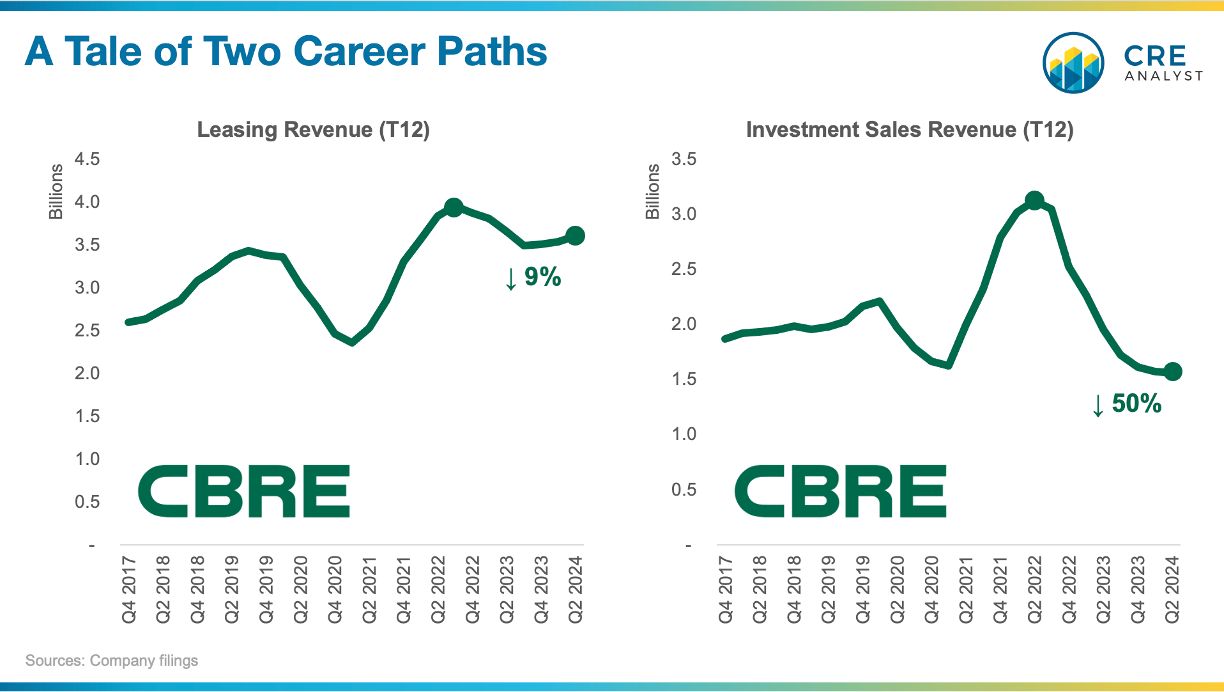

Will it take 25 years to get back to 2022's peak capital markets activity?

---- Perfect storm ----

To call the post-pandemic property trading frenzy 'anomalous' feels like an understatement. Everything came together to promote transaction activity:

-- Near 0% default rates

-- Once-in-a-lifetime 0% interest rates

-- Once-in-a-lifetime rent growth trends

-- Relatively constrained supply (at the time)

-- All-time-high dry powder

-- Extremely active debt markets

--- Big commissions ----

Which led to extreme brokerage earnings...

More investment sales brokers than ever pulled in seven figures a year in 2022 and 2023.

---- 25 years?! ----

How long will it take to get back to those levels?

At 3% annual growth, it would take nearly 25 years to hit CBRE's post-Covid peak. At 7% annual growth (CBRE's pre-pandemic investment sales growth), it would take more than 10 years.

---- Good news, bad news ----

Good news: transaction activity seems to have bottomed.

Bad news: there's not enough to go around.

Lots of people entered brokerage since 2020. It looked like relatively easy money. But it wasn't. Brokerage is hard.

...especially in investment sales, where advisors have to understand the intricacies of fundamentals, debt, equity, valuation, and partnerships.

Will we see a widespread exodus out of investment sales? Probably not.

But will many people find other career paths? Certainly.

Those who stay and invest in themselves will be rewarded, but the light at the end of the tunnel is faint.

---- Office leasing? ----

Is office leasing the most underrated position in real estate right now?

Leasing brokerage revenue is off the recent bottom and only down 9% from the peak. CBRE's leasing brokerage revenues cover multiple asset classes (mostly office, retail, and industrial), but office is a big driver.

If you're a leasing broker, keep plugging. We see you climbing out of the abyss and with virtually no new supply and most tenants needing to reconfigure their space, you don't have to get too creative to pencil some productive years ahead.

Source: CBRE quarterly filings. We use CBRE as an industry proxy since it is the largest brokerage and provides detailed revenue figures going back many years.

COMMENTS