each scenario, new debt schemes injected excess credit into the system, pushing up values, and setting the stage for more defaults.

-- Excess supply: This usually coincides with excess debt and is often regionally imbalanced. E.g., Arizona, Texas, and Georgia boomed in the 1980s with stock growing by 10%+ per year for 10+ years (a multiple of current growth), which led to very long recovery windows.

Note: We think this is the longest-lasting threat. The only way to rebound from an oversupply is to destroy properties (not practical) or wait for demand to catch up, which can take many years.

-- Rising interest rates: Rising rates coincided with falling mortgage originations in four historical periods, all in the late 1960s and 1970s, except for the current rate-hiking/QT cycle. Data on real estate values and performance in the late 1960s/early 1970s is scarce, but we found some interesting takeaways about that period and how it may compare to our current situation...

----- Good news -----

1. The late 1960s experience was relatively short and relatively mild from an equity erosion perspective.

2. The trajectory of the 10Y Treasury and 10s vs 2s between this hiking cycle and the 1960s cycle are remarkably correlated. The bear market re-steepening may be moderating since the 10Y leveled off three months after the final hike in 1969. Three months after this cycle's final hike would be Oct 2023, so maybe we're near the new rate peak.

----- Bad news -----

The moderating of the bear market steeping in 1969 also corresponded with the start of the late 1960s recession.

----- Glass-half-full thesis ----

Higher rates have been painful for commercial real estate, with values down 15%+, but most of the interest rate pain may be in the rearview mirror.

But conditions will eventually soften due to more restrictive capital (despite this week's GDP report), which will immediately shift focus to fundamentals, i.e., rents, vacancies, NOI.

COMMENTS