"Half a truth is often a great lie." Benjamin Franklin

Lots of click bait out there...

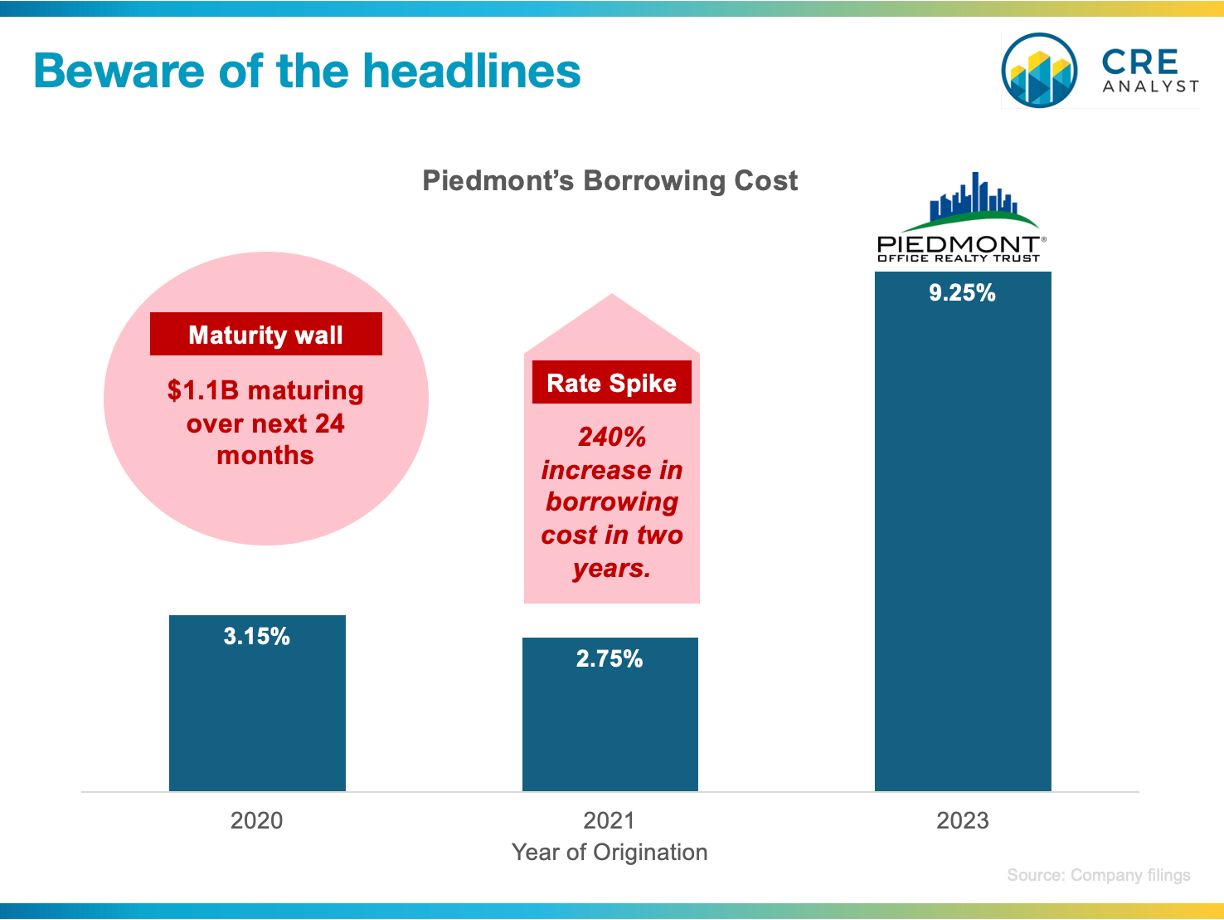

1. A big maturity wall

2. Interest rate spikes

3. Looming foreclosures

4. The office apocalypse

Seeds of truth are buried in these headlines...

- $1.5T of CRE debt set to mature.

- Borrowing costs are up 50-75%.

- Problem loans are up 20%.

- Office values are down 30%.

But these seeds don't tell the entire story...

When capital stops flowing into commercial real estate, the only way to differentiate between winners and losers is to focus on fundamentals over narrative.

Quick background on our perspective, as taught in our FastTrack class...

1. FOUR DEAL TYPES: Everyone in real estate is basically working on only four types of transactions (leases, sales, loans, and JVs.)

2. NO SHORTCUTS: Each deal is memorialized in a legal document. There's no shortcut around diving into these documents.

3. EIGHT FUNDAMENTALS: Everything in CRE stems from eight fundamentals, which feed into the frameworks that govern decision making.

How a headline becomes a narrative...

"Piedmont issues bonds at 9.25%"

- Piedmont is a $3B office REIT that owns buildings in the southeast.

- PDM trades at about an 11% cap rate (50% discount to NAV).

- Maturity wall: $1B of debt matures over the next few years.

- 90% of PDM's debt is in the form of bonds (not mortgages)

- PDM issued $300M of bonds in 2021 at 3.15%

- PDM issued another $300M of bonds in 2022 at 2.75%

- PDM issued $400M at 9.25% last week (***headline***)

Piedmont's situation isn't great. Hard to see the firm turning into an acquisitions machine, but are they going to blow up? Unlikely. There's more under the surface...

- PDM generates about $220M of NOI

- PDM's portfolio is 86% leased with <10% of leases expiring per year

- 70% of tenants are renewing their leases

- Upon lease expiration, rents are rolling up by 15%

- $2B of outstanding debt

- 4 year average debt maturity

- 75% of debt is fixed-rate

- All debt is interest only

- Some PDM bonds trade at a 30% discount

- PDM's average debt yield on its debt is 10.6%

- PDM pays about $100M a year in dividends

Our takeaway...

Piedmont is a poster child for the office apocalypse narrative. "A heavily discounted office REIT with decent properties and a maturity wall issues bonds at 9%."

So Piedmont is toast, right? Not necessarily...

- PDM could pay up to 10.6% on its debt (interest only) and continue to cover its debt service.

- Since 90% of PDM's is in the form of bonds, there's not going to be a huge foreclosure.

- PDM could cut its dividend to buy its bonds at a steep discount.

Conclusion...

Commercial properties are complicated. Headlines are pretty accurate when performance is highly correlated, but when sh*t hits the fan, there's no shortcut around diving into the fundamentals.

COMMENTS