"Even Oprah has bad hair days, she just has a better stylist."

There's no shortage of real estate players who have had a tough couple of years.

Apartment syndicators, banks, and office investors get most of the headline attention, but everyone has their baggage.

---- Example: BX ----

Blackstone is the 800 lb gorilla in investment management and commercial real estate. The firm just completed what was arguably the best 10-year run in the history of real estate investing.

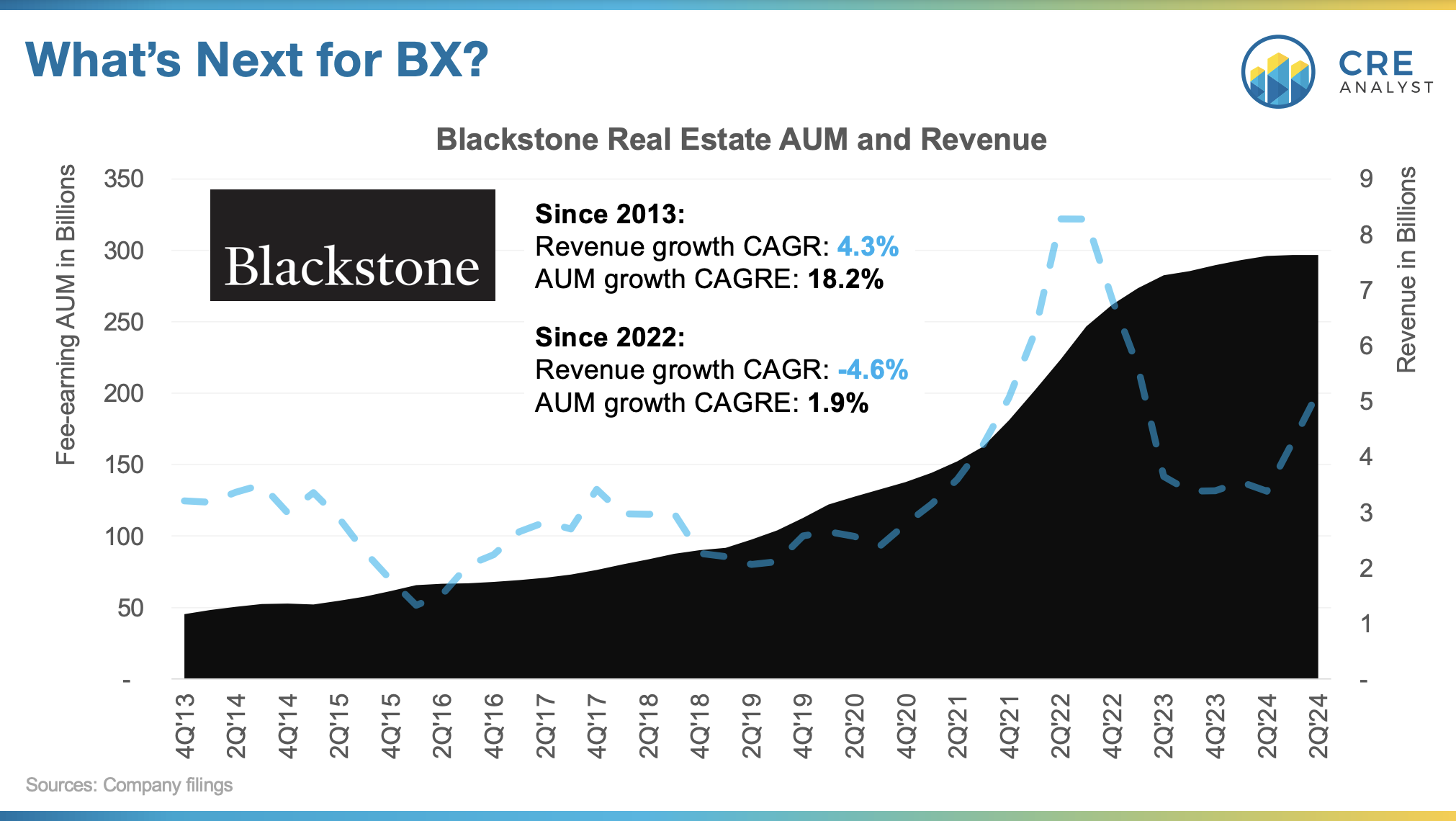

Since 2013, BX's real estate AUM has grown by 18% per year and associated revenues have grown by 4% per year.

But since the Fed's interest rate hikes, revenues have declined by about 5% per year and AUM has grown by less than 2%.

---- Takeaway ----

Had a tough few years?

You are not alone.

Even Blackstone is, relatively speaking, trudging through the mud.

Ps - What's next for BX?

Where do you look for future revenue and AUM growth if you're Blackstone Real Estate? Historical growth has been organic, but BREIT (a big historical driver) is now a headwind. Best guesses: huge data center bets, debt, and another monster BREP fund in a year or so. Then what? External growth/acquisitions?

COMMENTS