Rhyming (but different) real estate cycles...

A real estate slowdown:

1. Lending slows

2. Spreads gap out

3. Equity requires higher returns

4. Equity fundraising slows

5. Dry powder dwindles

A real estate depression:

1. Lending declines

2. Spreads gap out

3. Defaults mount

4. Losses mount

5. Banks/lenders fail

6. Equity requires higher returns

7. Equity fundraising stops

8. Dry powder dwindles

What do these patterns have in common?

They both start with debt.

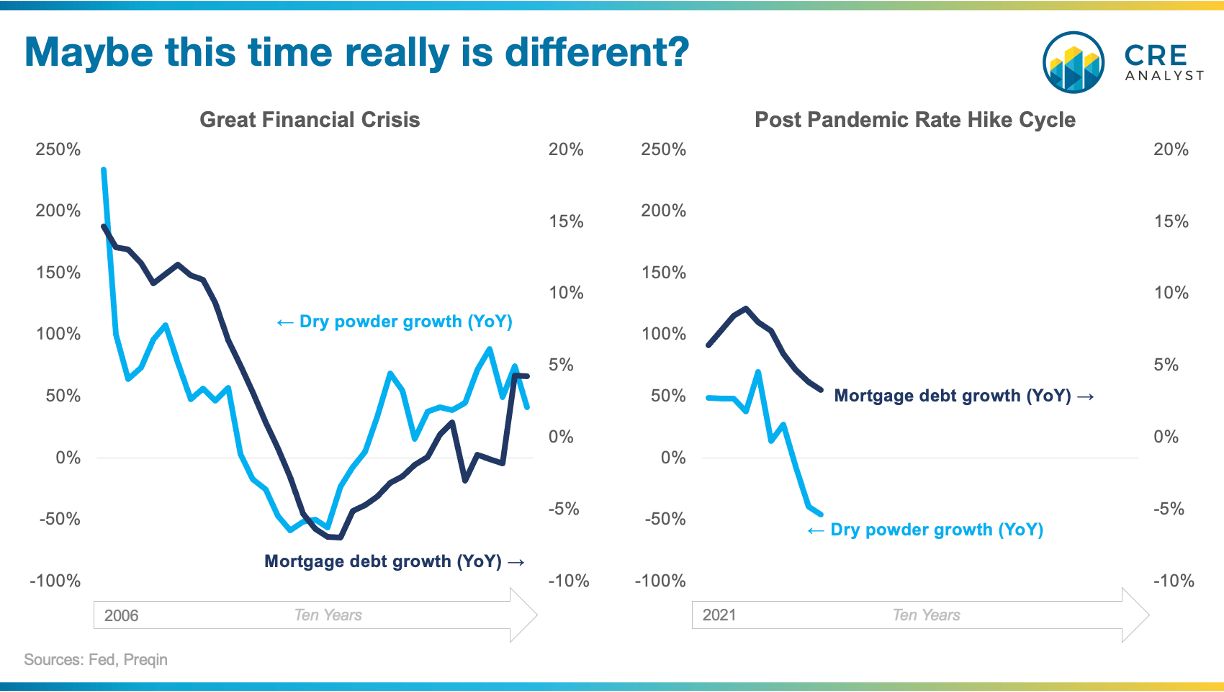

What do they NOT have in common (so far)?

Debt contraction.

A few days ago, we said that debt is the sun of the real estate solar system. This is what we meant.

When mortgage lending slows, real estate investors experience pain. Not fun.

But when mortgage lending contracts, i.e., lending institutions effectively pull debt out of the system, everyone suffers and the downturn feeds on itself. ...often needing governmental assistance to get out of the spiral.

This downcycle increasingly feels like a painful reset. It will spark meaningful losses for some. e.g., office investors, apartment syndicators, etc. But, unless we see a sudden contraction of debt, income growth seems positioned to pull us out of this downturn.

COMMENTS