Forget supply and demand. Follow the capital.

Best predictor of real estate returns?

NOT supply growth

NOT population growth

NOT rent growth

NOT NOI growth

Instead...

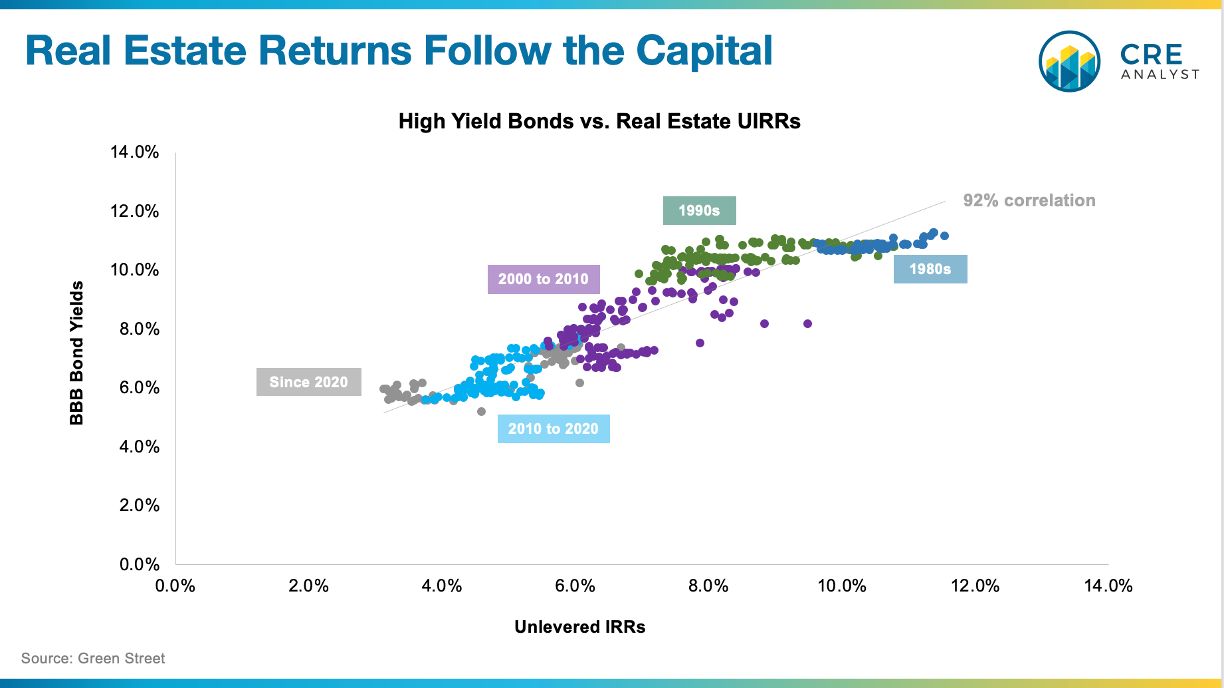

BBB corporate bond yields

90%+ correlated to UIRRs.

i.e., real estate has been an indirect bond trade ever since interest rates began their structural decline in the 1980s.

Core real estate, in particular, has been priced as a high-yield alternative.

When capital floods in, values rise.

Bond yields drop.

Real estate returns follow.

Does the money behind buildings matter more than the buildings themselves?

Sam Zell would roll over in his grave at that suggestion.

“The recovery of the market will be slow and painful. The monetization of the currency that previously bailed out real estate excesses will not appear this time. Success or failure will accrue to those who have focused their efforts on the basics… The HP jockeys of the scientific real estate community will be replaced by the traditional real estate professional who has learned his trade in operation and not in projection.”

A $10 trillion question...

Will the future look anything like the last 40 years?

Cap rate compression may be over.

Now what?

Sam's prognostication was wrong in the 1980s, but who would've predicted rates going to zero? With ZIRP a distant memory, he may be right after all. But at least for the last 40 years, it's been all about capital.

PS -- Capital is critical, which is why every FastTrack module starts with a deep dive into “the nine building blocks of the real estate balance sheet.” You must be able to "follow the dollars," but we still (and always will) spend time on fundamentals. Leases. Rents. Supply. DM us if you want to review the upcoming cohort syllabus.

COMMENTS