Clear as mud...

The BLS made a big downward adjustment to benchmark employment earlier this week. The revisions disproportionately affect job types that often drive real estate activity, but the biggest impact likely relates to the Fed's dependence on unclear data in deciding when and how much to cut rates.

From Oxford Economics:

"Job growth was not as strong as previously thought between April 2023 and March 2024..."

"The level of nonfarm employment for March is set to be revised lower by 818,000, or 0.5% (Chart 1). This is a noticeably larger than a normal revision."

"The Fed is attempting to calibrate monetary policy in a data fog..."

"The preliminary downward revision implies a reduction in monthly job growth of 68,000. Average monthly job growth between April 2023 and March 2024 appears to now average 170,000, compared with the 242,000 prior to the preliminary benchmark revision."

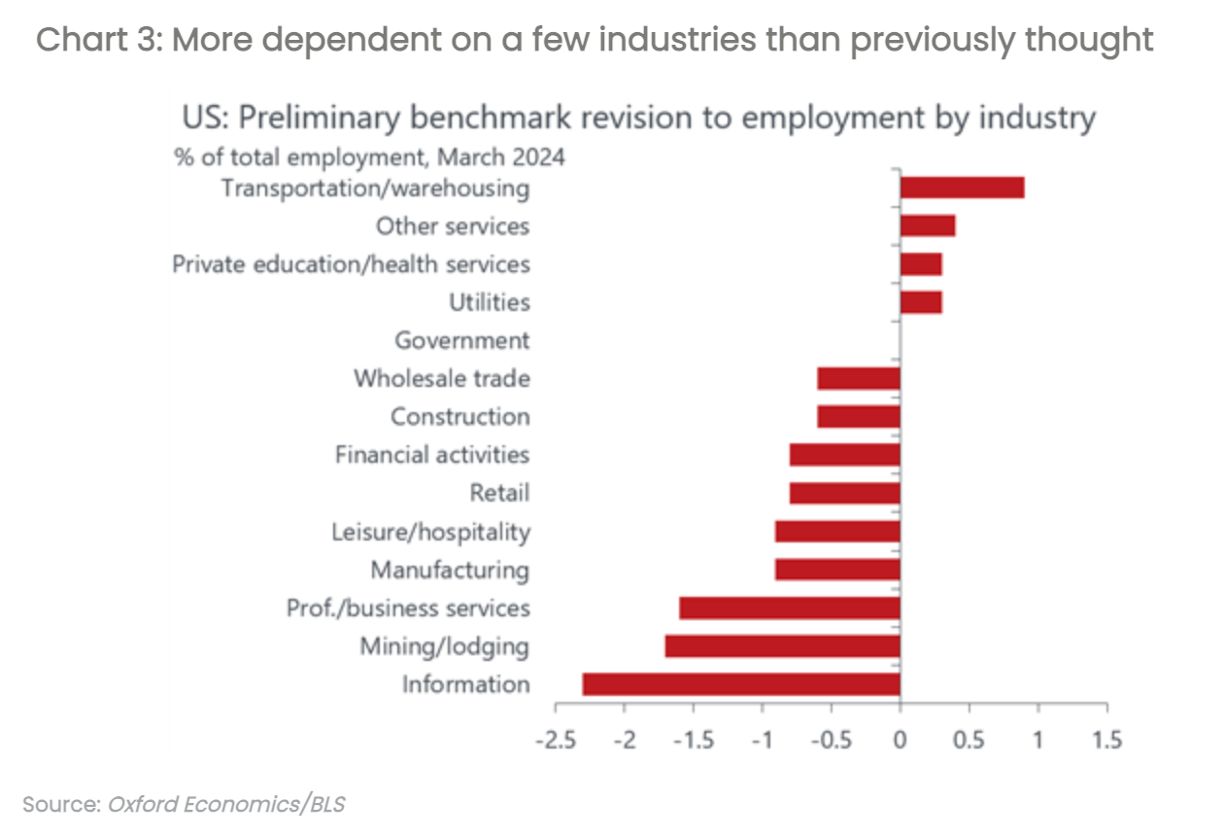

"The pattern of revisions is interesting and implies that job growth during the benchmark period was even more dependent on government and education/healthcare than thought."

COMMENTS