GFC flashback: CalSTRS

Townsend executive summary to CalSTRS Investment Committee

September 3, 2009

"The year 2008 not only marked the demise of several major financial institutions, including Bear Stearns, Lehman Brothers and Merrill Lynch but also the collapse of financial markets around the world. Rising unemployment, dizzying corporate losses and declining asset values were similar

global themes that have echoed into 2009."

"Institutional investors have witnessed the effects of a global marketplace in turmoil through the toll it has taken in their portfolios. The California State

Teachers’ Retirement System (CalSTRS) is no exception."

"In the first quarter of 2009, the real estate portfolio continued to reflect flagging fundamentals and aggressive write-downs. CalSTRS has taken proactive steps by engaging their partners in more frequent dialogue. With this increased oversight, Staff is able to continuously estimate portfolio risk

in the context of the rapidly evolving market. While every effort is being made to minimize the impact, the depth and duration of this unprecedented market correction remains unclear."

----- Returns -----

-- Fast-moving: Headed into 2009, the CalSTRS real estate portfolio was worth $19.7 billion. By the end of the first quarter 2009, the CalSTRS real estate portfolio was worth $12.9 billion.

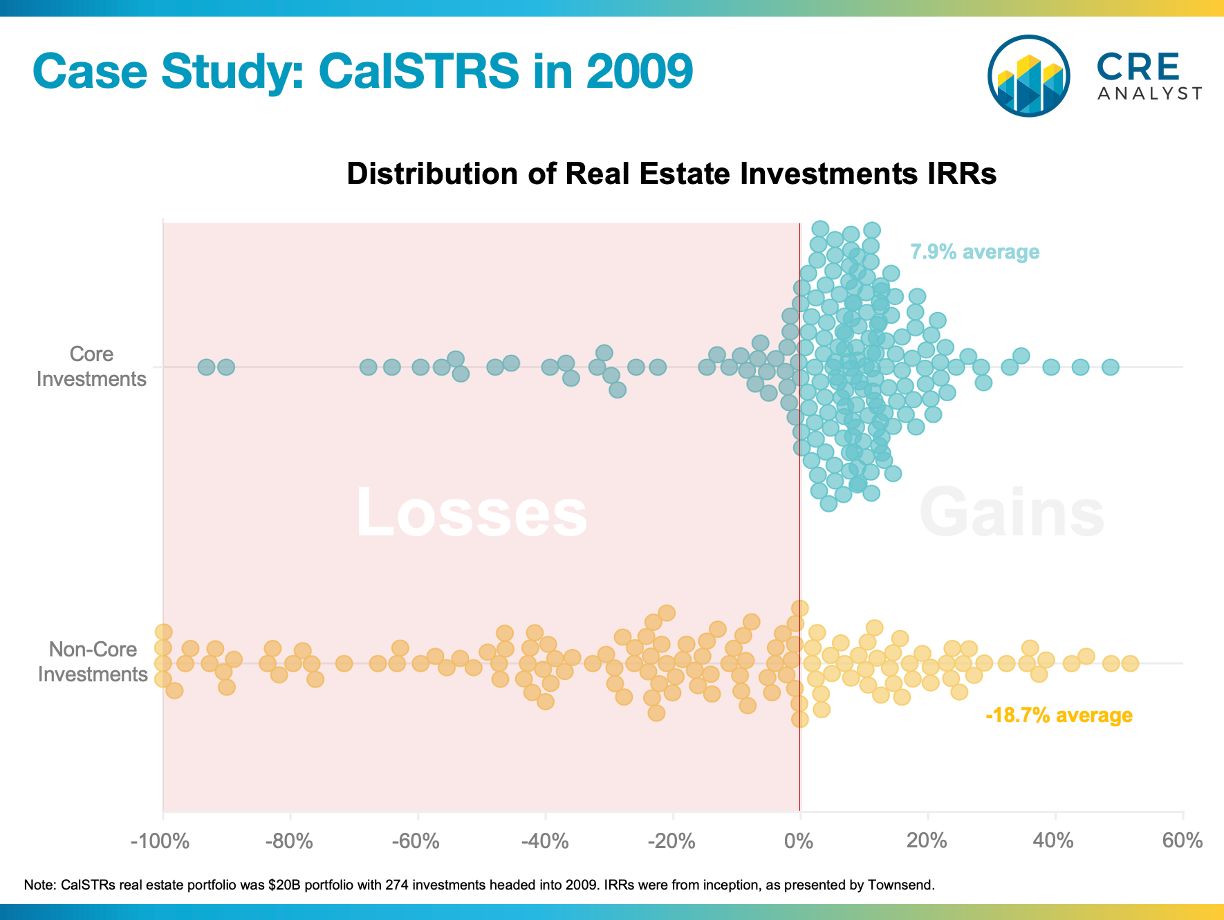

-- Core outperformed: As one would expect, the CalSTRS core investments were much more durable with cumulative returns of about 8%, even after factoring in 30% annual declines.

-- Non-core struggled: CalSTRS' riskier investments, with an average IRR of -19%, pulled down the portfolio.

-- Overall performance: Average returns were about 0.9% since inception as of 1Q09.

----- Implications for today -----

This time seems different. At least so far.

In light of an abundance of headlines calling for a real estate crash, we think this CalSTRS flashback is an insightful case study. Before you buy into the "doom loop" and "real estate distress" narratives, consider the economic conditions that were prevalent when the CalSTRS report was issued:

-- GDP was contracting at an annual rate of 6.1%.

-- Job growth was negative for 16 months (and counting).

-- Cumulative employment was down by 5.7 million jobs.

-- Unemployment was 8.9%.

-- Financing above 50% LTV was unavailable.

-- Value adjustments were much faster than prior cycles.

But conditions during the GFC weren't totally different.

Many projections from the 2009 report could be applied to today:

-- Losses to continue across all property types.

-- Public markets suggest further adjustment.

-- 30-40% peak-to-trough value declines for core properties.

-- Higher discount rates and exit cap rates.

-- Yields are low vs. historical averages.

What do you think: Will we soon see reports like CalSTRS in 2009 or is real estate doom exaggerated?

COMMENTS