Multifamily boom to bust...

1. Surge in household formations

National vacancy hovered between 6-7% pre-COVID, but new households surged during the pandemic. Roomates and adult children living at home wanted more space, and work flexibility led many to move to hot markets.

2. Vacancy declines

The surge of new renters pushed vacancy through equilibrium, with national vacancy falling below 5% for the first time on record.

3. Rent pops

Apartment rent growth exploded by 8-10% during the pandemic vs. 1-3% annual growth historically.

4. Accomodative debt

Multifamily was a favorite target for lenders across all major lender types: banks, life cos, agencies, CMBS, and debt funds. Lending at sub 7% debt yields (70%+ LTC) became common.

The Fed threw a major tailwind behind these debt markets by buying trillions of MBS bonds and cutting short term rates. Floating rate debt became a favorite tool for apartment investors.

5. Syndicator surge

Excess savings, technological advancements (crowdfunding), and lower regulatory barriers led to a surge in syndicated equity for apartment acquisitions.

6. Cap rate compression

Apartment cap rates quickly fell from 5% ish to 3% ish.

7. New supply wave

In a market defined by demand uncertainty (office/retail) and higher construction costs, apartments stood out as a uniquely favorable space with positive development spreads (6% YOCs vs. 4% exit cap rates). Every developer in the country seemed to get into multifamily.

----- You are here -----

8. Vacancy spike

Nationwide vacancy is marching upwards, with many researchers calling for a 200 to 300 bps increase in vacancy.

9. Rent declines

Rent growth fell to 0-1% in mid 2023, and more recent reports suggest rents are declining in the many oversupplied markets.

----- What's next? -----

10. Loan defaults

We estimate that 30-40% of the existing multifamily stock was capitalized near the peak. Floating rate deals and low DSCRs/debt yields were the norm. Expect a bumpy ride.

11. Cap rate expansion

With the 10 year Treasury around 5%, 3% cap rates are long gone. 5% is the new 3%, and 6% may be the new reality if rates don't moderate. i.e., values are down by 20%+.

12. Extreme drop in new supply

Developers, investors, and lenders react quickly. New monthly apartment starts are alrady down 45% from the recent peak. Expect a continued drop in activity, especially as long as construction loan rates stay around 8%.

----- Sample markets -----

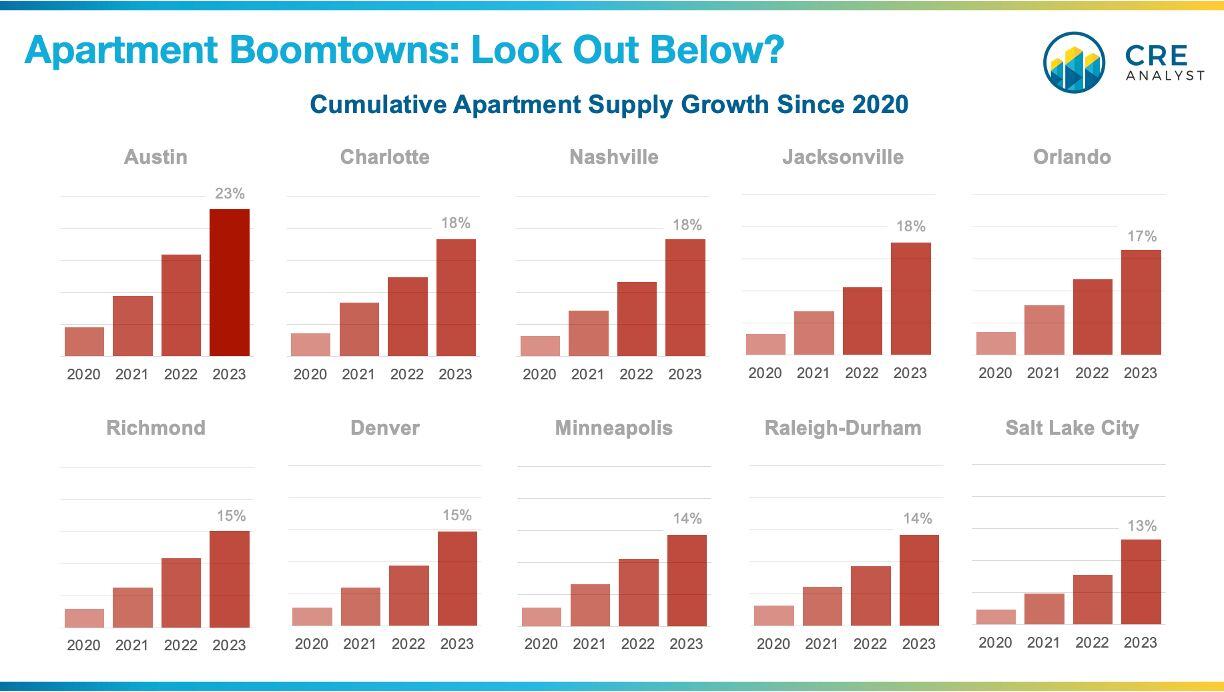

Will this cycle be most prounanced in the biggest apartment boom towns?This chart summarizes the markets where supply grew the most over the last four years.

----- Your take? -----

Will demand growth in these hot markets buffer all the new supply or will they lead the national market down? We're especially interested to hear from people who live and invest in these markets.

COMMENTS